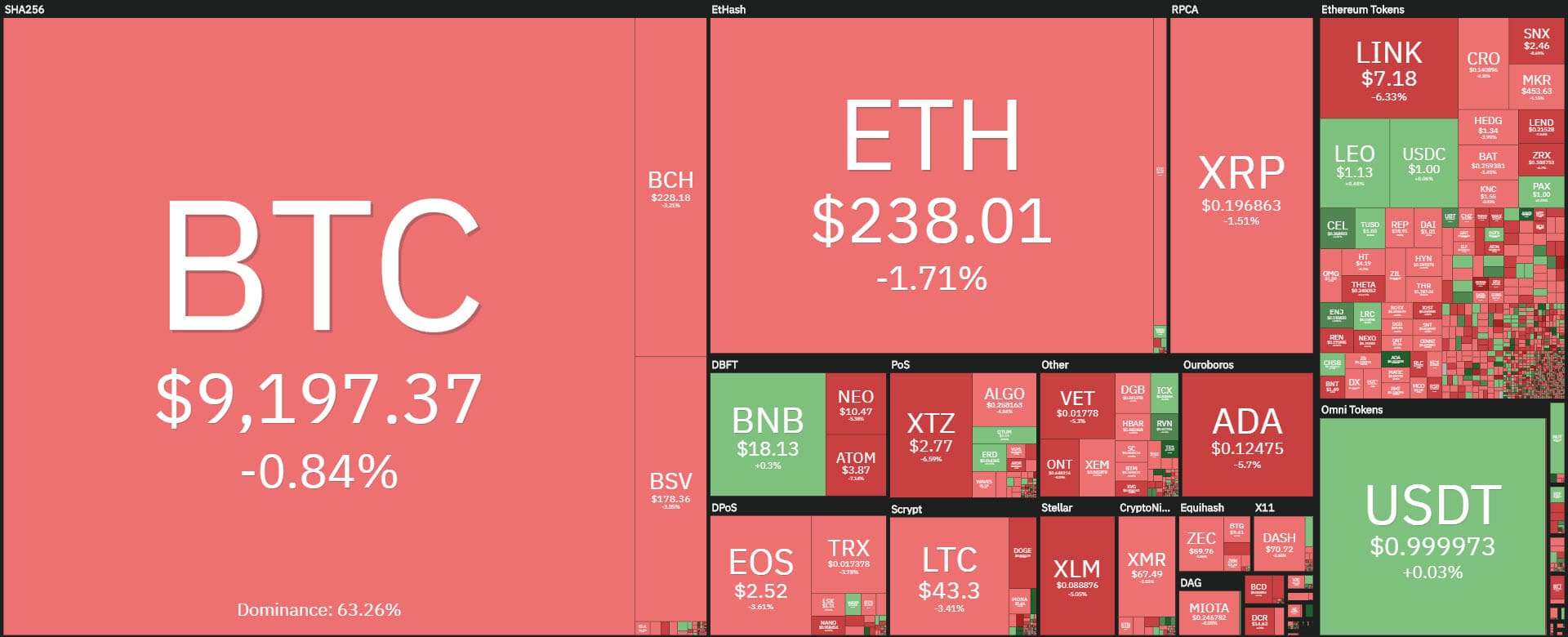

With Bitcoin looking increasingly dormant, oscillating between the lows and highs of the last 5 days within the $200 range, attention continues to shift to records in the DeFi sector and on altcoins, which, unlike what happened in the last few days, today show a prevalence of negative signs. More than 80% are below par.

Significant are the movements of the coins that in recent days have recorded strong increases. Cardano (ADA) today drops by 6%, losing the 6th position, where the head-to-head with Bitcoin SV (BSV) continues with a difference of 150 million.

Chainlink (LINK) lost 11%, dropping to 11th position. Stellar (XLM) also loses 7% occupying the 14th position.

Despite these strong downward movements, weekly gains continue to remain substantial. In fact, these three big players are recording double-digit gains. The best is Chainlink which scores +30%, Stellar +25% and Cardano +18%.

Chainlink, after climbing above new absolute historical records at $7.50, has seen a 450% gain since the lows of March. Half of this gain has been achieved since June. A bounce upwards that has now led to profit-taking, making the price of LINK fall back to test the psychological threshold of $7.

Among the first 100, the one that is attracting attention is Aurora (AOA), showing a strong increase. Aurora is a project that by means of a new consensus system aims to position itself among the blockchains that allow a trading speed particularly suitable for sectors that require immediate payments such as gaming, big data, IoT.

The token is traded on a few exchanges, in particular Asian exchanges such as Bithumb and KuCoin. The token is now up 250%, multiplying Aurora’s value by 4 times over the last month. Aurora’s value is now $0.015 for the first time.

Loopring (LRC) marks a good daily rise, +17%. Elrond (ERD) also made a comeback, +10%, continuing the climb to 53rd position with 190 million capitalization.

