The price of Chainlink (LINK) today marks a 20% jump that brings it back to a step from $3.40, levels still within the bearish candle of March 12th, which started with prices over $3.85.

It is a rise that makes the prices soar, which from the lows of March 16th have actually doubled, recovering more than 120%.

This allows Chainlink to recover with speed the 11th position that it had abandoned a few weeks ago, 11th position conquered at the beginning of March when it scored its absolute historical highs by barely touching $5. For Chainlink, therefore, a recovery not only of value but also of confidence is expected.

Chainlink goes after the 10th position of Tezos (XTZ) who defends himself with a day’s rise among the best of the big names and equal to 6%. Among the top 25, both Tezos and Chainlink are among the best climbs of the day.

The stationary prices that since yesterday have been fluctuating on period highs without giving particular indications of the short term, is a condition that usually anticipates a moment of reflection.

Bitcoin Cash (BCH) yesterday had highlighted the biggest rise among the big players, cancelling the mid-March bearish movement and returning to pre-March 8th levels, revising the $280.

Profit-taking is now prevailing with a 3% setback that is not affecting the bullish trend.

A bullish trend that continues to capitalize on the trail of privacy coins that in this period are getting noticed, today is the day of ZCash (ZEC) that rises by more than 5% and comes close to $40.

Among the best of the day, there’s also Bitcoin Gold (BTG) on the podium with a climb of about 17%, followed by Seele (SEELE), who after yesterday stood out as one of the biggest rises, today continues its climb with over 15%.

Seele with the elevations of recent days occupies the 76th position and is a heterogeneous token that aims to develop a heterogeneous multichain ecosystem, strengthening its protocol on a neural and scalable consensus.

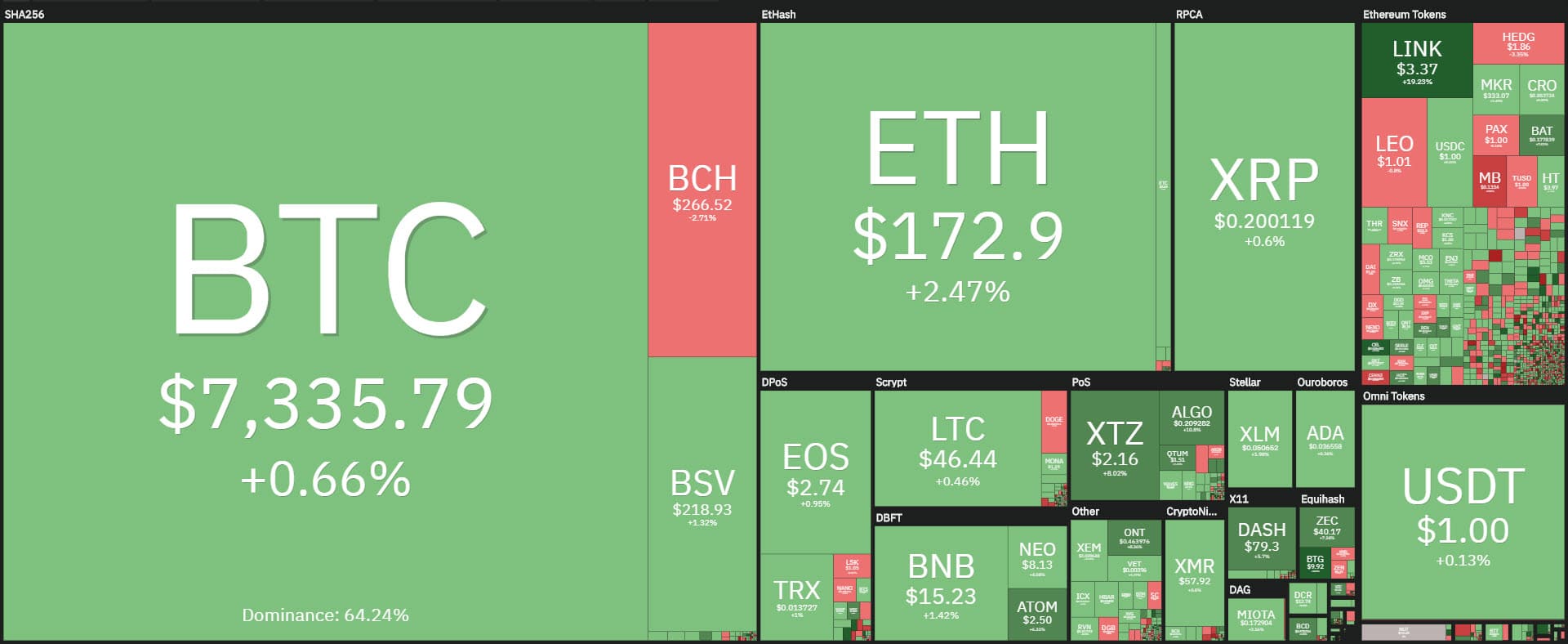

Total capitalization remains anchored at $210 billion. Bitcoin dominance falls slightly below 64% despite good price stability. This highlights how the rises of the last few days are particularly showing a relative strength on the part of the altcoins.

Ethereum confirms this indication by staying above 9%, a threshold regained exactly two days ago and which it had abandoned in mid-March. XRP remains unchanged with a market share of 4.2%.

Bitcoin (BTC) price

Bitcoin has stopped its rise for more than 48 hours, with prices that remain hooked to period highs, trying in these hours to consolidate around $7,400, which is a level that had already characterized the movements of Bitcoin last early winter, between late November and early January.

For this reason, the current levels are technically very important.

It is necessary to hold the previous relative highs which have now become an area of support and precisely area 7,000-7,050 dollars. In case of a holding in the coming hours and days, it would be a very good sign for the continuation of the bullish trend.

Technically and cyclically prices should be at period highs.

It is necessary to observe more the hold of the supports in this dynamic rather than the next level of resistance identified in the area 7,800 dollars. Only the overcoming of the 7,800-7,900 dollars would begin to leave behind the fall of March, achieving a recovery that would continue to restore and increase confidence.

Ethereum (ETH) price

Ethereum, after the jump that at the beginning of the week saw the breaking of the $150-155 resistance, is slowing down but, like Bitcoin, continues to fluctuate on the period highs, around $170-175.

For ETH, it is necessary to confirm the resilience of the former $155 resistance breach in the coming days in order to set a rise that would project prices above the downward trendline that combines the decreasing highs of last mid-February.

The break of the trendline that passes between $185 and $190 in the next few hours and days would give a strong bullish signal and would target the levels of early March.