Deposits in the DeFi sector are rising, with new records indicating growth in the sector. This is happening as we leave behind yet another downward week, the 4th consecutive for the cryptocurrency sector.

This decline is a movement that has seen prices continue to slide since the beginning of June with an extension that at present is not worrying.

If we aggregate the 4 weeks of decline in intensity, we are just over 10% and this shows a movement that, when summed up, is less than what we recently accumulated in the third week of May, which had seen a decline in less than 7 days of the same intensity.

To find a similar trend we have to go back to the summer of 2016, with levels far from the current ones (Bitcoin was worth about 700 dollars).

This leads to a further drop in volumes, with the second-lowest trading volume over the weekend since the beginning of the year. The previous one was on the first weekend of the year, in the middle of Christmas festivities.

Volatility continues to contract more and more, reaching 1.5%, the lowest level since March 2019, which is daily volatility on a monthly basis.

This highlights that this is a decidedly boring but peculiar period, with traders sharpening their weapons in anticipation of the explosion of volatility and a clear directional movement.

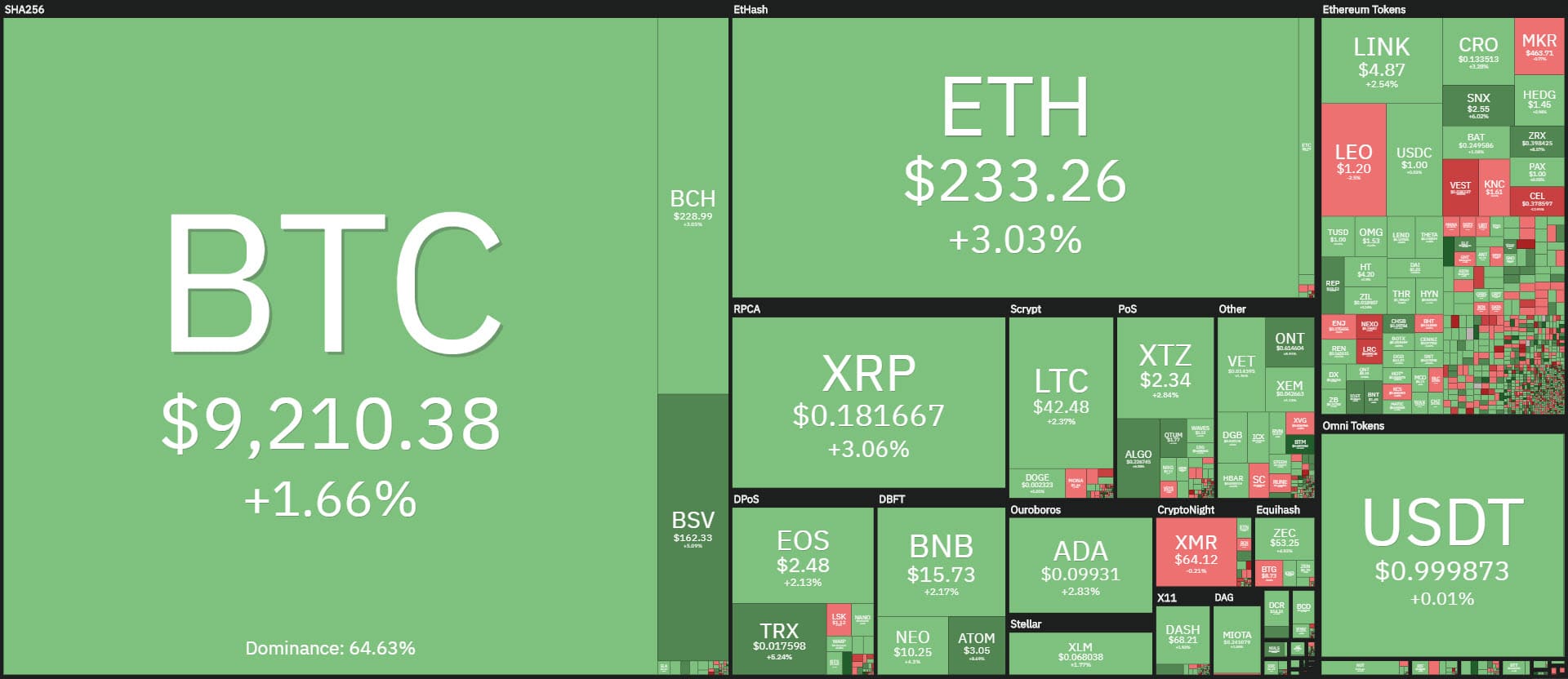

Today sees a balance between red and green signs. Scrolling through the movements among the most capitalized, it is necessary to go down to the 16th position held by Tron (TRX) which with a jump of 5% is the most eventful token of the day.

