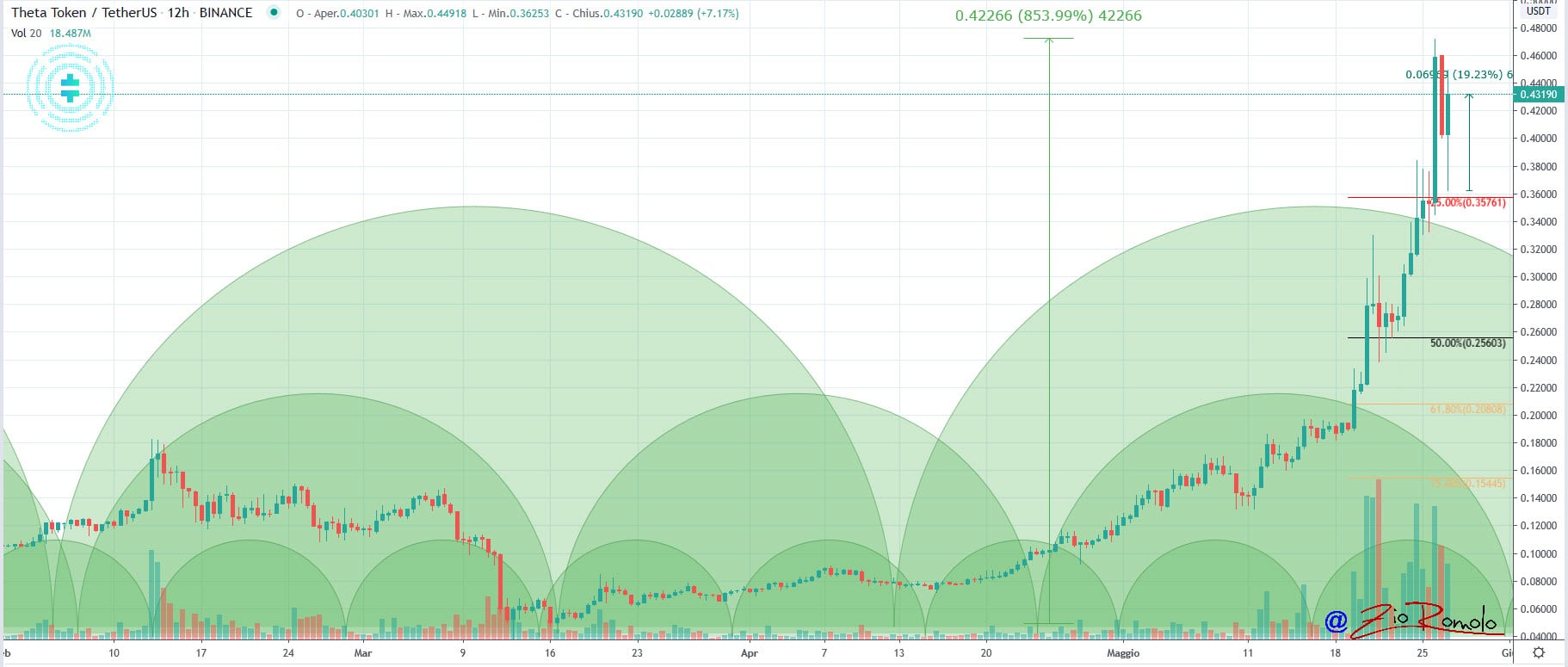

The worst of today is Theta Fuel (TF), with the price down 20%. It’s a drop that comes after an upward trend that in two weeks has seen the price of Theta Fuel multiply by about 10 times, allowing also Theta (THETA) itself to climb.

From mid-March levels, Theta Fuel reached the absolute top yesterday at $0.47, with a gain of over 850% from the March lows.

Theta, on the other hand, on a daily basis fell back by about 1%, a decrease not to be taken into consideration given that in recent days it had been subject to very high volatility of 20%.