On the opposite side, Ampleforth (AMPL) loses 40%. In the DeFi universe, Nexo (NEXO) loses 11%, followed by Synthetix (SNX), Ren (REN), Kyber (KNC) and Aave (LEND), all down between 7% and 9%.

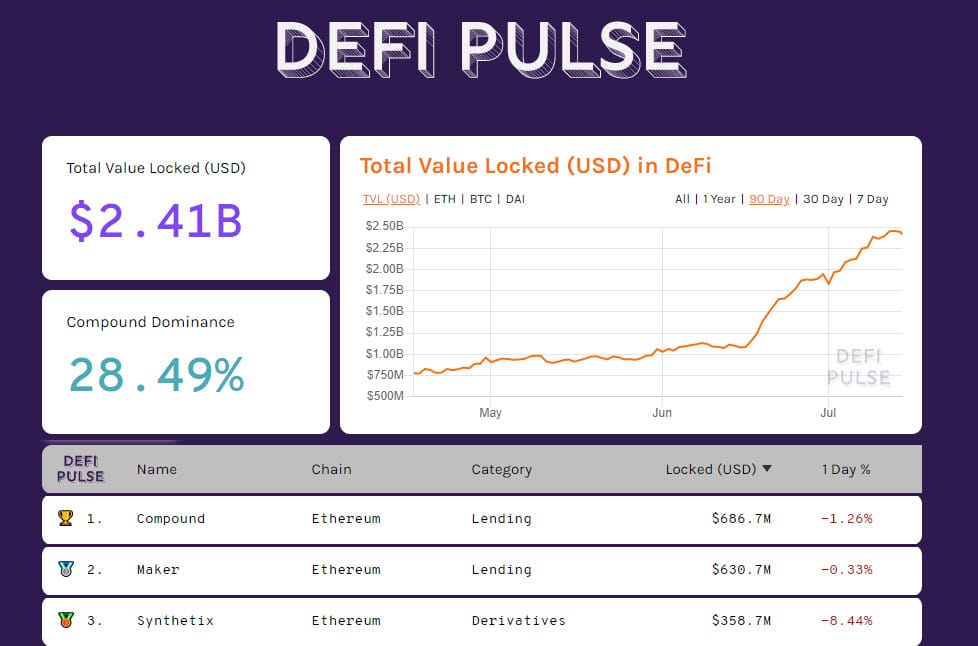

The records of the DeFi sector

It is precisely the DeFi sector that continues to be in the news, touching new TVL records in the last few hours, reaching $2.5 billion.

A rise that is exponential, considering that at the beginning of June the TVL recorded just over 1 billion dollars.

The DeFi sector recorded a total capitalization of 7.6 billion. The Bitcoin tokenized as ERC20 recorded a new maximum aggregate with over 140 million dollars tokenized on the Ethereum network, which corresponds to 15,280 BTC locked.

This too is a record, being the highest peak ever with a counter value of $240 million.

Compound (COMP), for the first time since the listing a month ago, falls below $160, and this also causes COMP to lose dominance in terms of locked value on the protocol, which falls below 30% for the first time.

Compound, together with Maker, hold over 60% of the tokens locked in DeFi.

The industry’s total market cap, with today’s setback, is back to $270 billion.

Bitcoin continues to be under 63% of dominance. The last time BTC touched this value was last June 2019, although at that time the trend was from the bottom up. In order to see a reversed break, we need to go back to April 2017.

Ethereum and Ripple remain at the levels of the last few days. ETH is at 9.8%, failing again to overcome the 10% dominance, an attempt that already happened last week and at the end of June. Ripple remains at 3.3%.

Bitcoin (BTC)

Bitcoin continues to be caged within a narrow range, and this further decreases daily volatility on a monthly basis by a fraction of a decimal point, which updates last year’s low to 1.48 points.

Nothing to observe from a technical point of view compared to yesterday’s update: hedges increase slightly to $8,950 for put options by professional investors.

CME’s derivatives and options trades are low, while those on Derebit, the leading platform in the sector, which trades 80% of the total volume on the options market, are decidedly strong. Resistance hedging between $9,600 and $9,850 remains on the rise.

Ethereum (ETH)

Ethereum remains quite asleep with fractional fluctuations that remain close to the highs of the last two months in the $240 and $245 area.

For Ethereum it is necessary to break the threshold of the maximums in the $250-255 area, tested several times since the beginning of June, but without success.

Area 240 and $250 are also the levels of coverage by professional investors trading in derivatives, the two most important barriers to break to start the uptrend.

Downwards, above the $215 threshold defended for weeks now, the $225-230 hedging positions have increased. $215, $225 and $230 are the levels that need to be monitored carefully in case of declines in the next few hours and days.

While the open interest in options derivatives on Bitcoin remains below the June average, the OI in options on Ethereum continues to grow. Yesterday, it nearly reached the historical highs at the end of June with about $170 million on contracts remaining open overnight.