Slightly below there’s Cosmos (ATOM), in 25th position, rising by 7%. Next comes Compound (COMP) which rises by 5%. COMP continues to remain under the eye of volatility and speculation both positive and negative.

Among the top 15, only two signs are below par, Eos (EOS), -0.3% and Leo (LEO) who loses 2.5%, going back below $1.20.

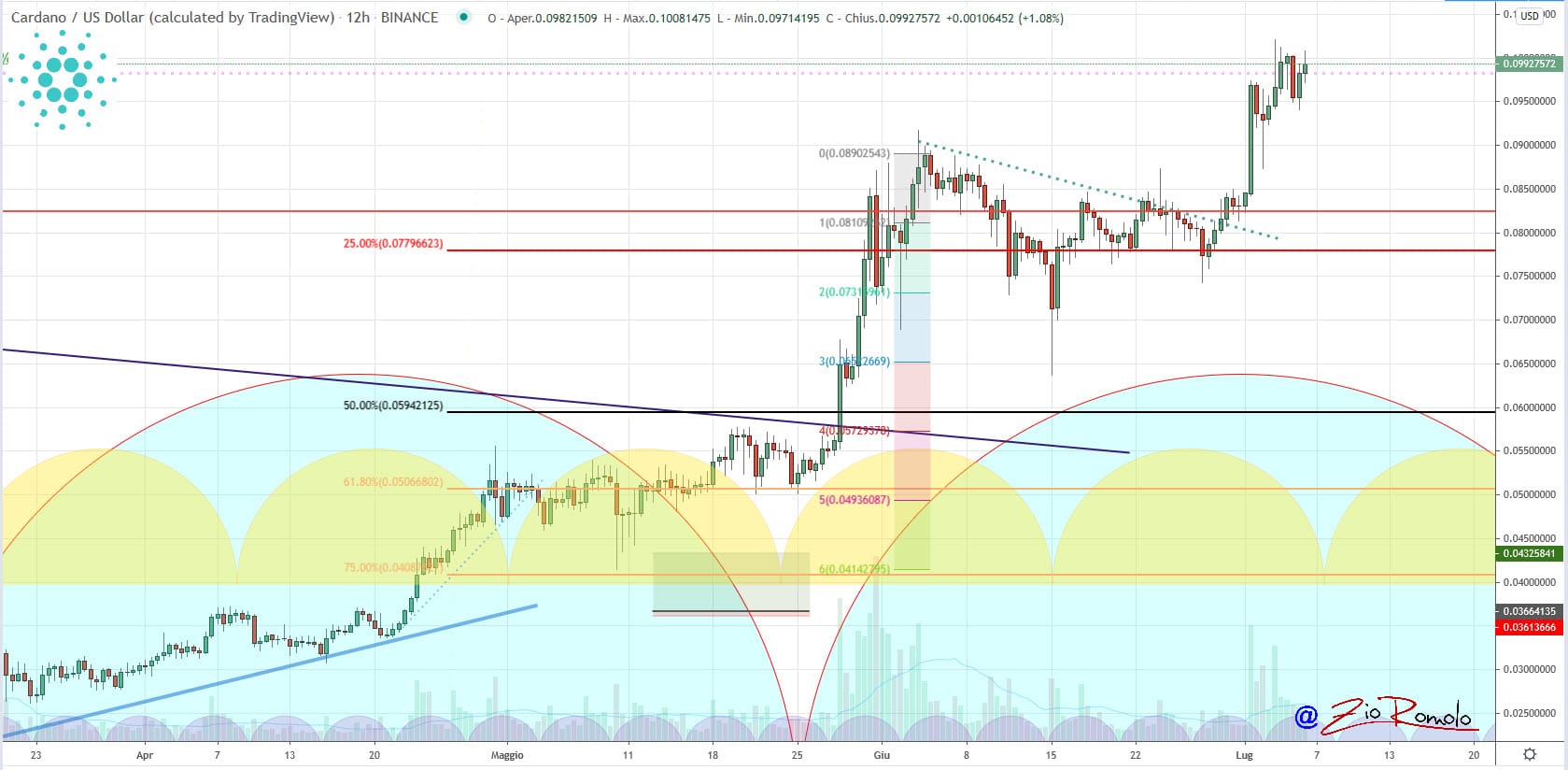

Cardano (ADA) continues to give bullish signals today, as it did over the weekend when it consolidated the gains achieved last week, reaching the highest level since the end of June 2019, pushing above 10 cents.

