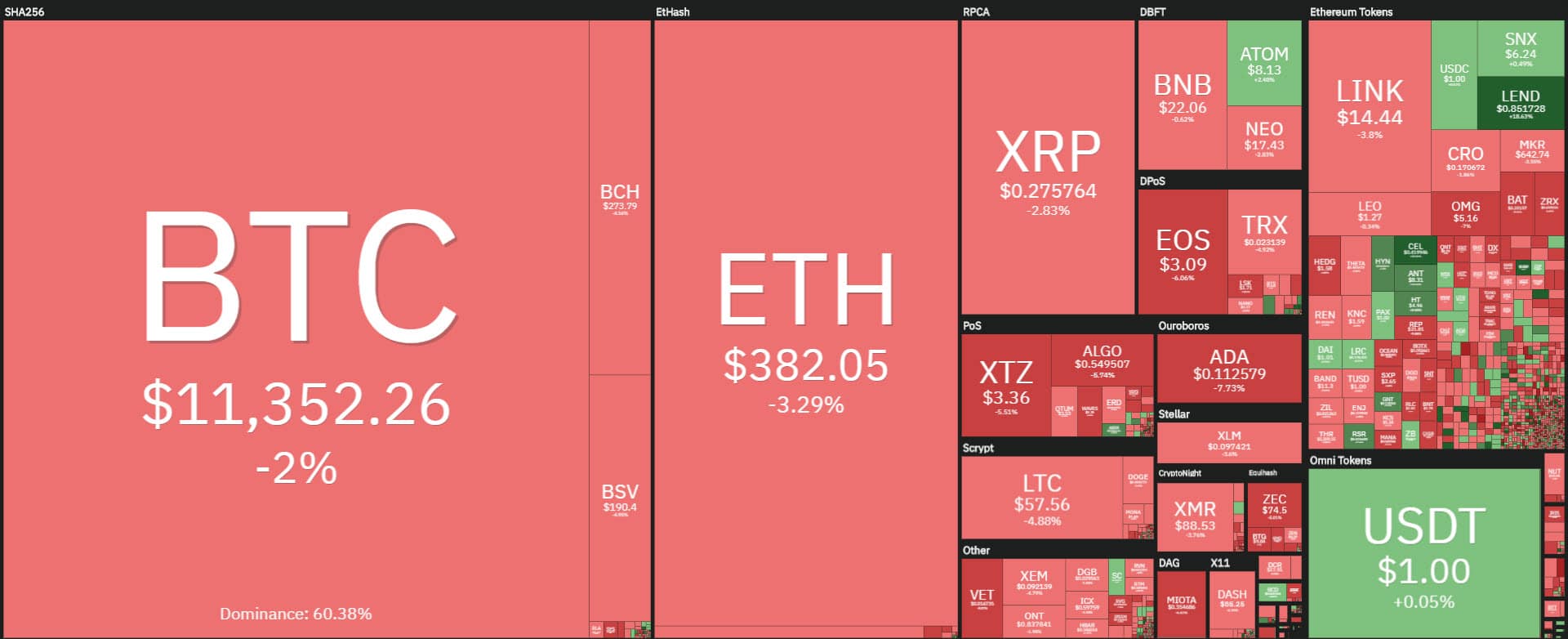

The parabolic ascent of DeFi continues, but for the rest of the crypto market, the prevalence of red signs increases to 80% today.

Scrolling the list of the Top 20, a faded green sign emerges, that of Cosmos (ATOM) which is alone above parity with +0.5%. Going down beyond the 22nd place, there is the rise of Aave (LEND), which today too marks a double-digit increase above 10%.

In the last hours, LEND has touched the $0.9% updating the historical maximum.

Among the best of the day, beyond Aave (LEND), there is Aragon (ANT) +15% and Kusama (KSM) +25%. The latter is a primitive project of Polkadot (decentralized protocol of interoperability between different blockchains).

On the opposite side, one of the worst is Flexacoin (FXC), down more than 13%, followed by Nervos Network (CKB) and Verge (XVG), both -10%.

The declines of the last few hours bring prices back to test relative lows of early August, increasing trading volumes mostly resulting from the closure of short-term positions. Total trade on spot platforms is over $165 billion, with Bitcoin just under $3 billion and Ethereum at $1.5 billion, both the highest level in the last week.

Total capitalization drops to $355 billion, the lowest level since mid-August.

Bitcoin dominance in slight recovery to 59.2%. Ripple unchanged at 3.5% while Ethereum is contracting and slipping to 12%, level of the beginning of the month.

DeFi on the rise

Today the wall of the $7 billion locked on the various platforms has been knocked down.

After the conquest of the first position for countervalue locked in collateral, Aave (LEND) strengthens the podium by climbing over $1.55 billion. New absolute record also for the total amount of Ether used in the various dApps. Over 4.8 million units. A 98% increase from early July levels.

