In these last 24 hours, Bitcoin is the one that is moving more than anyone else and revisiting the period highs recorded at the end of April, overshadowing the rest of the industry. During this day, Bitcoin recorded trades for more than 2.5 billion dollars, the third day with higher volumes although below the levels recorded on April 29th and 30th when the volumes have gone up to 3.5 billion during the day for a total of 7 billion.

Trading on the spot markets is confirmed by rising volumes. With regard to the futures traded by the institutional platforms of the CME and Bakkt, not only in terms of futures but also in the options market, the CME yesterday saw a record number of options contracts, with 210 contracts worth just under $10 million. This is the day with the highest trading volume on options for the US CME market, the highest level since options contracts were launched at the beginning of the year.

The open interest in derivatives on the CME futures and options market is also rising again, with a new record yesterday at $399 million, surpassing the previous record of July 2019. The open interest on Bakkt is also at a new high with a total open interest of $12 million.

This shows that institutional investors who hold significant positions are approaching the third halving in the history of Bitcoin protecting themselves from any fluctuations and analyzing in detail what is happening in the derivatives markets, to protect against a possible upturn on the part of Bitcoin, as 95% of CME options expire in May, so they will end after the halving. Therefore the analysis seems to indicate that there is a protection for a possible upward stretch, since out of 210 contracts exchanged 202 are on call and 8 on put, hence a protection from possible upward stretches.

The volatility of Bitcoin in recent hours remains at the lowest levels since the beginning of the year, at 3.4% daily on a monthly basis.

The day opens in perfect balance with 50% of the main crypto assets in positive territory and the rest under par.

Among the best of the day, there is Verge (XVG) with a 25% jump, followed by 0x (0X) and Aave (LEND), up 18% and 12% respectively.

Aave confirms the trend of recent weeks, while the movement of 0X continues determined with a daily gain of almost 20%, returning to review the threshold of 25 cents, levels abandoned last March 8th.

Among the big ones, Stellar (XLM) oscillates above parity, but in the last few hours it has been trying to consolidate the strong upward movement that with the recent highs has seen its value almost tripling after the sinking of mid-March, going from 0.03 to 0, 077 recorded in the last few days with an increase of more than 180%, allowing Stellar to regain the 11th position among the major capitalized with $1.4 billion, to the detriment of Cardano (ADA) and Chainlink (LINK) that slide into 12th and 13th position.

In contrast, Zilliqa (ZIL) loses 1% after the strong rises of the last two days. Same negative performance as DigiByte (DGB). Enjin Coin (ENJ) loses 4% due to profit-taking after the excellent performance of recent weeks and that have seen ENJ make a strong leap from the lows of mid-March, which with yesterday’s highs recorded a rise of 300%, thus going to triple its value in just over a month and a half. So it is natural for Enjin Coin as well as Zilliqa to take advantage of these moments.

The volumes in the last 24 hours for the entire sector have increased by about 20% to over $135 billion, levels that have not been seen since the beginning of March. The market cap, supported in particular by the rise of Bitcoin gaining 3% on 24 hours, is back to $255 billion, close to the highest peaks recorded in April when it was close to $258 billion.

The dominance of Bitcoin is strengthened, rising to 67%, this indicates that Bitcoin is gaining more and more ground, with this rise the market cap goes above $170 billion. The 67% market share is one step away from the highest in the last 3 years recorded last September 2019, when after two years Bitcoin dominance regained the threshold of 69%, which means we are one step away from that record. Despite the holding of the last few hours, Ethereum still remains below 9% as dominance. Ripple is stuck at 3.7%.

