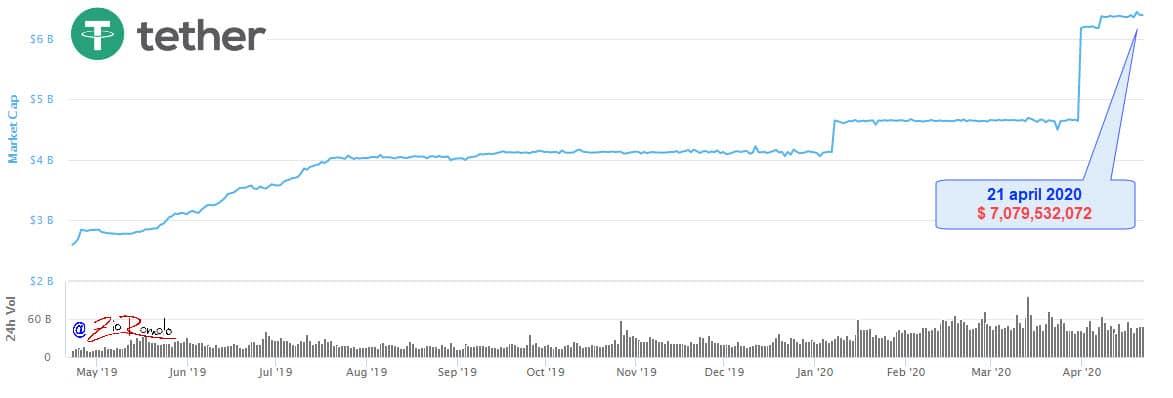

The news of the day is that for the first time the capitalization of Tether, a stablecoin launched in 2014, breaks the $7 billion threshold.

Tether, in the stablecoin sector, occupies over 84% of the market with daily volumes exceeding 96%. If Tether were to continue with the trend of these weeks (at the end of March it exceeded 4.5 billion dollars), it is not excluded that it could leapfrog positions and surpass Ripple, which registers less daily trading volumes.

To date, Ripple has over $8 billion of capitalization, although in recent days it seems to attract less and less interest from investors, trading fewer volumes.

