Melon Protocol is a smart contract-based management tool for investment funds, providing tools and infrastructure for the decentralized management of on-chain assets.

Melon Protocol and the problems it solves

Occasionally you may have gone to a bank, or to your trusted financial advisor, and received a proposal to subscribe to an investment fund that has performed very well over the past few years, and promises to yield good returns in the future.

While you are aware that past returns are no guarantee for future returns, you have decided to subscribe to the fund, but a voice inside you suddenly rang a bell.

The cost of managing a fund

Your trusted advisor has just omitted to tell you what are the subscription and/or exit commissions, any placement fees, current expenses (management fees), performance fees, etc…

This despite the fact that the European Mifid 2 regulation requires transparency on fees and subscription conditions towards retail investors like you.

The management fees for a fund can reach 2% per annum depending on the fund’s aggressiveness, and fees of up to 20% of the over performance compared to market benchmarks. Then there are also redemption fees, which can go up to 2.00% depending on how much time you stay invested.

Have you ever wondered why fund management fees are so high?

Even though it is 2020 and we have the most advanced technological tools at our disposal, funds are still managed manually.

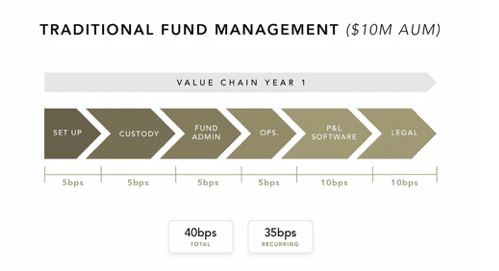

The reality is that the creation of a fund is incredibly difficult, mainly due to inefficiencies in traditional finance and bureaucratic technicalities. A complicated network of financial intermediaries is required for compliance, audit, administration, custody and supervision.

This means that setting up and managing a fund is extremely expensive, inefficient and lacking in transparency. How many times do you have to sign to accept all the conditions and declare that you are aware of this directive?

And you do not even know what happens with the documents you have just signed. In addition, a third party will verify that your money is managed exactly as stated in the prospectus for that fund, adding other management costs.

Another entity will check the fund’s daily P&L, someone else will certify that the fund’s basket actually contains those shares/bonds that have just been exchanged, and so on and so forth. Not to mention the performance calculation which is almost always entrusted to manually filled Excel spreadsheets – and manually verified by third parties.

How does Melon Protocol work

As an experienced trader, Mona El Isa found herself working on the creation and management of investment funds for institutions such as Goldman Sachs.

She realized firsthand how administrative management takes up most of the time in a fund’s management, rather than managing the fund’s composition, the activity that directly benefits its investors.

Faced with these difficulties, Mona El Isa had to admit her failure: the creation and management of an investment fund was something bigger than her.

Then, during a break, she got to know Bitcoin and Ethereum and had an insight: why not improve the process behind the creation and management of an investment fund through blockchain technology and smart contract automation?

This was her genius intuition that gave birth to Melon Protocol.

It allows people or entities to manage their own wealth and that of others within a customizable and secure environment, breaking down entry barriers. Melon has a highly automated design and allows anyone to set up, manage and invest in custom on-chain investment funds.

Thanks to Melon, the cost of setting up the fund is less than $50 and takes just minutes. Fund managers are required to define key fund rules and parameters, which in turn are implemented through smart contracts on the blockchain, eliminating the need for fund administrators. All transactions are recorded on the Ethereum blockchain, making audits and viewing returns extremely simple.

Unlike a traditional investment fund, all assets remain in the custody of the investors themselves and can be repaid at any time. Thanks to the speed of blockchain transactions, no clearing services are required. Subscription and management fees can be clearly displayed for each fund managed on Melon.

Kyber Network, which is completely on-chain and decentralized, is used as a price oracle.

In addition, a key and winning factor for the adoption of Melon, the trustless nature of the blockchain drastically reduces the ability of fund managers to act fraudulently or maliciously. It is worth remembering that in 2008 Lehman Brothers exploited the flaws in the system to conduct a fraud that led to the collapse of global stock exchanges.

In order to interact with Melon, all that is needed is the Melon Terminal built by Avantgarde Finance, where users can set up and manage their fund and navigate or invest in existing funds.

The future

Melon Protocol is open to everyone, but the assets it allows managing are currently limited to a dozen ERC20 tokens.

In the long term vision, Melon is ready to manage also traditional finance products (commodities, equities, stocks, bonds, real estate, etc.) in a tokenized form.

Melon is not directly involved in solving this problem, but once there are tokenized versions of the available assets Melon will be within everyone’s reach to create or subscribe to investment funds. For example, Synthetix is already working to tokenize Tesla and Apple shares.

This will allow benefiting fully from the advantages offered by tokenized assets, which can be summarized in greater liquidity, fractionability, security (no double spend), history tracking and elimination of brokers.

Melon’s smart contracts can be seamlessly integrated with many other DeFi protocols. Currently Kyber Network, Uniswap, 0x and Oasis are integrated, but many other implementations are planned in the future.

After the release of the v1.0 version of Melon in February 2019, Melonport AG dissolved as promised and made the governance of the project completely decentralized. The Melon Council DAO is managed through aragonOS in a custom version to interact with the Melon protocol. Melon Council members can thus manage protocol updates, resource allocation and network parameters.

Melon is also considering how to take advantage of the emerging interoperability of blockchains. The idea is that once Melon is on a blockchain able to interact with other blockchains such as Polkadot or Cosmos, it will be possible to access a whole new world of non-ERC 20 assets.