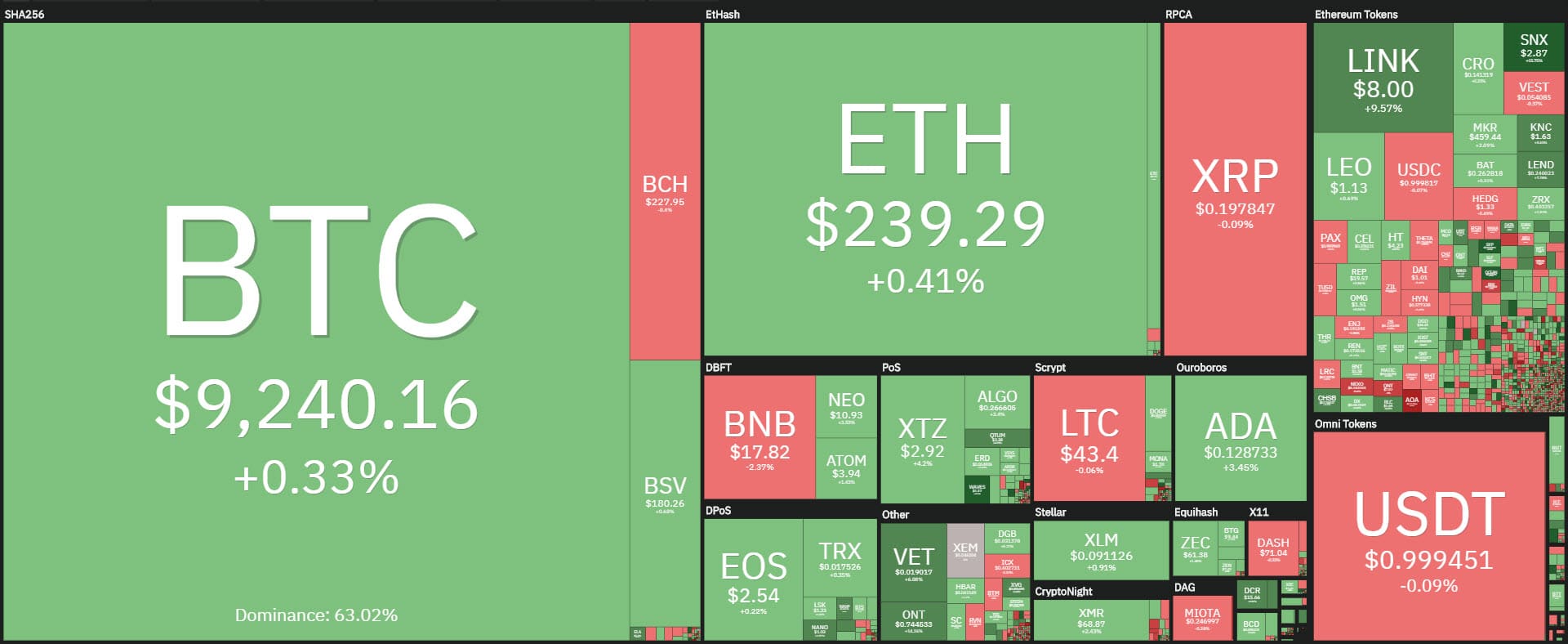

Bitcoin’s low volatility is also reflected in the other two top of the class: Ethereum and Ripple.

Ethereum has been fluctuating between 240 and 247 dollars for a week. Ripple, after having failed to exceed the 21 cents last week, is back below 20 cents with fluctuations of a few decimals in the last 48 hours.

Bitcoin continues to remain motionless with volatility at lows in the last 10 days. Daily fluctuations remain below $300. Daily volatility on a monthly basis drops to the levels of April 2019.

