While the prices of Bitcoin today try to form a valid support above $11,000, altcoins are the ones to push the rises of these hours led by Ethereum: with a jump of more than 10%, Ethereum exceeds $420 touching the highs of the last two years.

It was since August 2018, in the midst of the bearish trend started after having reached the historical highs seven months earlier, that the queen of the altcoins did not see these levels.

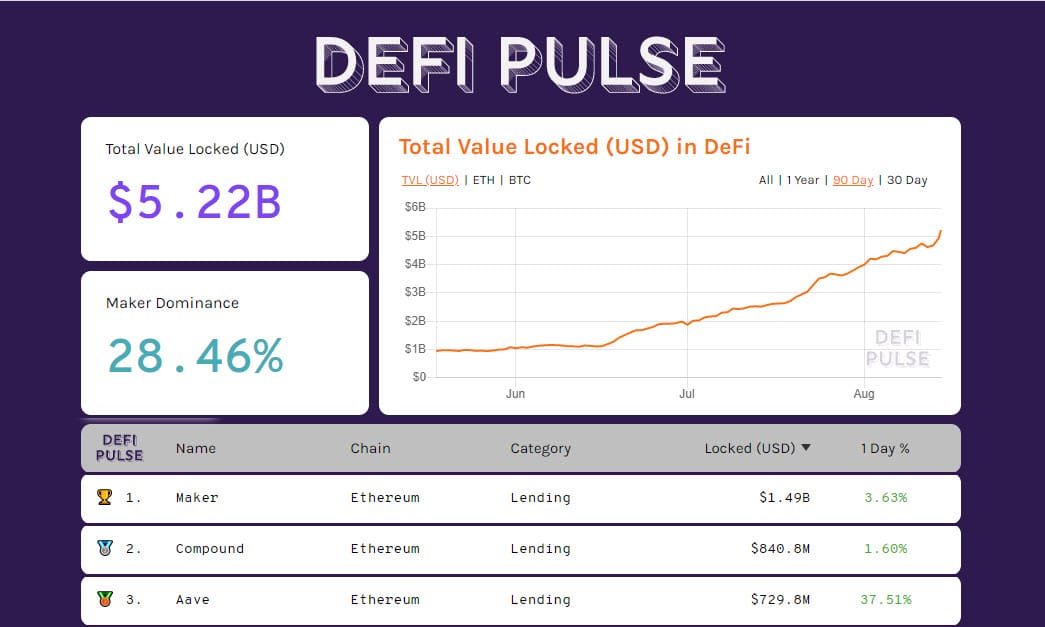

The strengthening of Ethereum is driving the DeFi sector to new records. There are more than $5.2 billion in countervalue locked as collateral on decentralized finance applications.

With more than 132 thousand ETH locked in dApps, a new record, the Aave (LEND) project regains the third position in the overall ranking. The LEND token also benefits, rising more than 3% from yesterday’s levels.