In these hours the 10 cents, are a key centre of gravity between purchases and sales. With the jump of the weekend, Cardano consolidates its position and today it climbs to the highest level ever, taking the 8th position, undermining Binance Coin (BNB) and pressing the 7th position of Litecoin (LTC). The difference between the two is $150 million.

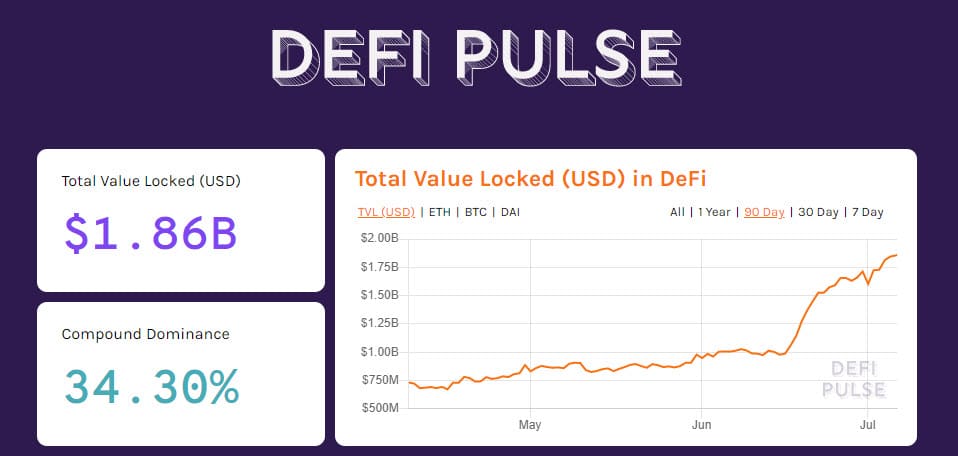

Over the weekend and on the first day of Monday, DeFi reached its new all-time high of deposits held as collateral, close to $1.9 billion. This is a figure that continues to show exponential growth in deposits locked as collateral.

Since the beginning of June, deposits have almost doubled from 980 million to today’s level.

This shows that this sector is definitely growing, increasing the possibility of risks.

Since its launch two weeks ago, Compound has been very volatile, but it still holds the first position as collateral, with 34% of the entire dominance followed by Maker (MKR), Synthetix (SNX), Balancer and Aave (LEND), which has about 127 million tokens locked as collateral.

The market cap remains above $260 billion. The dominance of Bitcoin cedes a few decimal places to 64%. A fractional gain for Ethereum reaching 9.7%. Ripple continues to fluctuate at 3%, the lowest levels in three years.

Bitcoin (BTC)

During the weekend Bitcoin went again to test the technical threshold of $8,900, tested three times in the last 2 days.

It is the options that highlight how the 8,700-8,900 area is a crucial area and protected by more than 80% of open put positions to cover the declines. On the contrary, the call positions in the last few days confirm the coverage in area 9,350 and then see more hedge positions upwards between 9,600 and 9,850 dollars.

Ethereum (ETH)

During the weekend, Ethereum recorded a contraction of very low trading volumes. Prices are holding up better than medium-term supports.

Despite the weakness and boredom of the weekend, Ethereum maintains the support of $225 and today in these early hours of the second week of July tries to push again above $230, bearing in mind that for Ethereum the crucial upward level that would attract new buying volumes is $235, an area that is also the first level of coverage for professional investors who indicate area $230-235 as the first level to be broken down to continue the rise to $245-255, these are the upward resistances.

Downwards, hedging increases towards area 215 dollars, where about 40% of total open put positions are established for coverage of possible falls, in area 218 dollars, former levels of technical support and former resistance area, now crucial support and not only technical.