The weekend brings new records. Yesterday, bitcoin hit a new all-time high above $24,200.

It is a record that comes after a decidedly eventful weekend. The total volume recorded between Saturday and Sunday reaches the peaks of the year. For a weekend with that much trading volume, it is necessary to go back to the second week of May. However, in May, Bitcoin prices attempted to recover the $10,000 mark for the first time since February. The number of bitcoin traded was definitely higher than yesterday, but the current price is twice the one in May so the trades gain ground based on the price but not based on the number of bitcoin traded which in any case remain very high considering the weekend.

The new records of the weekend accompany the week of Christmas with a retracement on the part of prices.

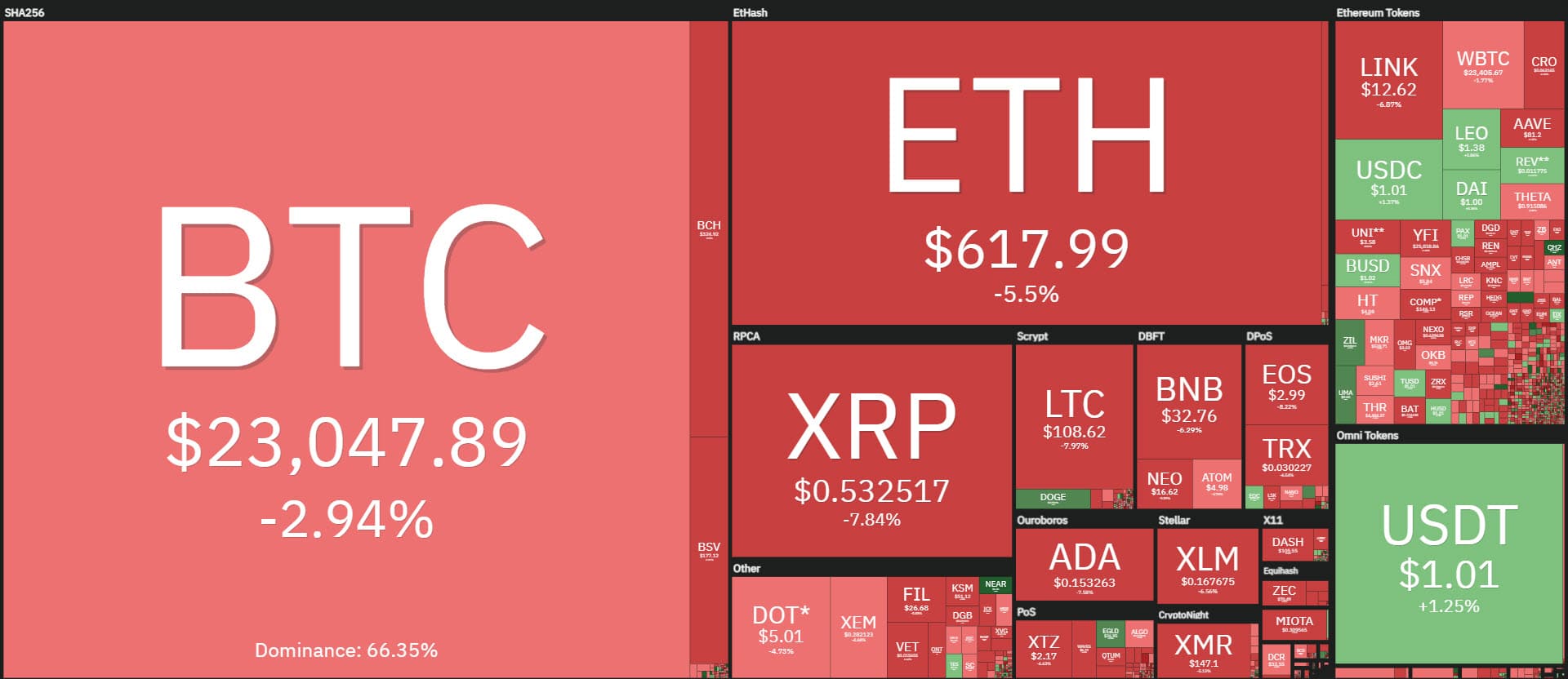

Today just over 85% of cryptocurrencies are below parity. The falls today do not affect the weekly performance which in fact remains firmly above parity.