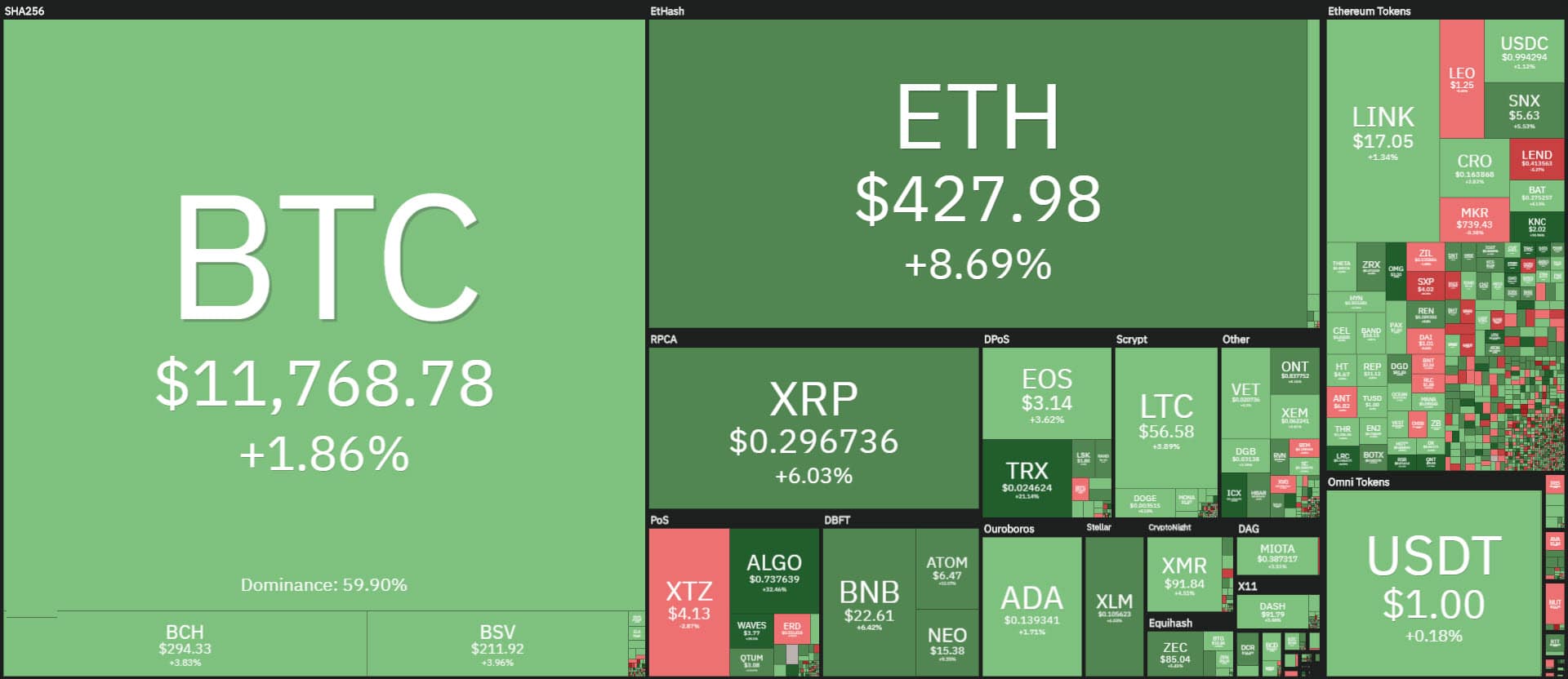

On the podium of the best today, Waves fly over 40%, followed by Algorand (ALGO) +37% and Icon (ICX) +20%.

The climb of Chainlink (LINK) is unstoppable and in the last few hours, it has set a new absolute record going over $18, strengthening the conquest of the 5th position with a capitalization of over $6 billion.

The rises of today bring the total capitalization back to a step from $370 billion, levels not recorded since May 2018. This is due to the altcoins. Taking away Bitcoin’s capitalization, now over $216 billion, the altcoin market cap exceeds $150 billion for the first time since July 2018.

The dominance of Bitcoin drops below 59% returning to mid-June 2019, while with the jump above 13%, Ethereum revises the levels of August 2018.

In the last 24 hours, trading volumes also returned vibrant, reaching more than $190 billion in total.

Chainlink is trading a lot with over $1 billion, behind only Bitcoin and Ethereum, both over $2 billion yesterday.

The return of trading increases the minting of new Tether (USDT). New record for the first stablecoin with over $12.1 billion widening the gap with USDC Coin, which capitalizes $1.2 billion. In the last 24 hours, Tether’s trading volume has exceeded $46 billion, the highest peak since mid-May last year.

Summary

Bitcoin (BTC)

After recovering the 11,500 dollars, the prices try to consolidate the new support with pushes that in these hours hesitantly accompany the quotations above 11,800 dollars, former resistance both technical and protecting from options. Levels of protection that are confirmed just beyond the highs of recent weeks, precisely between 12,100 and 12,350 dollars.

These are the levels that will have to be exceeded in order to continue the climb. Conversely, it is important not to fall below the $10,500 threshold, which corresponds to the low of the bearish spike established during the sell-off on August 2nd.

Ethereum (ETH) at highs

Having passed the previous high of the beginning of the month ($412), the race of the last few hours finds the first protective barrier in the $425 area.

It is necessary to go beyond this level to go and test the next resistance in the $445 area. The recent increase makes Ethereum gain over 75% from mid-July levels.

Among the big names, ETH’s performance is behind only Chainlink’s (+115%). To consolidate the morale of the latest arrivals, and attract new purchasing volumes necessary to set new records for the period, in the coming days it is necessary to consolidate the new support, former resistance, set at $400.