Last week the 1-month correlation index between gold and Bitcoin reached the highest level ever, confirming a direct relation with the prices and rises recorded since mid-July that brought gold to an all-time record of $2,074 an ounce and Bitcoin just over $12,100, reviewing last summer’s highs.

Gold and Bitcoin, prices updated

With yesterday’s decline, the price of gold lost more than 10% in just 3 days. A downward move second only to the one experienced last March when gold lost more than 14% in just 8 days. The movement in a few hours brings the prices back to mid-July levels, cancelling the rally of the last two weeks.

Even Bitcoin yesterday recorded a weak start of the day that pushed prices to update the lows of the last seven days going to test the psychological threshold of 11,100 dollars.

Only during the second part of the day did the hesitant return of purchases allow to recover the $11,500 threshold, managing to close the day with a positive sign. This condition is also reflected in these early hours of the day with a rise above 1% from yesterday morning’s levels.

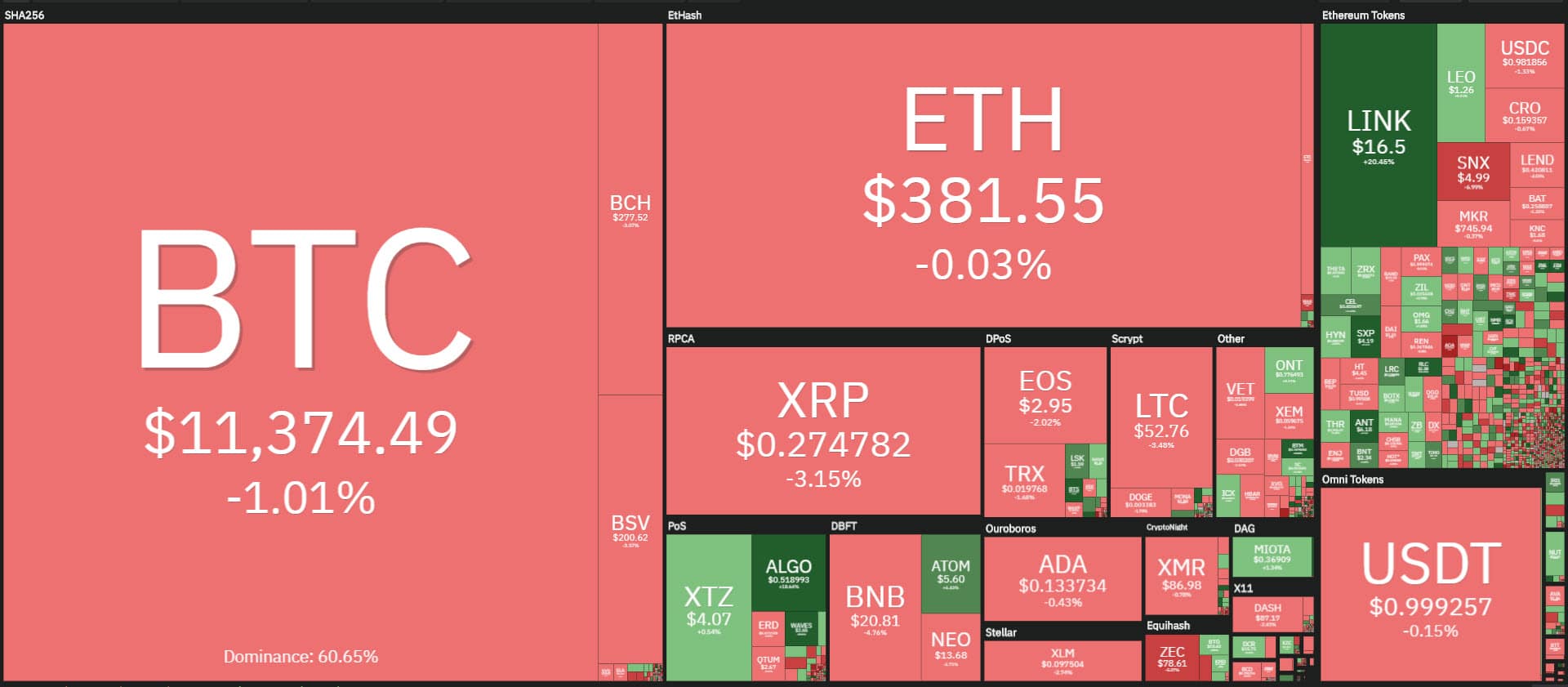

Crypto market in positive

Among the first 100 capitalized, even today the positive signs prevail with more than 70% preceded by the plus sign. Scrolling the list, it is necessary to go down to the 40th position to find the first red sign: it is the Energy Web Token (EWT), slightly down (-0.2%) from yesterday morning’s levels.

There are many double-digit increases, among them Chainlink (LINK) that with a sprint of 30% exceeds $17.5 setting a new absolute record.

