In recent days, the well known and increasingly widespread Tether stablecoin has reached and exceeded the $4 billion market capitalisation rate, ranking seventh on CoinMarketCap between Binance Coin and EOS.

This is the highest value ever achieved by a stablecoin, probably due to the recent issuance of a large amount of tokens on the ethereum blockchain, and the complete adoption by Binance.

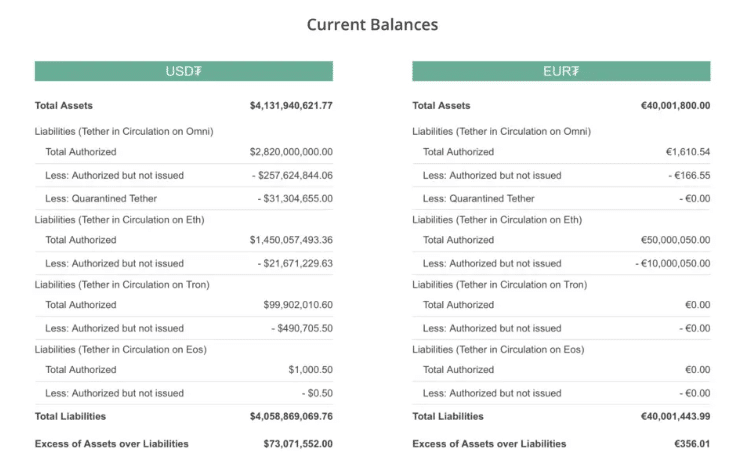

Just over 2 months ago, on May 16th, 2019, the total capitalisation of the Tether stablecoin was around 2.8 billion, while yesterday it exceeded 4.03 billion dollars.

Tether exceeds 4 billion capitalisation

In June 2019, almost half a billion ERC20 tokens were issued, bringing the total supply of USDT circulating on Ethereum to one and a half million dollars.

Moreover, almost 100 million USDT have been released on TRON, while on EOS only 1000 dollars have been issued to date since this is probably a solution that is still being tested.

Meanwhile, on the original Omni protocol, there are now 2.8 billion dollars in USDT tokens in circulation.

As always, it is difficult to estimate the reason for so much market demand, but certainly, the recent growth in the prices of bitcoin and other cryptocurrencies between May and June has led to an increase in market liquidity, thanks also to the use of the main stablecoins, including obviously Tether.

In addition to the increase in its capitalisation, Tether has also reached record volumes, surpassing those of bitcoin several times.

In fact, thanks to the use in trading and in particular in arbitrage between multiple exchanges, there are many transactions that are executed on USDT, resulting in an exponential growth in volumes.

Not only that, many trading bots use the Tether stablecoin to speculate on the daily fluctuations of BTC, even executing hundreds – if not thousands – of orders every day.

In fact, when looking at CoinMarketCap, USDT volumes exceeded those of bitcoin several times, sometimes achieving record volumes.