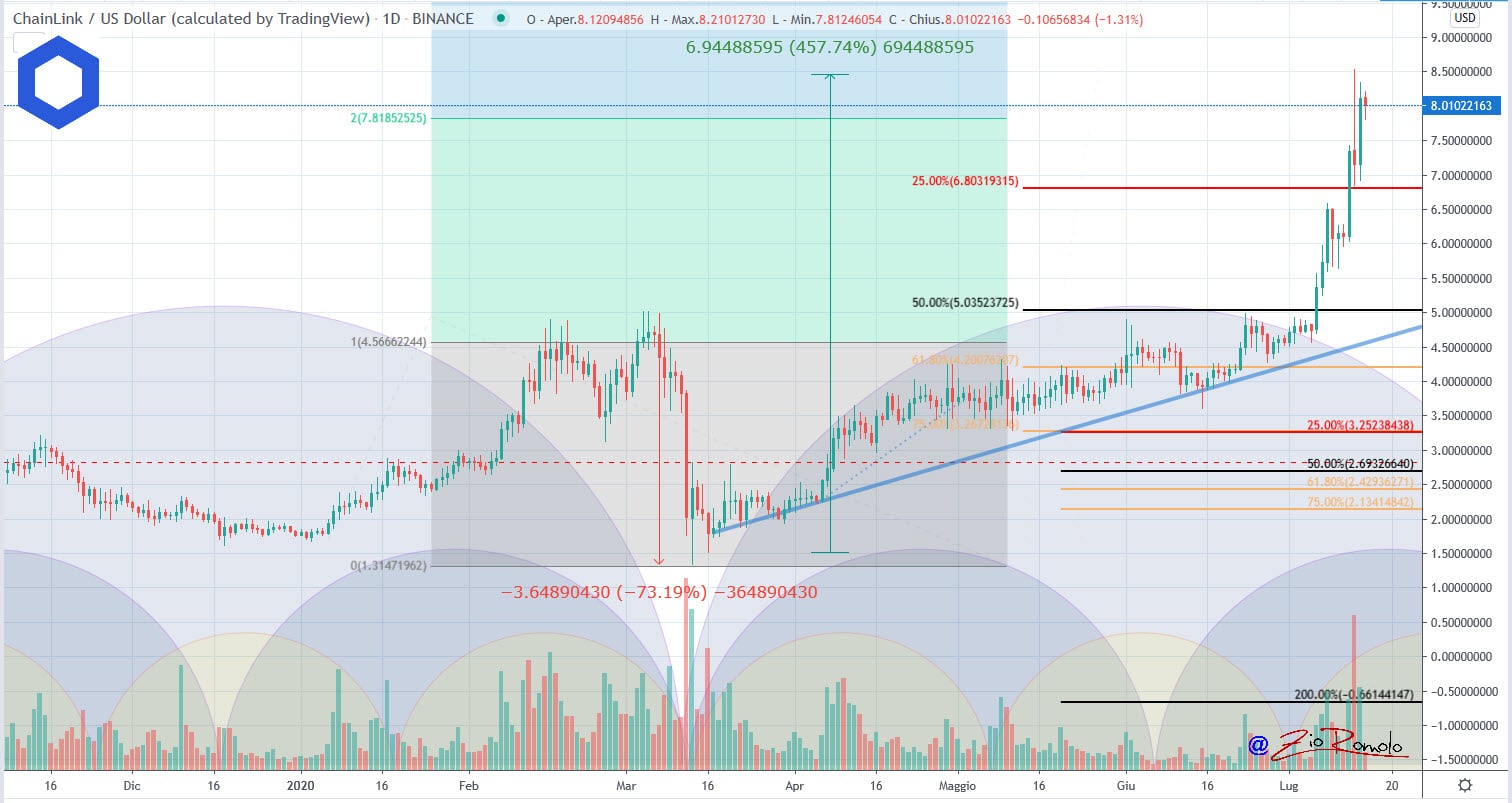

Attention shifts to the altcoins, which today see a leap upwards. Chainlink (LINK) achieves a double-digit increase, +10%, conquering the 9th position in the ranking to the detriment of Binance Coin (BNB) which loses 2%.

Chainlink, with today’s rise, tries again to recover the absolute historical highs in the $8.50 area where the profit-taking began to prevail, which brought prices down to $7. The recovery in purchases brings prices back above $8.

Cardano (ADA) also climbs again, with a +4% that allows it to challenge the position of Bitcoin Satoshi Vision (BSV) that defends itself with a daily rise of 1%.

Cardano, with today’s rise, despite the downturns of the last few days, tries to recover the 14 cents, reached last Wednesday and coinciding with last year’s highs.

The 14 cents were abandoned in July 2019.

Scrolling the list of the top 100, which today sees 65% in positive territory, in 13th position Tezos (XTZ) rises more than 3.5%.

Among the top 20, VeChain (VET) is another excellent rise of the day, up 6%. VeChain, after failing to exceed 22 cents last week, the highest level since August 2018, still continues to move to the highest levels of the last two years.