This value increases its capitalization over $6.2 billion, undermining the fifth place of Bitcoin Cash (BCH).

Also worth noting are the rises of Swipe (SXP) and Waves, both up by over 40%, as well as Algorand (ALGO) +31%; Synthetix Network (SNX), Maker (MKR), Cosmos (ATOM) and Theta, all over 15%.

For the first time since the end of June 2019, Bitcoin’s dominance drops below 60%. Ethereum also fell from last week’s levels to 12.1% – levels at the beginning of the month – and XRP at 3.5%.

The uncertain trend of the last 48 hours is causing overall trading volumes to fall below $150 billion.

Those of Bitcoin halved to just over $1.7 billion ($3.2 billion traded on Tuesday), as well as Ethereum with just over $800 million ($1.5 billion the day before).

Bitcoin (BTC)

The technical structure remains unchanged from yesterday’s analysis. Defences are strengthened at 11,850-11,900 dollars, even if the crucial levels in the short term remain at 12,100 dollars.

For a confirmation of the increase, it is necessary to go beyond 12,400 dollars.

The Euro cross chart continues to test the former resistance in the 9500 area.

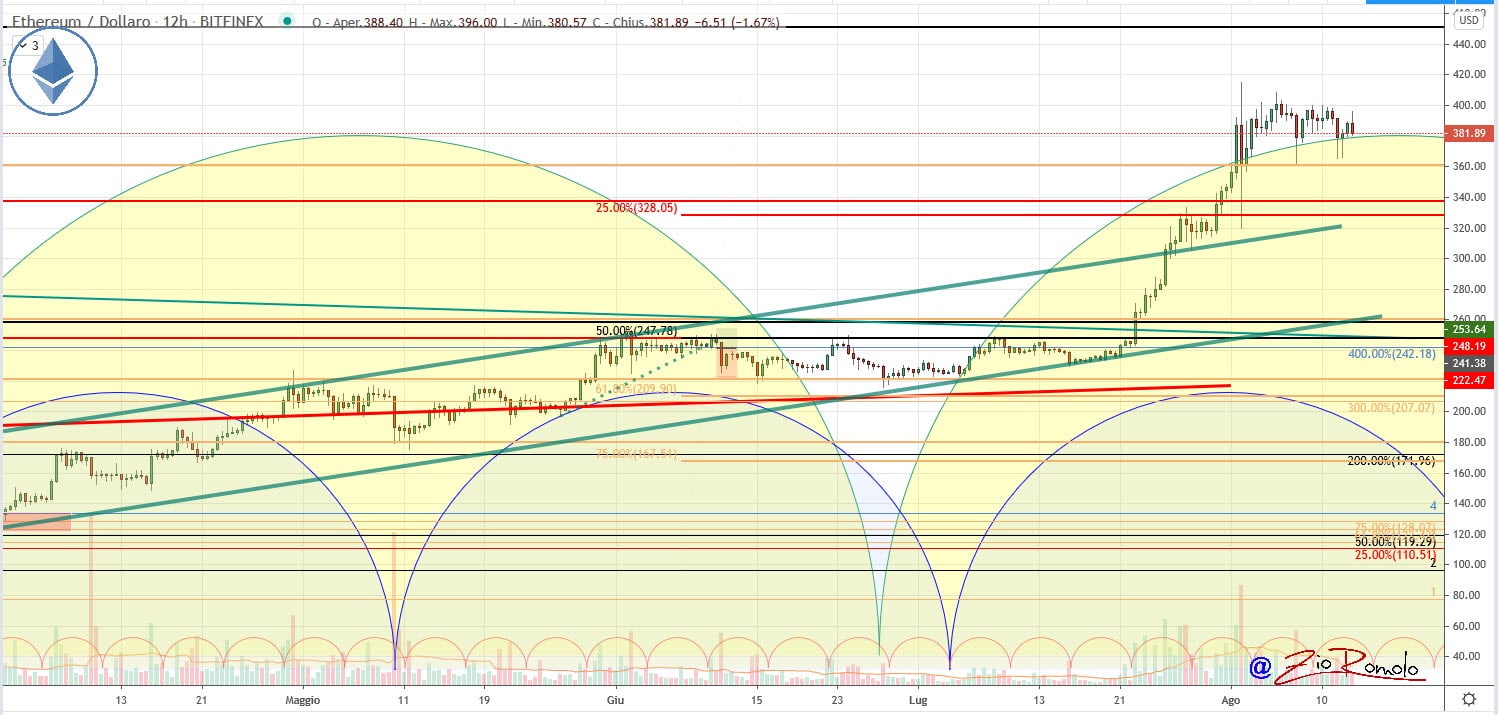

Ethereum (ETH)

The situation for Ethereum also remains unchanged. Yesterday’s operational guidelines remain valid. Upwards it is necessary to go beyond $410 in the medium term.

In the short term, it is necessary not to slide below $365 in order not to attract bearish speculation down to $325, lacking any particular protection.