Santiment has published a new Sansheets model dedicated to funding rates and linkable to Google Sheets.

🥳 We're proud to debut our new Funding Rates Sansheets Model, which connects with #GoogleSheets. Use it to see average funding rates between @binance and @FTX_Official & find assets forming excessive longs or shorts. Read all about it, and download here! https://t.co/6YwwXaxBns pic.twitter.com/UFhdXblYXI

— Santiment (@santimentfeed) November 30, 2021

Santiment’s model for funding rates

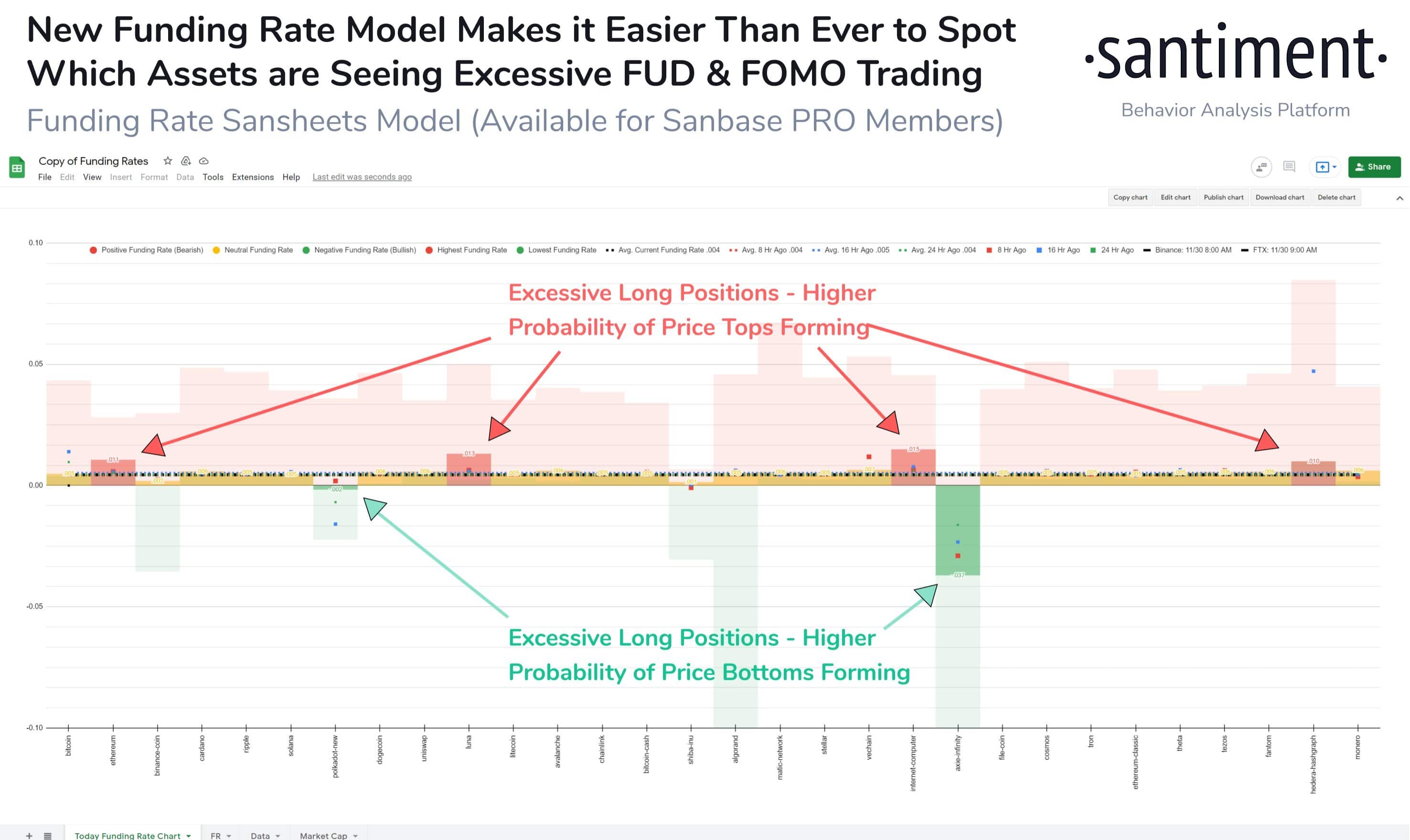

The model gives access to the average funding rates of the Binance and FTX exchanges, and makes them available in Google Spreadsheets.

According to Santiment, these funding rates could help identify where traders are placing their bets in bulk.

Financing rates’ in this case means the financing rates of perpetual contracts, i.e. the commissions paid for buying and selling these contracts. When these rates are positive it means that the Longs are paying the Shorts, while if they are negative then it is the Shorts who are paying the Longs.

Sentiment explains that excessively high borrowing rates for a particular asset mean that there is an abnormal amount of long positions on the price of that asset, indicating for example a FOMO phase. Conversely, very low rates indicate a possible excess of short positions, often linked to times of FUD.

Santiment’s Funding Rates model automatically calculates these rates on Binance and FTX, across hundreds of assets.

A short guide showing how to use them has also been published.

Exporting data

The tool also allows the comparison of the current funding rate of an asset with the maximum or minimum rates, and is only available to Sanbase PRO members.

The curious thing is that the data it contains can also be imported into Google Sheets, i.e. into personal spreadsheets created with Google’s free tool by linking the API.

In fact, Sansheets’ Funding Rates tool alone is not able to provide forecasts or projections to get an idea of how the prices of an asset might evolve. It is intended as a source of information to be used within a broader and more structured system of analysis that also uses other information to enable future forecasts or projections to be made.

By now, the volumes and instruments on crypto markets are so similar, in some ways, to those of traditional markets that it is also possible to use tools and analyses that have already been in use for some time to try to interpret cryptocurrency price trends.