Tyler Winklevoss has published a bitcoin price prediction that assumes a scenario that could take it to $500,000.

In fact, on the official WinklevossCapital.com website, he published a long article entitled “The Case for $500K Bitcoin” in which he analyses the current global financial scenario and its possible evolutions.

In particular, he focused on the role of gold and oil as reliable stores of value, and on the fact that the US dollar has also played this role over the last 75 years.

However, Winklevoss says:

“With that said, we believe there are fundamental problems with gold, oil, and the U.S. dollar as stores of value going forward. Below, we will make the case that bitcoin is ultimately the only long-term protection against inflation”.

With regard to the dollar, he says that the effects of inflation, or even hyperinflation, can be seen on the horizon and that according to him “The Great Monetary Inflation is nigh”.

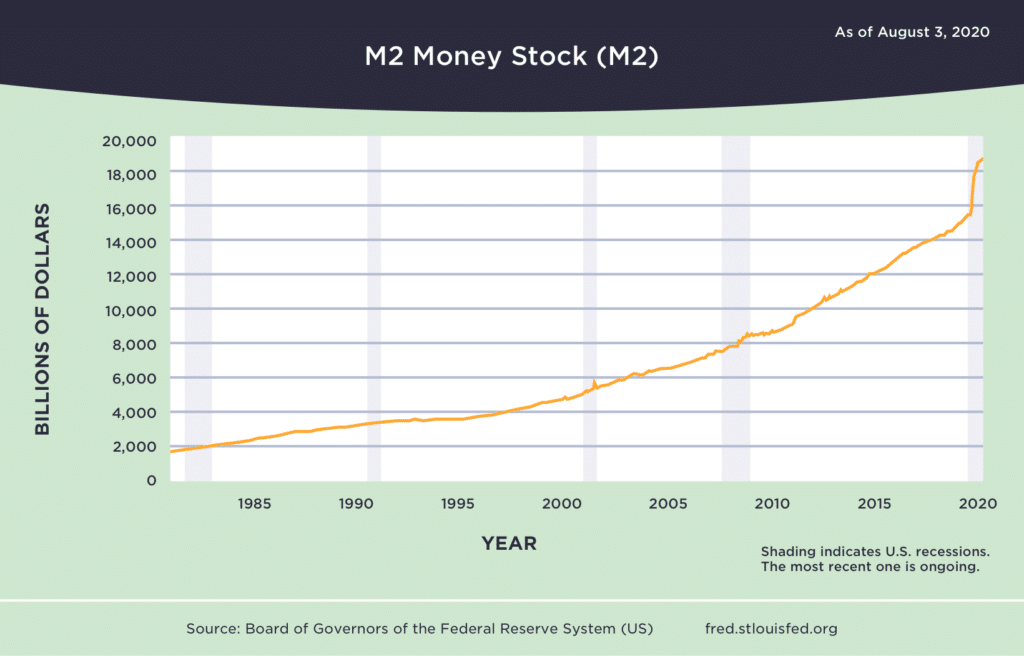

In particular, he illustrates a graph showing that, in 2020 alone, the M2 money supply increased from less than $16,000 to more than $18,000, an increase of more than 13% in a single year.

As far as oil is concerned, he says that it is no longer a reliable store of value, because of a drastic increase in supply resulting from technological innovation, and the fact that it has been discovered that there are many more reserves than was thought.

There are also some dynamics in place that are undermining demand, such as the push towards renewable energy, and political pressures to reduce the input of CO2.

As far as gold is concerned, Winklevoss admits that it is currently a reliable store of value, and is the classic hedge against inflation.

However, there are also a couple of points that need to be considered carefully with regard to the store of value par excellence.

First of all, its supply is not virtually limited, and in the future, it is even conceivable that there may be extraterrestrial sources of supply, as some techniques for extracting it from asteroids, for example, are already being studied.

In addition, it is difficult to move it, for example during a war or if there is a change in governments’ attitude towards property rights.

The prediction of Winklevoss: the price of Bitcoin undervalued

At this point, Winklevoss, comparing the market capitalization of more than 200 billion dollars of bitcoin with about 9,000 billion dollars of gold, assumes that if bitcoin continues on the current path, then the bullish scenario for bitcoin is currently underestimated by a multiple of 45.

In other words, the price of BTC in the future could appreciate 45 times from today, bringing it to USD 500,000 per BTC.

Furthermore, if bitcoin were to replace part of the $11.7 trillion of foreign exchange reserves held by governments, with central banks starting to diversify their foreign fiat holdings even partially into bitcoin, then the multiplication factor could reach 55x, with BTC at $600,000.

Finally, it should be remembered that Tyler Winklevoss is the owner of the Gemini crypto exchange, which profits from the purchase and sale of bitcoin.