Ethereum in the last few hours, after the highs reached yesterday afternoon, has seen prices go up to area 280 dollars, mid-February levels, a step from the highs of 2020, when in those days ETH recorded the record at $286.

Ethereum puts behind it the critical period that now seems to be a memory, exploded from those highs, which then extended in mid-March with the Covid crisis.

Bitcoin tries to give some shake to the movement that since last May is caging prices in a range between 9,000 and 10,000 dollars. It is a range that since the beginning of July highlights a fluctuation of about 6%. On a monthly basis it is the lowest price range since 2010.

Nevertheless, Bitcoin yesterday scored the third positive upward day, an event that hasn’t happened since mid-May when BTC prices experienced three consecutive days with a green sign from May 12 to 14. Despite being two months ago, prices were the same as they are today, $9,600.

Bitcoin continues to remain sneaky despite a decidedly lively market that is driven by Ethereum’s movements.

Ethereum, after having seen in the two previous weeks other alternative blockchains such as Tezos (XTZ), Chainlink (LINK), Cardano (ADA) and Stellar (XLM), with the leap of the last 48 hours back to the scene of the altcoins, with a rise that on a weekly basis is the best of the first 30, with a performance of +15%.

You have to go down in 31st position to find a better performance: it’s Balancer, a token of the DeFI ecosystem that goes up 40%.

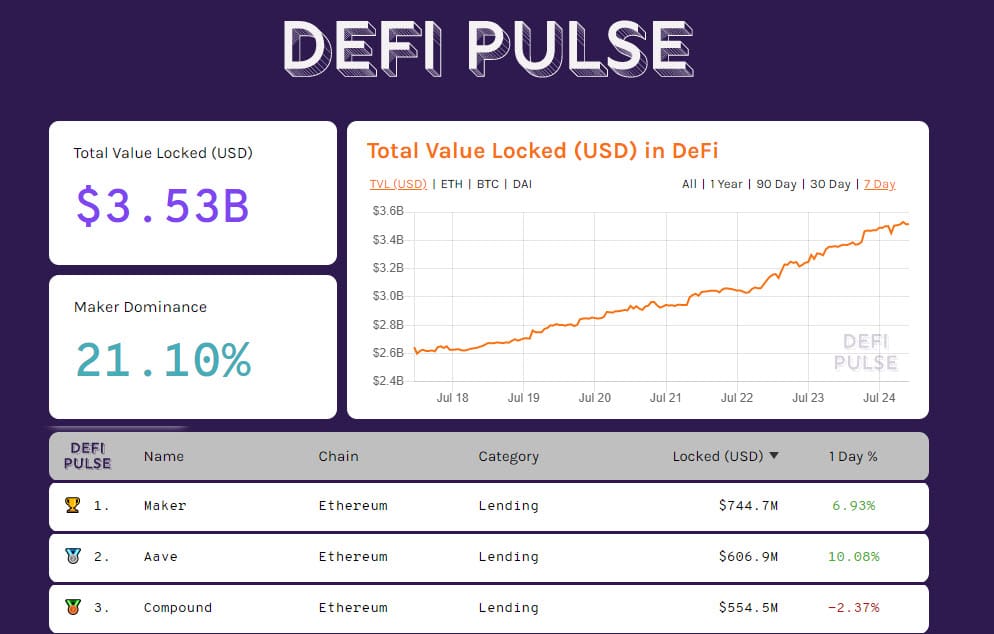

DeFI: TVL at $3.5 billion

Ethereum highlights what is happening in the DeFi sector. Decentralized finance seems to have taken flight, overshadowing Bitcoin’s performance and drawing attention to the flow of capital that is becoming increasingly important.

In the last few hours there has been a further cash inflow blocked on DeFi’s dApps with over $3.5 billion. This is the largest increase ever.

Only on July 22, 2 days ago, TVL (Total Value Locked) reached $3 billion for the first time in its history. In just 48 hours, the TVL made over $500 million. This indicates that we are facing a new phase in the market after what happened in 2017.

Aave, after having conquered the third position, now takes Compound in second place with more than 600 million dollars locked in, behind Maker who, after having conquered the first position at the beginning of the week, keeps the throne with 744 million dollars.

In the DeFi sector stands out the new record for the former EDO token, now PNT, which yesterday with the leap of the last 12 hours has reached $ 1.30: these are the highest levels that the token had not recorded since November 2018.

Among the rises of the day today stands out Flexacoin (FXC) with +38% rise. Flexacoin is a token that facilitates instant payments in cryptocurrency. You can define a CeFI project. Lately it has integrated payments through an app and QR code. This is rewarded by the market with the price of the token that flies from $0.002 to $0.005, doubling the value in a few days.

DigiByte (DGB) registers +5% as Maker (NKR). DigiByte benefits from the Binance quotation.

The total capitalization is at $285 billion, thanks to the altcoins, because Bitcoin capitalization is at the stake at the end of June levels.

Bitcoin dominance remains below 62%, lower levels since July 2019. Ethereum rises to 10.6% market share: they are the highest levels since May 2019. Ripple’s dominance remains stable at 3.2%.

Options and derivatives: record for Ethereum

The fizzy market of the last 24 hours is also back up, with Bitcoin’s trade at just under $1.7 billion, the highest since the beginning of the week. Ethereum’s trades stand out on the spot markets that yesterday recorded a countervalue of about 1.3 billion dollars. These are the highest levels since May 10th.

This is also reflected in derivatives, both futures and options.

Yesterday’s trading on CME’s Bitcoin futures reached the highs since June 24th. Options on Bitcoin also peaked highest on open interest since June 25th, the day when the all-time record was set. Yesterday, a day balance of $1.6 billion was recorded.

Ethereum records the highest trading volume on a daily basis since May 1. While the open interest of the aggregate volume on Ethereum’s features records the absolute historical record, a record that also concerns the options on Ethereum with over 240 million dollars.

Bitcoin (BTC)

Despite trying to put his head above $9,600, Bitcoin still does not give a bullish signal in the medium and long term. It is necessary for BTC to surpass $9,600 with momentum, which is not only a technical resistance but also the bulwark where the professionals in options have highlighted the first level to break upward.

It is confirmed the increase in put option coverage that since yesterday increases the ratio with calls in 1:4. The first supports to break and invalidate the holding of Bitcoin prices are the 8,950-9,000 dollars.

Ethereum (ETH) close to 2020 records

The rise in the last few hours breaks Ethereum’s protection pattern between $255 and $275. The breakage of these two levels triggers the rise of the covers downwards by increasing the level of protection to $245, formerly resistance now a support.

This will be the level to monitor for both the weekend and the next few days. A price hold above these levels will confirm the break of $245-255, which occurred during the night between Wednesday and Thursday.

Ethereum is about to conclude its fourth consecutive week on the rise with higher highs and lows after last week’s slowdown which has been cancelled out by the momentum of the last 48 hours. A recovery that brings ETH to a step to update the February record, 287 dollars, last year’s record.