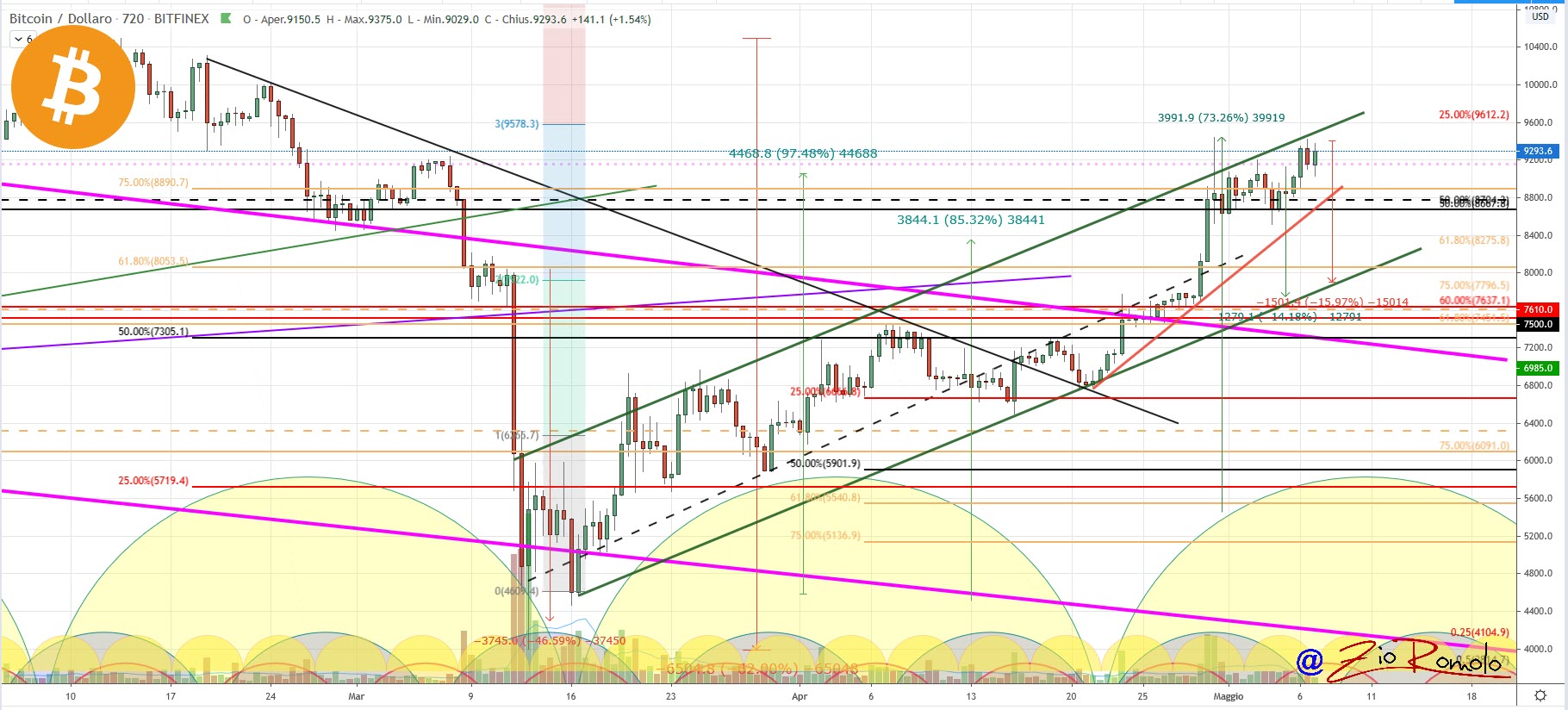

Bitcoin (BTC)

With the rise of the last few hours, Bitcoin confirms the consolidation of the $9,000 and goes to the attack of $9,500, now one step closer, the highest level which was not recorded for Bitcoin since the end of February.

Bitcoin totally cancels the disastrous March and arrives at the finish line of the third halving in a decidedly unbelievable form. Worries for Bitcoin would only come with a drop below $7,800, levels that are currently 15% off. What is certain is that in the coming weeks the halving will also increase volatility, which is now at the lowest levels in recent months.

Ethereum (ETH)

Ethereum remains within the bullish channel started from the March lows. Although it returns to test the $210 threshold, Ethereum shows more than anything else a holding of both the technical and psychological level of $200. A possible break of this threshold would see the first technical support decisive to maintain this trend at $190. In case of a break of the $190, ETH would open a downward phase that has been absent for more than a month and a half and that ended with the lows of mid-March.