After lighting the fuses in the past few weeks, with the small altcoins that have achieved triple digit elevations, the last week sees the Ethereum price going up.

After two years in the shadow of Bitcoin’s performance, Ethereum has achieved an increase of 30%. An intensity that ETH had not experienced since May 2019. Ethereum takes a step from the records of June 2019, surpassing the highs set in mid-February and turning on the altcoin season, the so-called “altseason”.

The weekend recorded explosive trade, which generally exceeded 160 billion dollars. These were volumes that had not been recorded since last February. Also the volumes on Bitcoin for the first time since June 25 are back above 2.2 billion dollars.

The volumes on Ethereum in some parts of the weekend exceeded, for the hourly trades, also those of Bitcoin. These are volumes that exceed the record of March 13, with over 1.6 billion dollars.

It’s 4 consecutive days that ETH trades exceed the countervalue of 1 billion dollars. Such a long event has not been recorded since mid-February.

This highlights how the sector has definitely returned to the forefront, initially dragged by mid- and small-cap altcoins. These days, however, it is Ethereum that is taking the scepter of the rises.

Today Bitcoin and Ethereum rise by more than 6%, while instead XRP goes in the countertrend and loses 1.5%.

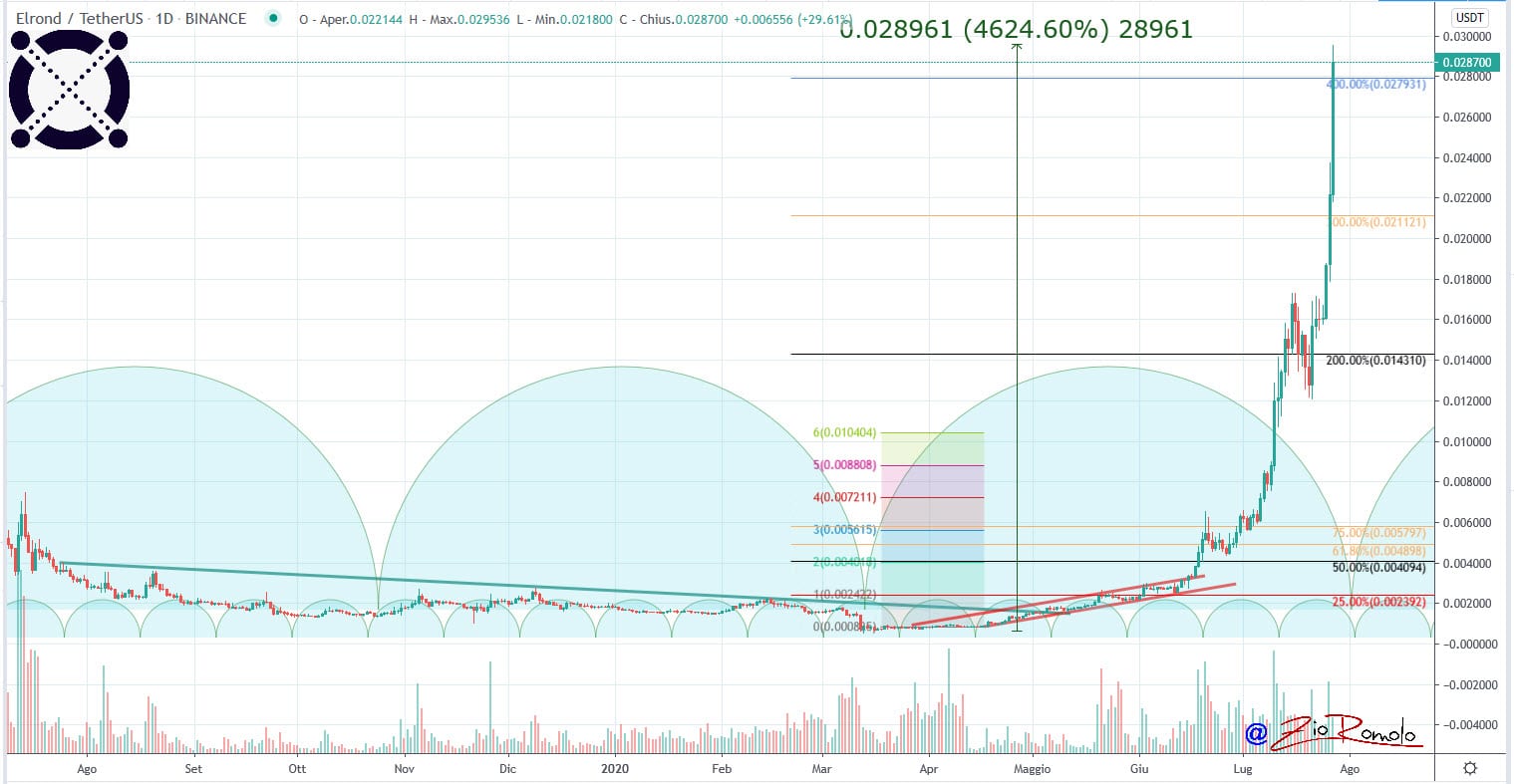

Scrolling through the list of the top 50, the Ethereum climb is among the best with +35%, behind only Elrond that on a weekly basis scores an increase of over 100%, doubling its value.

On a daily basis Ethereum is at the third step of the podium for the best climbs. It does better than a few decimal fractions Bancor (BNT).

But the best is Elrond (ERD), which with a 50% jump establishes one of the most explosive rises of the period.

From the lows of mid-April, Elrond scored a rise that multiplied his value by 50 times, seeing $0.003 for the first time. It’s an ambitious reality, a new blockchain architecture that makes transaction speed its boast.

It is a PoS-based mechanism that allows the network to scale efficiently and securely, theoretically guaranteeing 10,000 transactions per second. Elrond is a project born in July 2019, which one year later already ranks strongly in 33rd position, with a market capitalization that with the recent increase is over $385 million.

DeFi records

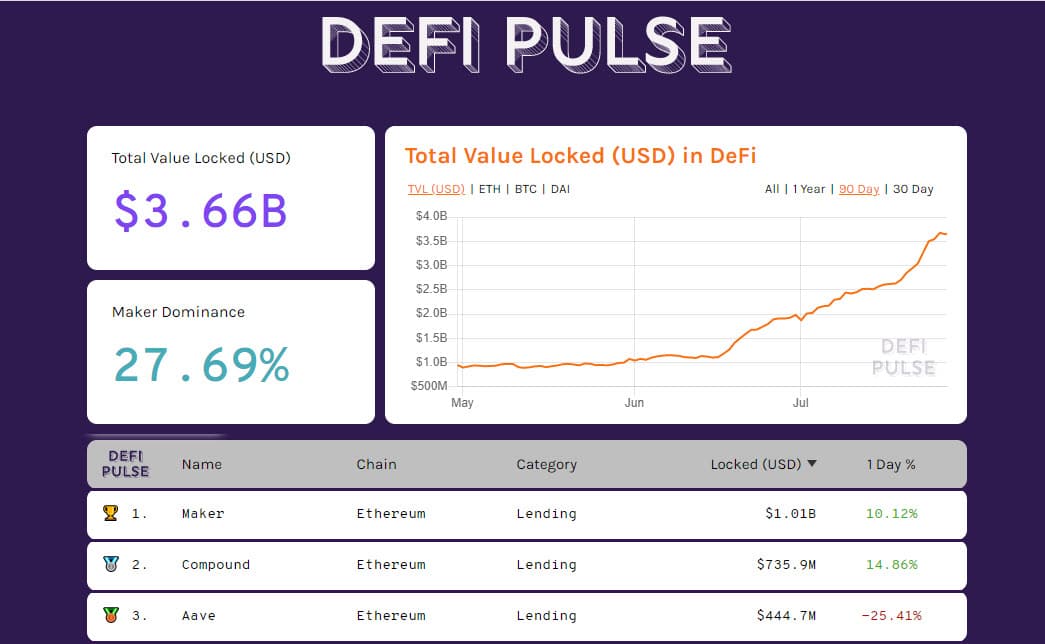

Over the weekend, DeFi’s TVL (Total Value Locked) saw over 3.6 billion cash locked in on the decentralized ecosystem recording a new high.