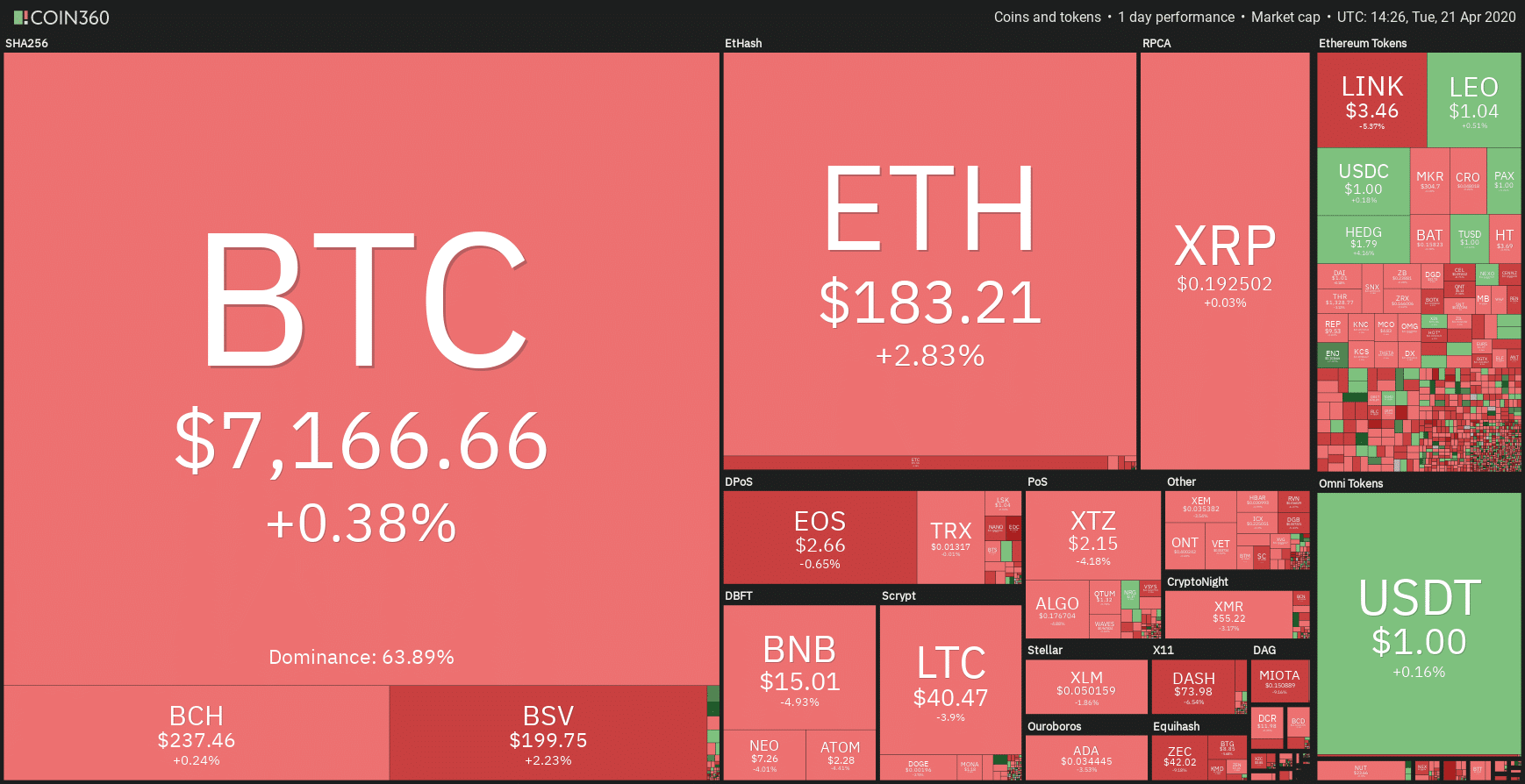

On a daily basis, for some time now, after Bitcoin and Ethereum’s record trading volumes, and excluding Tether, the third crypto to see high trading volumes more than Ripple is Chainlink.

Today sees a clear predominance of the red sign. Scrolling through the list of the most capitalized, the first positive sign can be seen going as far as the 50th position, precisely at the 53rd place where there is Enjin Coin that with a double-digit climb rises to the podium of the best.

Among the top 100, there are 4 in positive. The best is precisely ENJ that with today’s high jump shows a strong upward trend started from the lows of mid-March. With today’s rise, Enjin returns above 11 cents, which are levels that it had abandoned in early March. Enjin, NFT token that sees the participation of Microsoft in its development, brings back the prices of early March, officially putting behind the decline of March, thus resuming a positive upward trend that could provide space for a further extension in the coming weeks.

Aave (LEND) is the second-best crypto of the day in 94th position with 34 million of capitalization, today rising by 3%.

Besides the 4 positive tokens, the others move under the parity. Among the top 10, the worst is Binance Coin, which drops by more than 5%, as does Chainlink (LINK). LINK is experiencing profit-taking after the strong rises that restored the 11th position in the ranking.

Today is a temporary setback in a context that is seeing the cryptocurrency sector recovering ground since mid-March, a recovery that in reconstructing the bullish trend allows for red days like today.

The market cap is under 200 billion, dominance unchanged for Bitcoin, Ethereum and Ripple.

Observing the trend in the medium term, it is possible to observe how the correlation between Bitcoin and gold continues to decrease further and further, with gold that in the last 5 days has pushed upwards while Bitcoin with the weekend rises has shown a lack of conviction in going beyond the highs of early April.

5 days ago gold recorded the highest highs in the last 8 years, thus highlighting a correlation that is decreasing.

The movement of the last few hours sees a continued correlation with the S&P 500 stock index, but it is an event that needs to be put into context at the current time.

When looking at the annual correlation between Bitcoin and the S&P 500, as well as the other historical stock market index of the Dow Jones, both have a correlation of 0.2%, a Pearson index that shows how the stock market and the cryptocurrency market share truly short periods of specular movements.

Bitcoin (BTC)

After five days, Bitcoin returns below the psychological threshold of $7,000. Bitcoin continues to follow the hypothesis of being close to the end of the monthly cycle scheduled for this week’s course. It is important for Bitcoin to keep its prices above $6,700 and not to go any further below $6,500. Under this threshold, some alarm bells would start ringing in a mid-term perspective.

Ethereum (ETH)

Ethereum is doing better, staying inside a solid bullish channel that started from the lows of March. From the weekend highs, Ethereum falls about 10% from today’s levels but this does not affect the bullish trend on a weekly basis and sees Ethereum gain about 10% from last Tuesday’s levels, among the best performances of the first 30 crypto per capitalization. Even if later than Bitcoin, Ethereum is starting to conclude the monthly cycle expected within the next week.

For Ethereum, a holding of $155 in the coming days will confirm the upward trend. New purchases could be attracted by a break in weekend highs above $190.