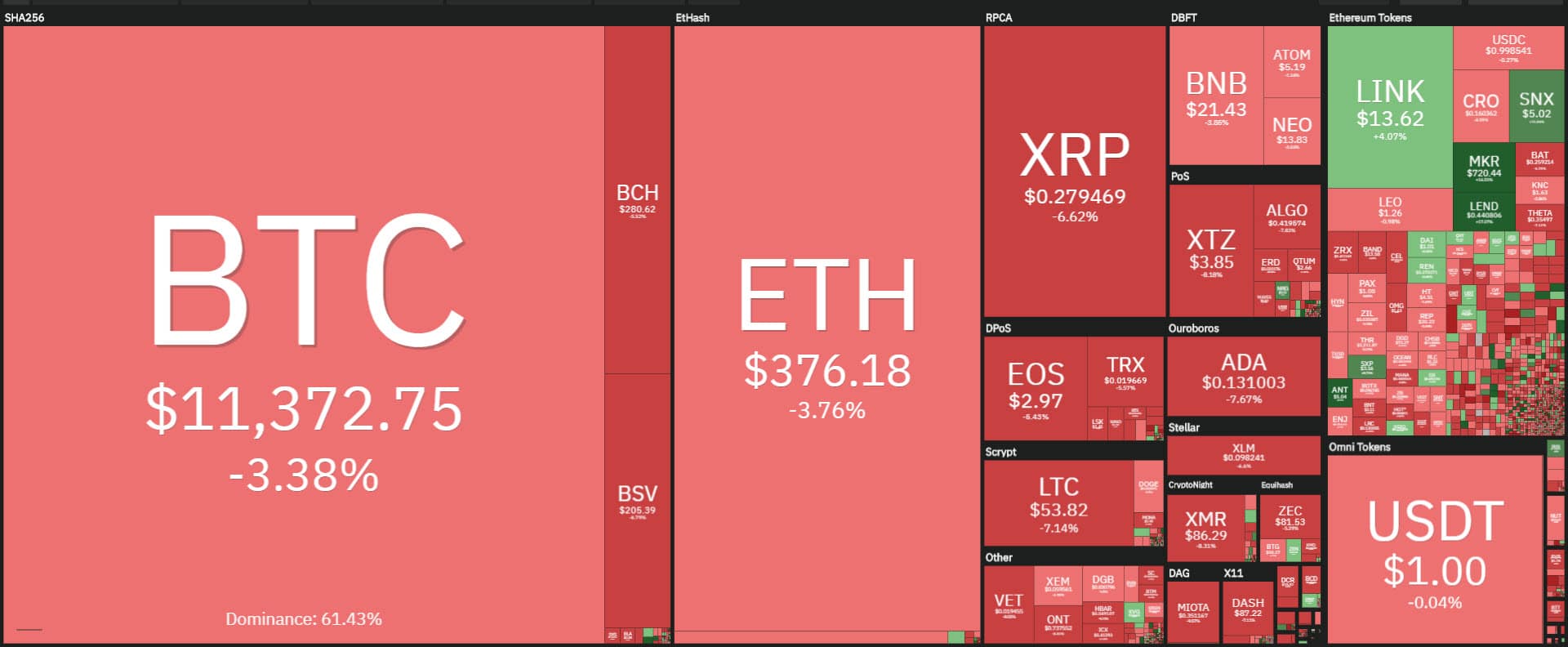

With over 80% of tokens under parity, today opens with the cryptocurrency sector down, with a clear prevalence of red signs.

Declines are prevalent between yesterday and today, both in the stock market and in the cryptocurrency market, with gold falling by -5.6%, marking the worst daily decline in the last 50 years.

Bitcoin’s decline stops just above the 5 points of loss and in 24 hours cancels the attempts to consolidate in the $11,600 area, marking a dangerous double maximum after the attempts at the 12,000 points advanced in recent days that instead of attracting new purchases seem, at the moment, to have been exploited to make the abundant gains of recent weeks.

Yesterday’s downward daily closure comes just a few days (nine) after the drop of over 6%, after that Bitcoin attempted to break the $12,000.

A similar sequence was seen at the beginning of June when prices were testing the psychological resistance of the $10,000. Breaking attempts that only took place after one month, at the end of July.