Maker for the first time exceeds as capital locked on its collateral protocol over $1 billion, winning 28% of dominance. Compound follows and regains second position, while Aave slips, in 3rd position, tailed by Synthetix. The market cap of the first 100 tokens of the DeFi ecosystem exceeds 7.1 billion for the first time.

Derivatives

Volumes also set new records on the derivatives front. The aggregate volume of Bitcoin futures, despite the closing of the CME weekend, has been the highest trading peak since June. Open interest also rose to new records at $4.5 billion, the highest levels since February. The open interest on options has seen a new record of the last month, close to the historical record of June 25.

As for the volume on Ethereum derivatives, yesterday ETH set the second historical record ever for volumes on futures, behind only the record of March 12, when it was in the midst of the Covid crisis.

Open interest in futures continues to rise, setting a new record above $1.1 billion. This indicates that the open positions of the last few days continue to be held in investors’ portfolios. This is a strong sign that the trend is likely to continue in the coming weeks.

The strong rises in the last few days are starting to be a movement that goes well beyond the average of the last few months.

Volatility on Bitcoin continues to score new lows, reaching 1%, the lowest level since October 2016, when for the first time in a few months, daily volatility on a monthly basis reached an all-time low below 1%.

This is an indication that with the upward movement is positive, but at the same time it must increase caution, precisely because now the confirmations of the ongoing rises are necessary.

This is confirmed by open positions on options. Bitcoin increases support protections by $8,950. Upward, after sweeping the hedged positions between $9,800 and $10,300, it is now necessary to understand for professional traders what the next levels of upward hedging are.

Market cap and dominance

Total capitalization goes up over $307 billion. These are levels that have not exactly been recorded since August 2019, slightly above the record of 305 billion dollars last February. thanks to the altcoins that with over 117 billion dollars return to June 2019 levels.

Bitcoin dominance drops to 61%, the lowest level since late June 2019. Ethereum rises at nearly 12% market share, the highest level since January 2019.

Ripple, despite the benefits of recent increases with prices that see it return to test the 22.5 cents, levels already seen last May, XRP remains at 3.2% dominance. This shows that the recent rise is due in particular to Ethereum and the other blockchains that make their workhorse the involvement in the DeFi ecosystem.

Bitcoin (BTC)

Bitcoin returns to review the highs set last June at $10,400, already seen in February. A resistance that will have to be broken keeping the tonic volumes as recorded in the last 48 hours.

In case of breakage accompanied by volumes, the next level of resistance is in the area 10,600 dollars that correspond to the relative highs recorded in September 2019. It is a level where the next levels of protection for options begin to position themselves, although currently little moved.

It will be necessary to understand, if in the coming hours the psychological and technical level of the 10,000 dollars, already tested in June and that rejected the bullish attack, this time will be a valid level of support to consolidate the attack of the 10,400 and then the 10,600 dollars.

Confidence in Bitcoin rises, with the Fear and greed index back to 58 points, the highest level since mid-February.

The rise of Ethereum (ETH)

Ethereum sets the best week since May 2019 with an increase of 35% in 7 days. It goes to review the highs of the last two years in area 360 dollars. The peak of the period recorded in the last few hours in area 330 dollars shows promise for a bullish continuation by Ethereum even if before a further cue would be healthier a consolidation above 280-300 dollars.

At the moment Ethereum has all the characteristics for a continuation of the trend in the coming weeks.

On options, professional investors increase positions to $215-230 as a support area, while on the upside we see the first weak coverages between $260 and $275. At the moment prevail the 8:1 put positions in ratio with calls to protect against bearish positions. The professional operators are more projected towards increases in the near future.