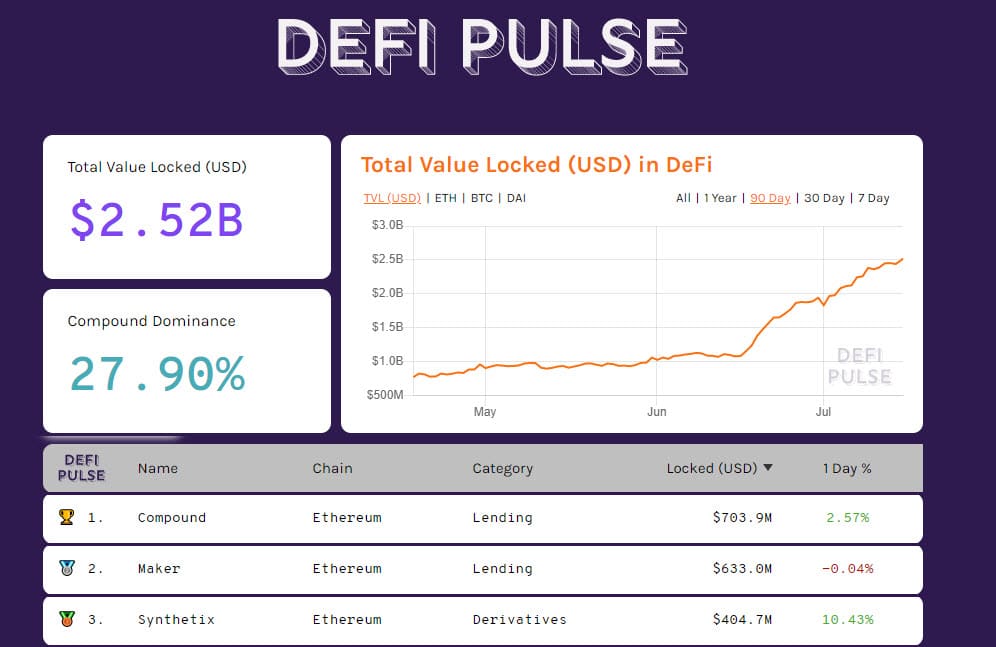

Among the best of the day, today is the high jump of Kava (KAVA), up 20%, followed by Synthetix (SNX) +15% and Ampleforth (AMPL) +12%. Aave (LEND) also achieved a double-digit increase.

Kava is a platform for decentralized financial services that is part of DeFi.

Launched in the fall of 2019, Kava is now at an all-time high with prices above $2, twice the value recorded at the beginning of June, when it broke the $1 after the mid-March declines. With today’s high, Kava doubled its value in a month and a half,

The rise of DeFi’s tokens sets further new records: TVL leaps over $2.520 billion for the first time. DeFi seems to be driven by the decidedly positive period that has been characterizing its tokens for one month, with values doubling.

This is due to the euphoria that is bringing attention to the platforms. Euphoria that is becoming dangerous because it is unimaginable that this bullish trend could continue for a longer period. It is necessary to increase the levels of caution for a consolidation and then follow the upward trend later.

The DeFi sector is proving to be an alternative to traditional finance which in the last few days is causing problems and deviations between the financial economy and the real one.

More than 60% of the capitalization is held by the first two platforms, Compound and Maker, the first holds more than $700 million, the second just under $635 million.

The growth of bitcoin tokenized on the Ethereum network is also confirmed with wBTC exceeding $205 million, the highest level ever. Comparing the bitcoins locked by Liquid on Lightning Network, LN today records deposits of just over $9.2 million.

The total market cap recovers just over 2 billion from yesterday’s levels and reaches a total of $272 billion. The dominance of Bitcoin continues to remain unchanged as those of Ethereum and Ripple at 9.8% and 3.3%.

Bitcoin (BTC) volatility

Bitcoin continues to record a lateral trend that has been going on for a very long time, which hadn’t been recorded since April 2019. At that time, for the whole month, BTC recorded fluctuations of about $300.

This raises awareness while waiting for a movement that could prove to be more and more explosive as time goes on.

The levels to be monitored are the same as in the past few days. Upwards, the 9,350-9,600 area that corresponds to the first hedges of open call positions.

Downwards, the protections increase between $8,950 and the subsequent support of $8,700. These are the two levels that professional operators see as the area of defence in case of downward breaks.

Ethereum (ETH)

The last few hours see Ethereum fluctuate between $240 and $243. Even Ethereum has not given particular jolts for 5 days, after the high jump that characterized the return to the $245 area last Wednesday.

For Ethereum, given the volatility that is contracting, it is necessary to turn the attention to the 250 dollars, technical and hedge level for professional operators who see this level as the first barrier to break.

Downwards, the protection of the $215 level is consolidated with the protection barriers positioned at $225 and $235. The highest ones are placed between $215 and $225.

It is necessary to follow very carefully the developments as there could be a sudden upward or downward explosion.