Summary

Bitcoin Analysis

Bitcoin’s price failed to print a third straight green daily candle on Tuesday and concluded its daily session -$769.

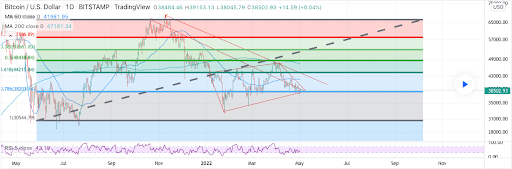

Today, we’re looking at the BTC/USD 1D chart below from mjelicespanol firstly. BTC’s price is trading between the 1 fibonacci level [$30,544.79] and 0.786 [$38,203.44], at the time of writing.

BTC’s price is -33.66% for the last 12 months and bullish traders are trying to reverse course back to the upside before the $30k level. If bullish traders lose the $30k level we could see the lowest prices on bitcoin for the last 12 months.

The primary target to the upside if bullish traders can reverse course is 0.786, followed by 0.618 [$44,215.84], 0.5 [$48,388.84], and 0.382 [$52,661.83].

BTC’s 24 hour price range is $37,614-$38,657 and its 7 day price range is $37,614-$40,183. Bitcoin’s 52 week price range is $29,341-$69,044.

The price of bitcoin on this date last year was $53,464.

The average price of BTC for the last 30 days is $40,820.80 and BTC’s price is -18.7% for the last 30 days.

Bitcoin’s price [-2.00%] closed its daily candle worth $37,751 on Tuesday.

Ethereum Analysis

Ether’s price closed more than 2% down on Tuesday and when traders settled up to close the daily session ETH’s price was -$74.52.

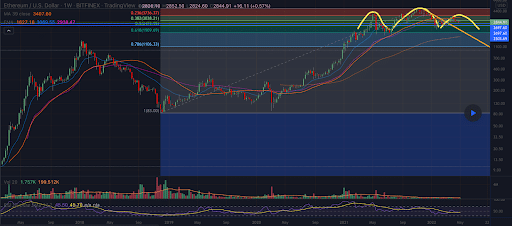

The second chart we’re analyzing today is the ETH/USD 1W chart below by Cheesy-Bean_and_Rice-Burrito. Ether’s price is trading between the 0.5 fibonacci level [$2,473.95] and 0.382 [$3,038.21], at the time of writing.

This interpretation of the ETH/USD 1W chart shows Ether’s price potentially painting a Head & Shoulders pattern.

If bullish ETH traders can negate what looks to be a bearish breakdown their first target is 0.382 [$3,038.21] followed by the 0.236 fib level [$3,736.37].

If bearish traders continue to control ETH’s price action and the H&S pattern continues to unfold, the targets for bearish traders below are 0.5 [$2,473.95], 0.618 [$1,909.69], and 0.786 [$1,106.33].

The price of ETH on this date in 2021 was $3,245.

The average price of ETH for the last 30 days is $3,046.12 and Ether’s price is -20.89% for the last 30 days.

Ether’s price [-2.61%] closed its daily candle on Tuesday worth $2,781.46.

Cardano Analysis

Cardano’s price has finished in red figures for four of the last five days and wrapped up Tuesday’s daily candle -$.0106.

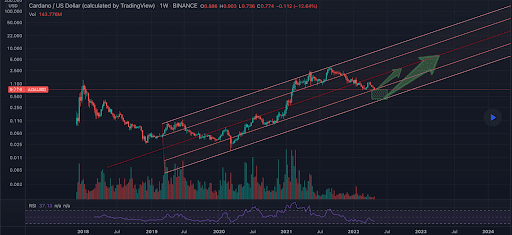

The ADA/USD 1W chart below by a_sd shows ADA’s price in a long-term uptrend on the weekly timescale.

Traders can also see that ADA’s price did manage to close above support at the $0.774 level on Sunday and held that long-term trend line shown on the chart.

ADA’s price is attempting to cling to that level again as we’re mid week but with the macro pressure currently on bulls to the downside of the charts, could the more obvious bottom on ADA’s price potentially be at the $0.40 level or below that level?

We can see Cardano’s price touched the bottom of its channel at the end of the last bear market and that’s where ADA’s price pivoted to the upside to begin the 2020-2021 bull market.

Cardano’s 24 hour price range is $0.763-$0.798 and its 7 day price range is $0.757-$0.851. ADA’s 52 week price range is $0.738-$3.09.

Cardano’s price on this date last year was $1.28.

The average price of ADA over the last 30 days is $0.9403 and ADA’s price is -32.4% for the last 30 days.

Cardano’s price [-1.36%] was valued at $0.7708 at the end of the trading day on Tuesday.