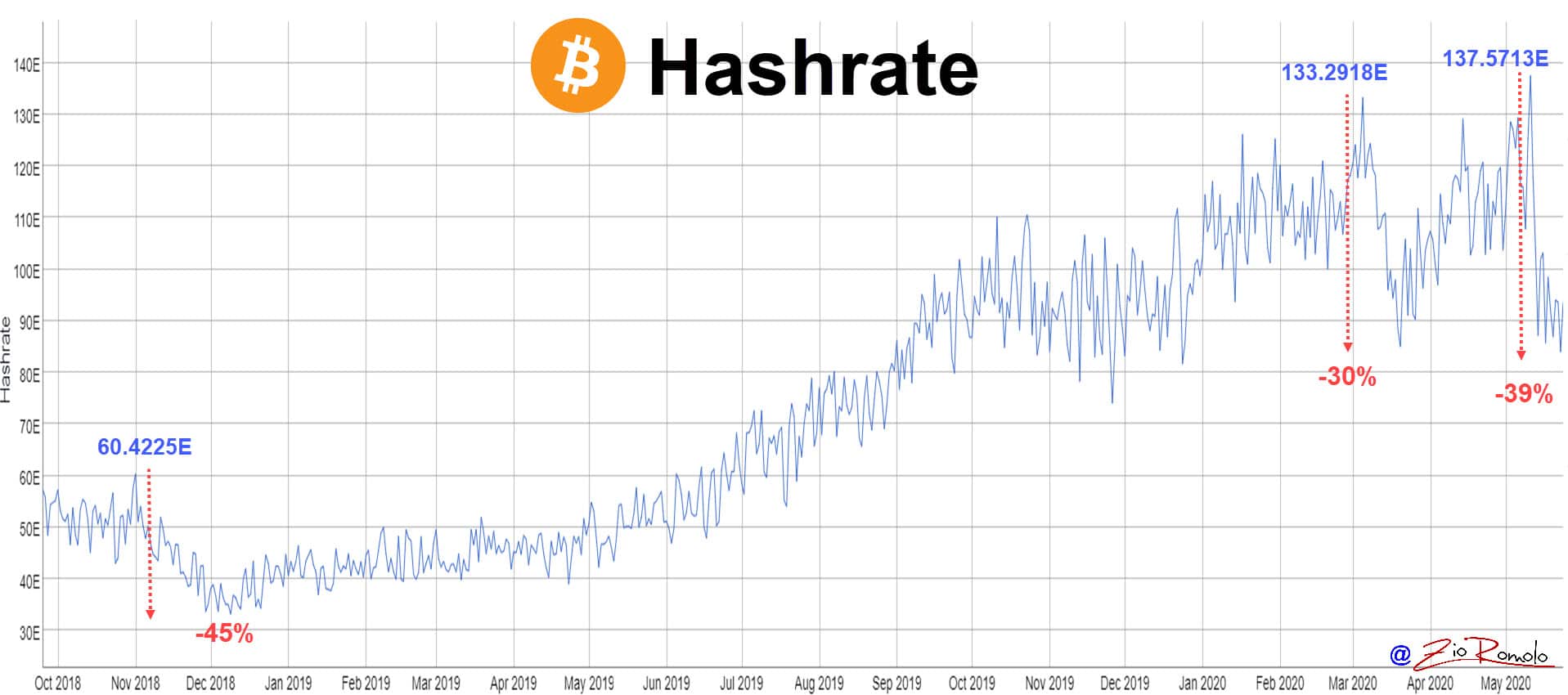

As was expected, the third halving led to an adjustment of Bitcoin’s hashrate, the computational power of the blockchain network.

From the highs reached in the hours right before the halving, when it scored its absolute all-time high at 137.57 exahash/sec, the hashrate dropped in the last few hours, or rather collapsed, breaking the 100 threshold and hitting its lowest point since last December, 84.08 exahash/second.

This is the lowest level that the Bitcoin network had not recorded since the end of last December, showing a drop of about 39% and which confirms how the halving of the miners’ reward is leading to the shutdown of old machines and the adjustment of the policy for those who can no longer sustain the costs and do not have the possibility to buy latest generation machines to obtain the reward for the closure of the blocks.

The increase in fees, which is always part of the rewards that miners receive for each block closure that takes place every 10 minutes and which in recent weeks has been delayed with blocks closed in times of up to 20 minutes, confirms that the halving is coming to a slowdown of the network itself.

In some moments of today, the network has seen a slowdown in the process of fulfilling orders that remain suspended.

This increase in fees has seen the last few days exceed 6 dollars, a level that on average had not been recorded for over a year and a half.

This is currently not allowing some miners to be included in mining management fees and therefore highlights how the strategy at management level is leading to an adjustment of the network itself.

The price of Bitcoin

The fall in prices in recent days has made Bitcoin lose more than 12% after touching the $10,000 threshold again, a few days before halving and precisely on May 8th and then subsequently touching this threshold between May 14th and 18th, after the halving.

This shows that at the moment some of the miners are still keeping the machines running and liquidating some of the Bitcoins that they held, trying to cover the costs with the sale of BTC.

At the moment these are assumptions which we will be looking at in the coming days to see how they will adjust with respect to the entire network.

Previously, another movement of the hashrate similar to the current one with an intense drop in a short period occurred in March, in the middle of a bearish storm.

But what happened between the days of the halving and today overcomes the collapse of last March when in the full storm of the falls the exahash limited the losses that were less deep than the current one, stopping at -30% compared to -39% of these days.

To find an even deeper movement we need to go back to the end of 2018 when in the period between November 1st, 2018 until December 9th, 2018 so in just over a month the hashrate collapsed by 45%.

If we go to compare the current movement with that period it is possible to identify how with that movement Bitcoin prices went to mark the lowest of the last three years in the $3,250 area a few days before, to then start a movement of consolidation by the prices that characterized the trend for the following months, when from the lows of early February 2019 began the rally that led Bitcoin prices to record an increase of more than 330% and highs at a pace from $14,000 which at the moment continues to remain the highest peak recorded in the last two years and a half.

We will see what will happen in the coming weeks.

Even the adjustment of the network difficulty remains to date close to the highest historical levels that were reached in mid-March with over 16.5529T. To date, we are below, at 17.138T.