In the last 12 months, the overall cryptocurrency transaction volume in North America has grown by 300%.

According to CoinPayments Quarterly Pulse, for the second quarter of 2020, which ended on June 30th, the total volume of cryptocurrency transactions received by merchants in North America exceeded $60 million, compared to just over $20 million in the same period in 2019.

$60 million in three months is still very little, but 300% growth on an annual basis suggests that this trend may continue in the future.

On the other hand, the growth trend has been very clear, continuous and definitely sustained since the first quarter of last year.

A very interesting fact is that the average amount of the transaction is also increasing significantly, since at the beginning of last year it was between $100 and $150, while in 2020 it was well over $200.

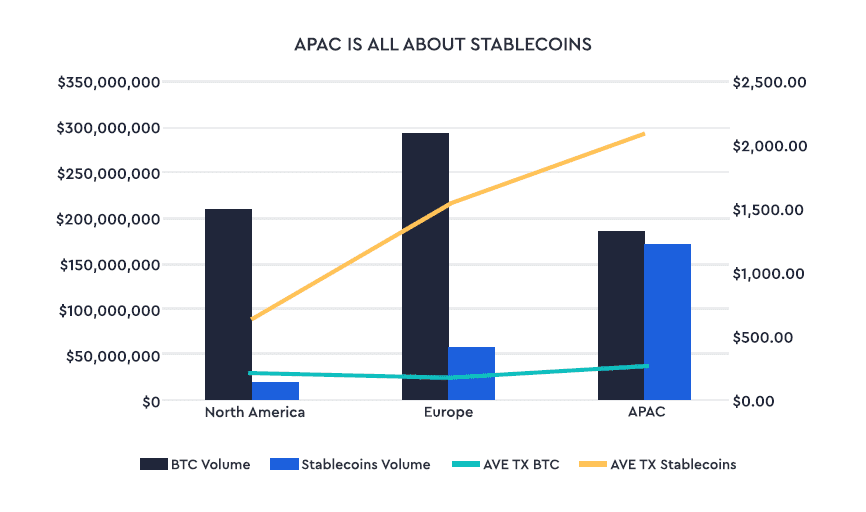

It should be noted that, as far as bitcoin is concerned, Europe exceeds North America in terms of transaction volume, but the most striking figure is the success of stablecoins in the Asia-Pacific area.

Crypto transactions, stablecoins

In this area, which includes China and Japan among others, the volume of transactions in stablecoins is three times higher than in Europe and even more than six times higher than in North America.

Since the most widely used stablecoin is USDT, these data suggest that Tether is used in particular as an alternative to fiat currencies, and probably as a substitute of the dollar, in countries where it is not easy to use dollars, or similar currencies such as the euro.

In these countries, almost half of the payments in cryptocurrencies are made in stablecoins, nevertheless, there is still a slight prevalence of bitcoin, although this could change over time.

In contrast, specifically in the US market, the most noteworthy figure is the doubling of the average amount of cryptocurrency payments from $100 to $200 in a year.

According to CoinPayments Quarterly Pulse, the reason underlying this increase would be a greater confidence of sellers and buyers towards the use of these new currencies.