Bitcoin (BTC)

The prices of Bitcoin are again testing the $11,200 support. This is the third time in two weeks. Previously, both times, the support has rejected the downturn by bringing the prices back up to the period highs.

It will be necessary to keep this level in order not to risk going to test the next level in the 10,500 area where in the last 48 hours the defences of professionals in options have increased.

In the last week, the relative strength has increased in favour of the Call options, showing more fear of further declines. This is a factor that raises prudence and encourages the expectation of further confirmation of the consolidation of a valid support in the medium term.

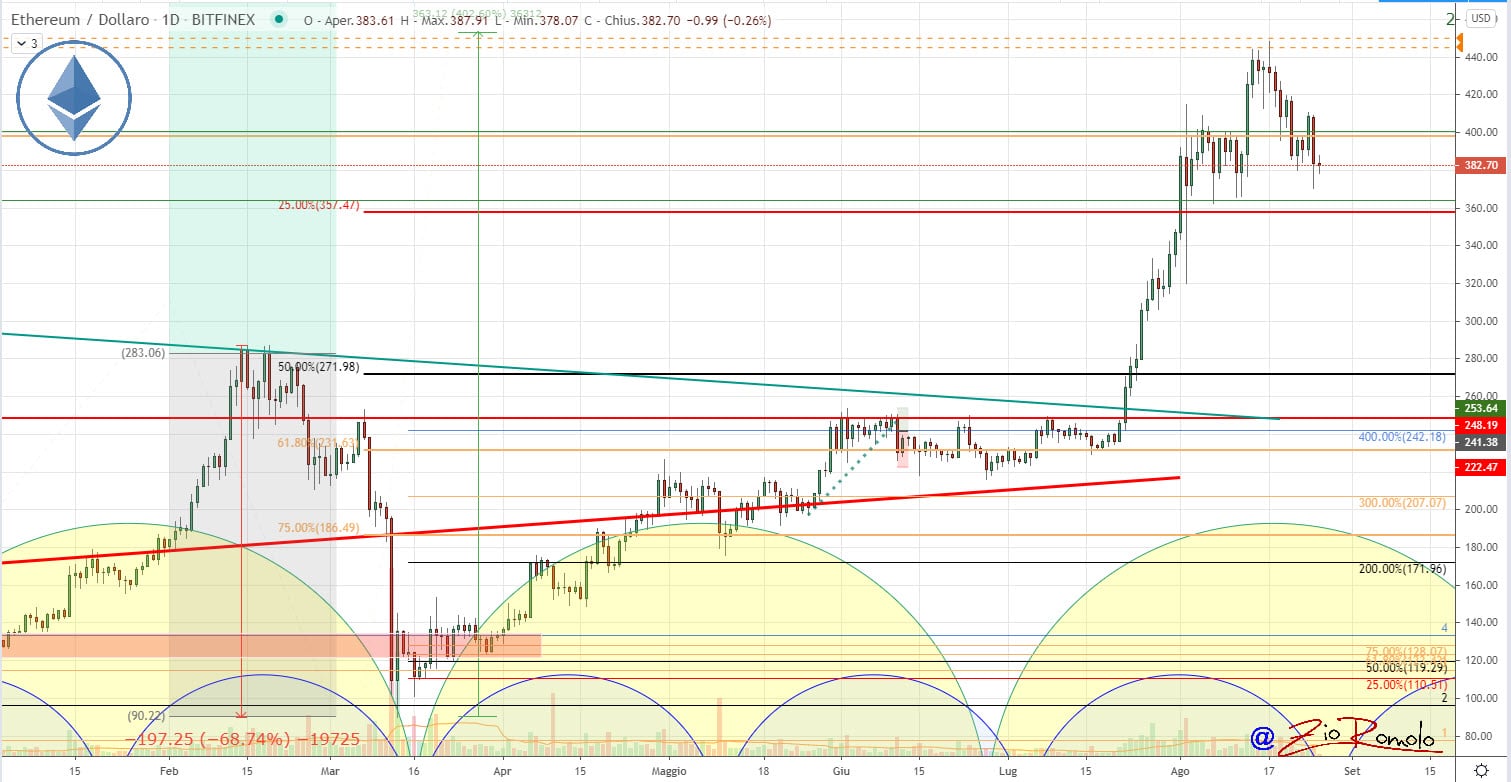

Ethereum (ETH)

Despite the ferment in DeFi, the price of Ethereum continues to indicate particular weakness.

After the highs reached on August 17th, a slow decline started, due more to lack of new purchases than short sales. At the moment there are no concerns about fluctuations below the psychological threshold of $400.

The technical support to monitor remains the 355 dollars, first level protected also by the Put positions of the operators. A break of this level would open spaces for descents down to $310-305. Only a descent below these levels would begin to ruin the solid uptrend built from the lows of mid-March.