Overall, in the second part of the day yesterday, weakness prevailed again, which is also being reflected in the early hours of today with a balance between positive and negative signs. However, scrolling through the ranking of the most capitalized, the red sign prevails, with the Theta Fuel price falling sharply.

In fact, among the top 20, only two positive signs emerge. These are Cardano (ADA), which rises by about 3%, regaining 11th position in the general ranking, and Neo (NEO), which occupies 20th position and today rises by 1%.

NEO and the Ethereum gas

Neo is a project that dates back as far as 2014 and which underwent an evolution of the mainnet and the name (in 2014 it was called AntShares) which then saw a turning point between 2016 and 2017. It is a project of Chinese origin which aims to be an alternative blockchain for the launch of applications, directed at both companies and government agencies.

The characteristic of Neo is that for its structure it uses Neo tokens and gas.

Precisely the gas that is the token used by the Ethereum network for smart contracts, in recent days is at the highest levels and therefore this use is particularly affecting the behaviour of Ethereum.

In recent days, in fact, the percentage of gas used for the execution of smart contracts on the Ethereum network has reached 95% of the network, almost saturating it.

A similar situation occurred last September when the last real congestion occurred.

Gas is the unit of measurement used to execute smart contracts. The more complex they become, the more they need more computational calculations that affect the use of gas to run contracts.

Usually, the average gas used in recent weeks is around 69%, so this is definitely impacting on the Ethereum network.

At a general level, among the best of the day, there is Matic Network (MATIC) that rises by 20%, confirming the bullish trend that began in mid-March and which saw a brief pause between March 10th and 11th but immediately recovered. With the rise of the last few hours, Matic’s prices have risen to $0.026, regaining the levels of early March.

Even EDO on a daily basis remains positive with a rise of 2%. As a result, the prices of the Eidoo token see one of the best rises in the last two months from the lows of mid-March with a rise of 1000%, even if today profit-taking begins.

The volumes of cryptocurrencies, on a general level, are substantially unchanged from yesterday’s levels with values of around 90 billion dollars. Bitcoin remains on last month’s average with volumes above $1.8 billion yesterday.

The market cap remains unchanged from yesterday at $250 billion, so does the dominance: Bitcoin at 65.5%, Ethereum at 9.1% and Ripple at 3.5%.

The first three today are below parity, Bitcoin and Ethereum lose 0.4%, while Ripple oscillates around parity, in an attempt to regain the third position in the ranking, despite its prices fluctuating below $0.20 for 5 days.

Bitcoin (BTC) price

Bitcoin continues its movement glued to the lower neckline of the bullish channel that passes today around the $8,850-8,900 area. To give a positive signal, Bitcoin must recover the $9,300, the weekend’s relative highs, as soon as possible.

Otherwise, a holding of the weekend lows would see the first key support level at $8,100, a level touched a few hours before the halving.

The halving at the moment is not influencing the speculation on prices but sees these days a decisive adjustment of the network.

The revenues of the miners, slightly more than two weeks later, are seeing greater losses than those estimated as a result of the halving of rewards. A loss of up to 60% is estimated in these weeks and this is partly balanced by the fees that in addition to the block rewards are definitely influencing the revenues. Fees in recent days have accounted for up to 20% of the rewards of each closed block.

From about 1 million a week, fees now account for $10 million on a weekly basis, showing how they have jumped from a few cents to a maximum of 7 dollars.

This is having a big impact on the strategic decisions of miners and some of them are liquidating part of their Bitcoins.

At the moment these dynamics are not particularly affecting Bitcoin price fluctuations.

Ethereum (ETH)

The price of Ether maintains the psychological support that is now also technical: $200. In these last few hours, it is trying to break the dynamic bearish trendline that passes on the decreasing highs of the last three months in the $205 area.

A rise above this level accompanied by volumes would bring prices to $215-220, the highest levels in the last month.

Concerns for Ethereum would be with sinkings under 190 dollars, which would see the first real support in the low of March 11th, former resistance of April in the $175 area.