Even yesterday, for the fourth time in five days, Bitcoin prices plunged below $10,000.

This is a psychological threshold that from May to mid-July had repeatedly rejected any attempt to go up.

Whereas now, instead, every time an attempt is made to extend the downward movement, defences are triggered.

The sector continues to show a generalized weakness. From last Tuesday’s levels, September 1st, the balance is in the red.

Among the top 50 capitalized, there is only one sign above parity, that of Tron (TRX) which is gaining 15% on a weekly basis. This performance is also favoured by today’s increase of +5.5%.

Today’s crypto market

The day sees a delicate balance between positive and negative signs, even if the green sign prevails among the Top 20.

Only two crypto assets are below par: Chainlink (LINK) -1.5% and Eos -2%. Among the big ones, the best is Bitcoin SV (BSV) climbing above +6%, followed by Monero (XMR) Tron (TRX) and Neo, all above 5%.

Among the best of the first 100 capitalized, on the highest step of the podium, today climbs IOST with a jump of over 30% from yesterday morning’s levels, followed by Elrond (EGLD) that with a +16% tries to react to the storm that has hit prices in the last two months recording a loss of over -75%, due to the delisting from the Binance trading platform.

Privacy coins are back: Monero (XMR) +5%, Dash and Zcash (ZEC) both up more than 10%.

Total capitalization drops below $320 billion, the lowest level since the end of July.

Volumes are down from weekend records, although with over $170 billion traded in the last 24 hours, they remain well above the daily average for the last quarter.

The dollar (USD) value of Bitcoin trading volume rises above $2 billion after the weekend break. Conversely, the USD value of Ethereum’s volume drops below $2 billion after one week.

DeFi

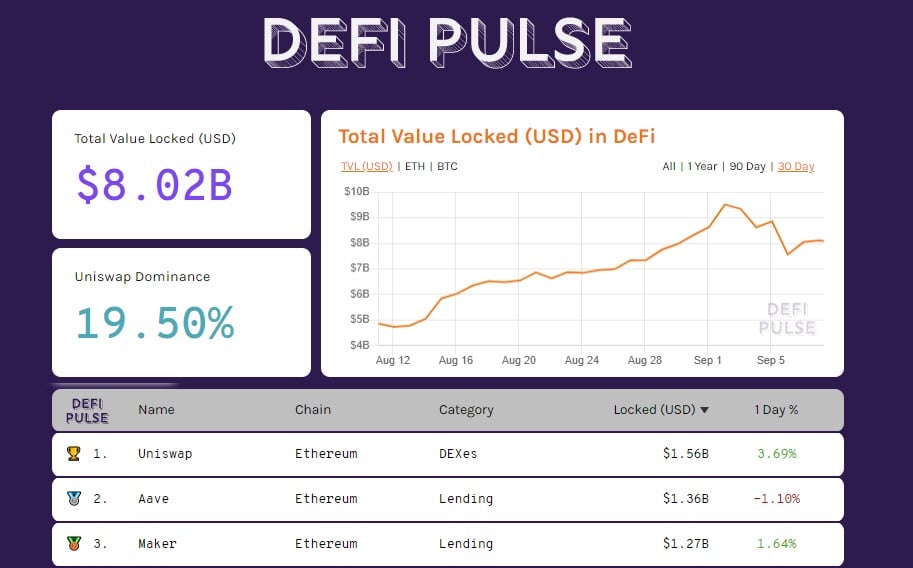

The drop in prices over the last few days also has an impact on DeFi. For the first time, Total Value Locked (TVL) on DeFi platforms fell by $2 billion from a record $9.5 billion on September 2nd to $7.5 billion on Sunday.

The reason is justified by the growing demand among investors who decide to freeze their assets on the various decentralized protocols.

In recent days, there has been a peak of interest among Chinese users with records of daily searches of the term ‘DeFi’ on WeChat’s messaging application.

Some data shows that many traders have bought Ethereum to move them immediately on decentralised apps. Whereas the locked collateral on the various dApps did not decrease.

The number of locked Ether reaches almost 7 million, while the number of tokenized bitcoin is over 80.4 thousand, setting an absolute record.

The DEX (decentralized exchange) Uniswap, with over $1.5 billion, holds the top position in the dApp ranking, followed by the Aave and Maker lending platforms, both with around $1.3 billion in locked assets.

Bitcoin (BTC) at $10,000

The $10,000 support resists even though it becomes increasingly fragile with the passage of time and repeated testing. Traders’ sentiment reinforces the possibility of further sinkings that demobilize open positions on futures.

In 20 days, open interest on futures derivatives drops from $5.8 billion to $3 billion, causing tensions to emerge even among professional traders as they demobilize bullish positions. Option strategies show a clear Call/Put ratio in favour of the former, highlighting fears of further declines.

Only a return above $11,500 will restore confidence.

Ethereum (ETH)

Yesterday’s fall did not affect the prices of Ethereum, which, although struggling, manage not to sink below Sunday’s lows ($310).

The bulls continue to defend the $355 area, a former support that has now become an area of clash between purchases and sales.

As opposed to Bitcoin, professional operators in the last few hours return to cover the levels of support tested in the last 48 hours, between $305 and $325, although strategies to cover possible rises remain much higher.

Only a comeback above $415 would begin to push the bears back.