Let’s take a look together at what the most important news is and how crypto assets Fetch.ai (FET), Coti (COTI) and Kaspa (KAS) are doing chart-wise.

Summary

The latest updates for crypto assets Fetch.ai (FET), Coti (COTI) and Kaspa (KAS)

The crypto market seems to have woken up in good spirits today, with several altcoins experiencing positive price movements.

We begin with a roundup of the most important news for these 3 crypto assets

Fetch.ai, the decentralized artificial intelligence project, is bringing its frameworks to Kusama and Polkadot along with the participation of Peaq.

This was announced via a blog post by the latter platform built on Polkadot, which aims to build a decentralized EoT (Economy of Things).

Together with the help of Fetch.ai’s Autonomous Economic Agents (AEAs), there will be a wide range of use cases that can be powered on the Kusama and Polkadot blockchains, such as connecting smart vehicles with the optimal charging station, ushering in a new era in which EoT will play a crucial role.

Fetch.ai’s microagent integration is currently on Peaq’s testnet and will soon also land on Kusama.

BIG NEWS 🔥

peaq and @Fetch_ai are bringing Fetch's autonomous #AI agents to the @Polkadot and @kusamanetwork ecosystem 🚀

— peaq (@peaqnetwork) April 17, 2023

On the other hand, as far as Coti (COTI) is concerned, nothing special except for the announcement of the end of the campaign that the team had organized to allow its users to earn the gCOTI token, the layer 1 infrastructure governance token.

Until a few hours ago it was possible to stake COTI (both the native version and ERC-20), USDT and USDC for 180/270/360 days and earn gCOTI returns.

In total, more than $36 million has been locked and will go into COTI treasury.

The $gCOTI airdrop campaign for Native $COTI holders is now closed! Thanks to all participants who locked a total of 359M $COTI. We’ll share the full campaign recap tomorrow.

Next stop: gCOTI airdrop campaign for $COTI ERC20, USDT, and USDC holders on April 24th. See you then! pic.twitter.com/dawfIrOaSH— COTI (@COTInetwork) April 17, 2023

Finally, speaking of Kaspa (KAS) there are two important pieces of news: the first is about the integration of the Rust programming language that will allow faster actions and performed more efficiently. A hard fork is planned and has yet to be announced.

At the moment, core users do not have to do anything to continue using the Kaspa protocol.

The second piece of news concerns the collaboration with the Tangem wallet, which according to the team is an important milestone in the development of Kaspa.

One of the most secure hardware wallets, @Tangem, is now integrated with #Kaspa! Offering unparalleled security, extensive features, and physical backups, this collaboration is a significant milestone for $KAS holders, miners, and users.https://t.co/JHj8nuZasc$BTC $LTC #ETH pic.twitter.com/yvspPhvp9O

— Kaspa (@KaspaCurrency) April 17, 2023

Price analysis for Fetch.ai (FET), Coti (COTI) and Kaspa (KAS) crypto assets

On the price front, all 3 crypto assets are performing reasonably well, as is the entire altcoin sector this morning.

In the last 24 hours, FET is up 8.90%, with a market capitalization of $353 million and a trading volume of $205 million, up 175% from yesterday.

The current price of the crypto-AI project token is $0.431 and could continue to rise given the positive trend of the past 7 days.

Should it break the $0.5 resistance we could see a truly remarkable price breakout.

For COTI, the situation seems similar: up 10.5% in the last 24 hours, current price of $0.104, capitalization of $123 million, and trading volume hovering around $50 million.

Here again we can see organic growth over the past 7 days, which gives us hope for a continuation of the short-term bullish trend.

Be careful though, because COTI has recorded 5 consecutive green candles, without ever resting and finding support points. In such cases, it is easy to see a short reversal, which does not challenge the main trend but serves to find support chart points.

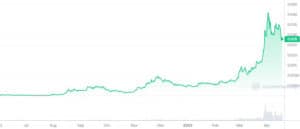

By contrast, the crypto that has not been doing very well in the last few days is KAS: the token is up in the last 24 hours by 3.44%. However, for the past 7 days it has been moving downward, also justified by the fact that from February until early April the price of KAS did almost a 5X.

Despite the fact that the situation in the short term is not all too reassuring, compared to FET and COTI, the token seems to be better off chart-wise and can boast a price near all-time highs, which is by no means the case for the other two crypto assets that are in drawdowns of 60% and 85% respectively.

KAS currently trades at $0.028, market capitalization of $500 million, and trading volumes around $16 million.

BTC dominance meets resistance: altcoins say thank you

A very interesting piece of data to observe in relation to the price development of altcoins is Bitcoin’s dominance chart.

The dominance chart indicates the percentage of the crypto market in which BTC is dominant in terms of capitalization.

In other words, it is a measure of how capital is moving, whether onto the king of cryptocurrencies or the alternative coins.

Currently, BTC’s dominance has reversed from the 48% threshold, which has already been touched and approached as resistance on two occasions, namely in June 2022 and July 2021.

It will be very important to see how the situation evolves: usually the more one attempts to break a resistance the higher the chances of this happening.

A fourth touch of the 48% value could decree a break and a shift of the crypto market’s capital to Bitcoin. This does not necessarily mean that BTC will go up in price, but rather that altcoins will be penalized.

Currently, however, exactly the opposite is happening: dominance is going down and altcoins are reacting well. Should dominance continue to fall and break supports, we could see the long-awaited alt season phase, in which most cryptocurrencies, except Bitcoin and of course stablecoins, achieve stellar price movements.