The new week for cryptocurrencies starts again along the same lines as the weekend with low volumes and volatility.

With the price closing below $10,700, Bitcoin ends up slightly down for the second week in a row. This is a circumstance that hasn’t occurred since June and that binds Bitcoin to the majority of Altcoins.

Among the big ones, in fact, there are few cases that register a positive difference in balance from last Monday’s levels. It’s the case of Ripple (XRP) that manages to recover almost 2%. Better Binance Coin (BNB) climbing above 7%. The best is Monero (XRM) which flies over 10% recovering the $110, levels it has not seen since June 2019.

Cryptocurrency volumes on hold

Between Saturday and Sunday the Bitcoin trades on the main exchanges in both days did not exceed, in counter value, the billion dollars. Same fate also for Ethereum with exchanges under 500 million dollars. Such low daily trades have not been recorded since the central weekend of last July when prices for both were lower than the current ones.

In total the volumes of the last 24 hours do not exceed $70 billion. Here too, to find similarities, one must go back to the days after mid-July. This is a waiting phase among operators. Even in the past, these phases were suddenly interrupted by explosive movements.

On the top step of the best’s podium, with the only double-digit jump among the top hundred capitalized, today rises Zilliqa (ZIL), followed by Yearn.Finance (YFI) and Ripple (XRP) both up by more than 7%.

Total capitalization is back above $340 billion, with Bitcoin taking 58% of the market share at just under $200 billion. While Ethereum remains under 12% dominance, the rise in prices of XRP makes a few decimals of share gaining back to 3.3%, levels at the beginning of September.

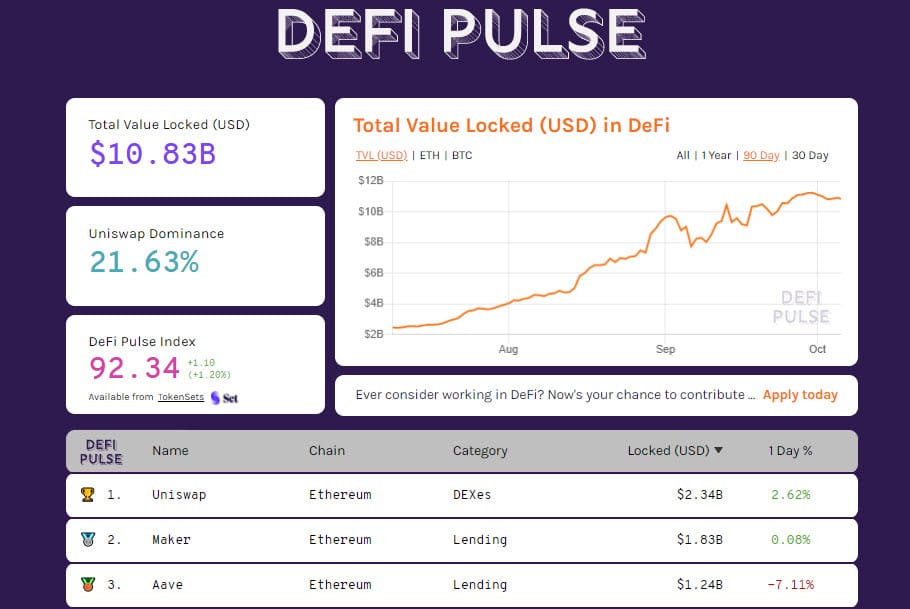

After peaking at the end of September ($11.2 billion), the total liquidity blocked by TVL in the various applications of decentralized finance fluctuates just under 11 billion dollars, confirming the stability of funding despite the period.

Uniswap’s DEX (decentralized exchange) maintains the top position in the DeFiPulse ranking with over $2.3 billion blocked. Followed by Maker with $1.8 and Aave with $1.2 billion. The number of tokenized Bitcoins continues to grow today above 141 thousand BTC, a new absolute record.

Bitcoin (BTC)

Prices rebounding from the lows of $10,400 USD which confirms that it is a well protected support from bullishers and considered to be the first level to be knocked down by option traders.

The reaction brings back the quotes to review the area of $10,800 USD. Short-term movements that do not change the medium-term structure with fluctuations that have been caged in $500 USD for more than 10 days.

Ethereum (ETH)

It tightens the price fluctuation margin of Ethereum even more. Since the beginning of September, congestion has not been able to rise above $390 USD or fall below $315 USD.

The volatility drops to the lows at the end of August-beginning of September, raising the alarm for a next directional movement.