Cryptocurrencies down today

Scrolling the list of the most capitalized, it is necessary to go down to the 27th position to find the first positive sign.

It is that of Maker (MKR) which rises more than 14%, followed by Aave (LEND) with +12%. Compound (COMP) does better and is positioned between the two in 28th position, with a flight of almost 30%. They are the three best of the day, together with Aragon (ANT) and Ampleforth (AMPL), both up 11% from yesterday’s levels, in clear contrast to the rest of the sector.

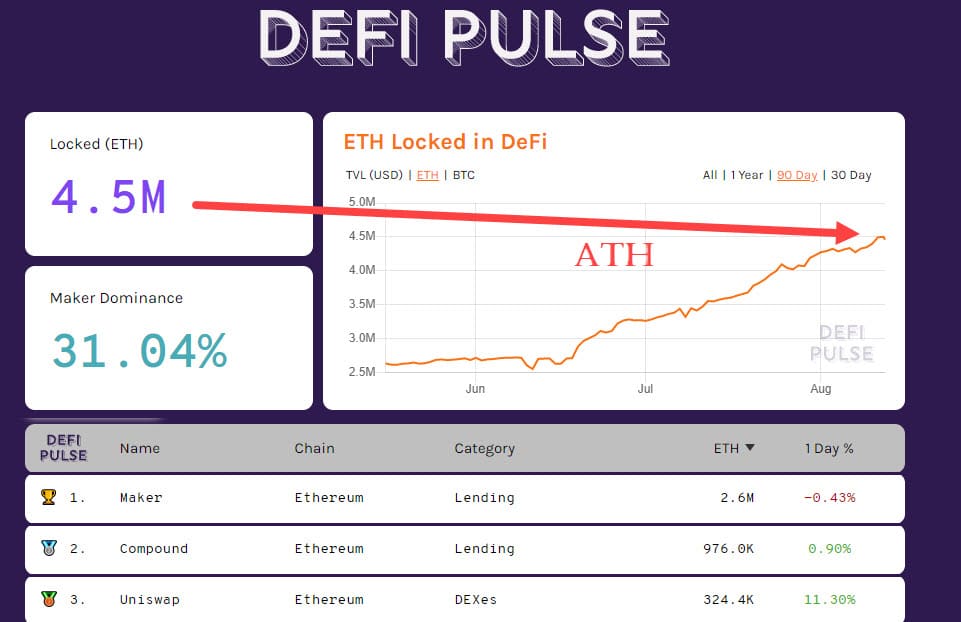

They are all tokens linked to projects in the DeFi ecosystem, which is now experiencing a contraction in the value locked below $4.5 billion after exceeding the $4.8 billion yesterday.

The drop is due to the weakness of the Ethereum price, the most used collateral in dApps and DEXs, which fell below $375 in the last few hours. In fact, with more than 4.5 million units locked, the absolute record, there is no decline from yesterday’s levels.

The tensions of the last 24 hours have increased total trade to over $180 billion. For the second consecutive day, over $3 billion was traded in dollars for Bitcoin. The same for Ethereum with over $1 billion. Volatility also rises, returning above 2.8%, levels that had not been recorded since the end of June.

Why is Bitcoin falling?

The reasons behind Bitcoin prices dropping more than 7% in less than 48 hours are confirmation of what has been reported for several days. Since the beginning of the month, the $12,100 area has started to record, day after day, an increase in upward hedges by professional option traders.

This seems to be the main reason that in recent days has rejected the double bullish attack of the resistance above $12,000.

Defences that in the last 24 hours see a rapid increase in protections even in the $11,800 area.

If the trend should be confirmed today (increase in openings of Call options) it becomes important to follow the further decline in prices that currently find the first level of support, both on a technical basis and in options, between 10,450 and 10,700 dollars.

The cross with the Euro returns to test the 9500 points, former resistance now crucial medium-long term support.

Ethereum (ETH)

Even for Ethereum, the $410 resistance, defended by a high number of open calls in recent days, has proved to be a level where the overlays prevailed in closing profit positions, rather than attracting new purchases.

The descent in the last few hours below $375, begins to raise the first levels of protection, in the event of further falls, from $305 to $345. The latter is the first real barrier that will have to reject any extension of the current drop.