The rise in the price of Bitcoin Satoshi Vision (BSV) continues to stand out.

With the highs reached at the end of yesterday, BSV increases the gains of the last two weeks by scoring a new historic high that, at one point of the day, has even overtaken the other Bitcoin fork, Bitcoin Cash (BCH), from which it originated in mid-November 2018.

The strong rise that has characterized BSV since the beginning of the year sees it multiply its value by more than 4 times. The crypto rises 25% over 24 hours but currently is seeing natural profit-taking: speculation increases with a retracement from last night’s highs of 30% in just over 12 hours. Despite the decline, Bitcoin Satoshi Vision confirms its 5th position in the overall ranking.

What stands out most in Bitcoin Satoshi Vision’s movements is the explosion of volumes recorded on most exchanges with trades approaching 7 billion in the last 24 hours, going beyond the cryptocurrency’s total capitalization.

The day continues to show positive signs for more than 75% of cryptocurrencies, although in the second part of the day profit taking prevailed with a tendency to collect the increases that have been characterizing these last 5 days.

The gains are optimal, particularly in the last 48 hours, which have seen a strong climb that is the second bullish movement since the beginning of 2020.

Dash‘s decidedly positive performance also stands out and is among the best of the top 100 with an increase of 40%, being one step ahead of its direct competitor in terms of privacy, Monero (XMR), in 11th position, which has a capitalization of more than 40 million dollars.

There are also two other Bitcoin forks, Bitcoin Gold (BTG) and Bitcoin Diamond (BCD), both up 80%, highlighting how these last few days are characterized by the direct and indirect forks of Bitcoin.

The entire sector keeps the gains of the last few days by consolidating the total market cap at $241 billion with volumes that support the strong rises of the last 24 hours, increasing further by about 30% from the already high volumes recorded yesterday to over $150 billion, a figure not recorded since last November.

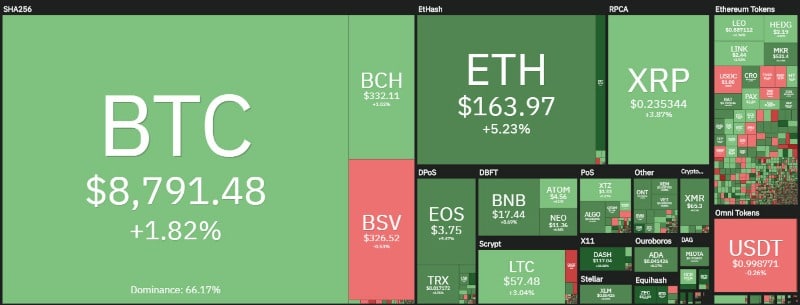

Bitcoin’s dominance is falling back to 66%, which is still a high level. Ethereum (and the other altcoins) benefited from this slowdown, returning to 7.5% market share, while Ripple remains stable at 4.2%.

Bitcoin (BTC) price

Bitcoin, with the rises of the last 24 hours, brings its prices back above the $8,850 threshold, updating the highs of the last 12 months and reviewing the levels of mid-November.

This rise underway since yesterday morning confirms the breaking of the bearish dynamic trendline that was passing in the $8,200 area. The final confirmation will come in the coming days with an extension above the $9,000 area.

The uptrend built from the relative lows of January 2nd will be affected only with movements that would bring prices back below $7,800. Otherwise, it is necessary for BTC to consolidate the uptrend while keeping the value above 8,300-8,500.

Ethereum (ETH) price

Ethereum is also doing very well, which, with the rises of the last 36 hours, brings prices above the threshold of medium-term support at $165, reaching slightly above $170 during the night and going to update the highs since mid-November.

For ETH, $170 is a level of profit-taking where prices have been retracing in the last few hours, trying to stake out the support from which they could possibly start again.

The uptrend started from the lows of January 2nd will be affected only with a return under 145 dollars, a level now prudentially distant and that allows Ethereum to find a point of consolidation from which to trigger a rise.

The breaking volumes of the former resistance of $155 proved to be very strong. It is necessary to wait for the developments of the next few days to see a confirmation and the possibility of recovering the $185 as the next medium and long term resistance.