Stellar (XLM) is one of the big ones that benefit the most from the increases in progress and with today’s leap its price goes beyond 13%, revising the levels at the end of February, putting the negative month of March behind.

With today’s performance, added to the performance of the previous weeks, XLM has achieved a rally that pushes more than 140% from the lows of mid-March. Stellar with today’s jump recovers the 12th position, going to press on the 11th position of Chainlink (LINK). Between the two today, there is a difference of just under 150 million dollars of capitalization.

After days that showed signs of uncertainty, today marks the second consecutive day of significant increases in the sector, with more than 80% of crypto in positive territory.

These are choral rises that see all the big names recovering their period highs, highs reached at the beginning of April for Bitcoin, which in these hours return to the levels of the beginning of the month, as does Ethereum.

Ripple while showing a slowdown, is back over 19 cents but still missing a few points to review the highs since the beginning of the month.

Among the best, in addition to Stellar who climbs to the top step of the podium, there is Cardano (ADA) who returns above the levels of early March, recovering all the sinking of the second half of last month, in which it had lost over 55% of the value in a few days. Cardano, therefore, rebuilds a good bullish structure.

Among the best, Tezos (XTZ) continues to stand out, confirming the bullish trend that had already emerged in recent days, consolidating more and more the 10th position in the standings.

Today’s rise is also accompanied by growing volumes that go beyond 110 billion dollars with an increase of 15% compared to yesterday.

Total capitalization touches $215 billion. The dominance of Bitcoin remains below the threshold of 64%. Also unchanged that of Ethereum just under 10%. Ripple also oscillates around 4.1%, levels of the past few days.

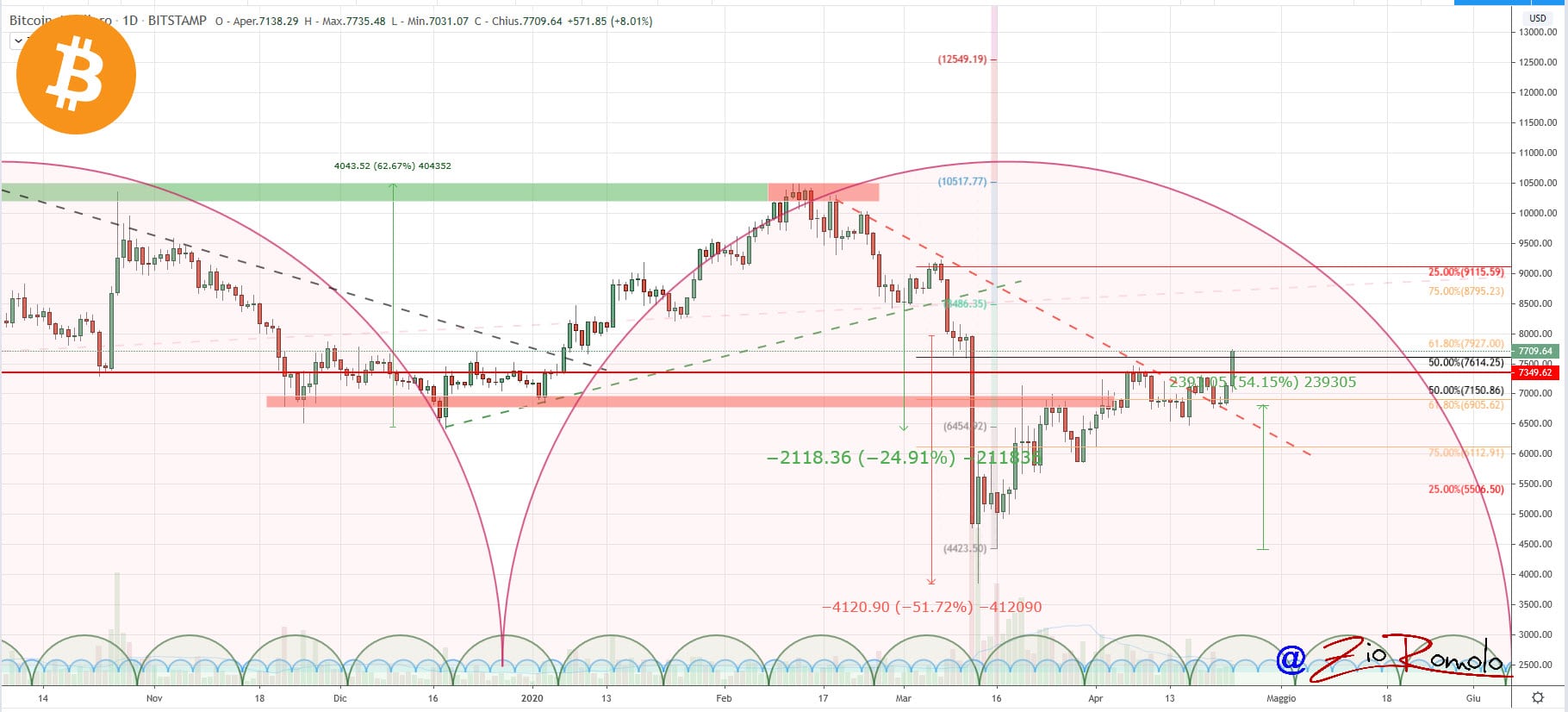

Bitcoin (BTC)

With today’s jump Bitcoin goes to test again the threshold of $7,400, which at the beginning of April had been precisely the level of resistance that had rejected the previous attack.

If the current high jump were to be confirmed by the growth in volumes, it would gain more and more strength by repositioning the next target area at 7,800-8,000 dollars.

Ethereum (ETH)

Ethereum’s bullish structure confirms the current upward trend that accompanies the rise from the lows of March 16th. A rise that has occurred unexpectedly because a possible jump over $190 in the next few hours would give a signal of strength against the setting that would see the closure of the bi-monthly cycle hypothesized with a conclusion at the end of April and beginning of May.

This signal would bode well for a continuation of a trend with bullish strength of equal if not greater intensity.

These are crucial hours to follow carefully. Contrary to what has happened in recent weeks, with the current movements it is necessary to observe resistance levels.