The day continues to trade at decidedly high volumes with yesterday’s volumes jumping 20%. In the last 24 hours, a total of over 350 billion dollars have been traded, among the highest peaks since the beginning of the year.

Among the best of the day, Chillz (CHZ) stands out in particular, jumping 30%, followed at a distance by Dogecoin (DOGE), with another double-digit climb.

On the opposite side, there are many negative signs, among the worst being Nexo (NEXO) and THORchain (RUNE), both down 10%.

The rise of the last 48 hours reinforces the dominance of Bitcoin which climbs over 66%, setting the highest peak since last June.

Ethereum falls sharply below 11% for the first time since mid-November. Ripple is weak and slips under 3.8%.

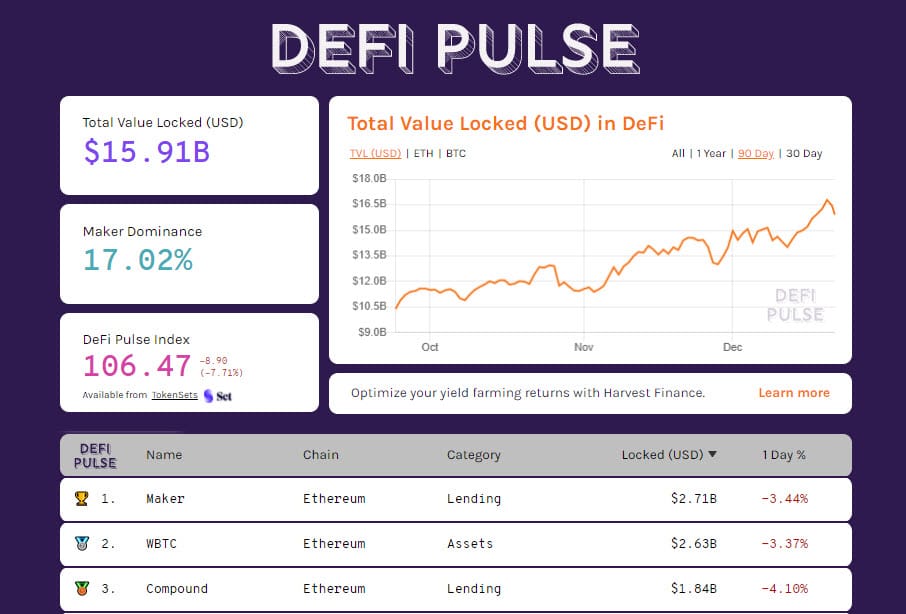

Yesterday DeFi touched the highest peak of the TVL reaching 16.7 billion dollars.

Maker remains the leader with 2.7 billion, followed by WBTC which is getting closer thanks to the strengthening of Bitcoin prices, reaching 2.6 billion. It’s the highest peak for this platform that came close to 2.7 billion yesterday, while it now slips to 2.6 as BTC retraces. Compound does very well, strengthening its third position by breaking away from Aave and moving towards $2.4 billion locked in the protocol.

Bitcoin (BTC), records followed by a retracement

After celebrating yesterday the breaking of the previous high of Saturday, reaching $24,000, both records were not accompanied by an increase in volumes compared to the previous hours and this led to a prevalence of profit-taking that brought BTC prices back below $22,000 for the first time since last Thursday.

It is a retracement within a bullish context, the medium and short term trend remains in fact set to the upside. The first alarms to be considered in a short-term perspective would only come with a price retracement below $21,800.

Ethereum (ETH)

Ethereum over the weekend updated the highs of the last two and a half years, above $670, where profit-taking prevails also for the queen of altcoins, bringing ETH prices back to test the $600 mark, to be precise at $590.

The movement remains in a decidedly bullish context. The trend would only be scratched with a drop to $580. A movement above this level is an up and down of a bullish trend. In the medium term, the reference support is only 470-490 dollars.