The best crypto performance of the day is Ocean Protocol (OCEAN) +30%, followed by the price of Sushi Swap token (SUSHI) +25%.

Sushi, the price of the token going up and down

Sushi is a token under the spotlight because of the ongoing trend that is involving, for better or for worse, the fans of the sector with the decisions of Chef Nomi, founder of the new DeFi protocol created by the Uniswap fork, to unexpectedly sell all his stakes, causing a drop in prices of over 90%.

The decision was justified as a step to make the governance of the project independent for the benefit of the community by handing over control of Sushi Swap to Sam Bankman-Fried.

He promised to transfer the keys to a multi-sig wallet and ensure its decentralization.

A decision that restored the momentary confidence of the owners by rebounding the quotations by more than 100%.

This event is remotely reminiscent of what happened at the end of 2017 when the founder of Litecoin, Charlie Lee, sold all his tokens, motivating the choice as an incentive to focus on the development of the project. A decision that anticipated the collapse of Litecoin’s prices by a few weeks.

September in red

For the rest of the sector, the first week of September closed with the worst slide in six months. There had been no weekly closure with double-digit losses since last March.

A decline that comes after weeks of euphoria culminating with the tops recorded on the first day of September for altcoins, two weeks behind the Bitcoin highs.

As is often the case in phases of uncontrolled euphoria, the descents can arrive unexpectedly sustained by an irrational fear of danger for a long time.

The descent seems to have been generated more by the profit taking than by technical or fundamental reasons.

The explosion of trading volumes on both centralized and decentralized exchanges culminated in weekend records, the highest ever with over $298 billion yesterday, Sunday, 80% of the total among altcoins.

The trading frenzy shows a move away from futures and options derivatives, halving the Open Interest (contracts open overnight) on Ethereum from the tops on September 1st, while Bitcoin lost 40% from the all-time highs on August 18th.

The crypto market today

Today, with more than 65% of the main cryptocurrencies in positive territory, is trying to reverse the trend of the last few days.

Even among the Top 20 the green sign prevails. The best one is Chainlink (LINK) with an increase that goes further than 15% making it regain the $13 area and the fifth position in the ranking. Among the best of the big names, there is Binance Coin (BNB) above +9% from yesterday’s levels and Polkadot (DOT) +6%.

A thrilling weekend for the DOT token that saw the value halved from the tops at the start of September, from $6.8 on September 1st to $3.5 on Saturday, September 5th. A drop that caused the token to lose two positions, from fifth to seventh, in the ranking of the most capitalized.

Bitcoin (BTC) price

The sinking of the weekend, for a few minutes, brings the prices just below the psychological threshold of 10,000 dollars, for the first time since last July 27th, causing the reaction of the purchases between Saturday and Sunday, rejecting the prices to test the bullish trendline in the $10,500 area.

A rebound in part triggered also by the cover-ups of the options opened in recent weeks to protect against any reductions that have taken place in recent days.

Currently, the last remaining valid level is 9,880. A drop under this area would cause a further descent with dangerous downward stretches.

The current sentiment of professional operators remains bearish with a ratio of 1 to 10 between Put and Call. Only a rebound of the prices in the $11.900 area, relative maximums at the end of August, will modify the repositioning of the covers to the rise.

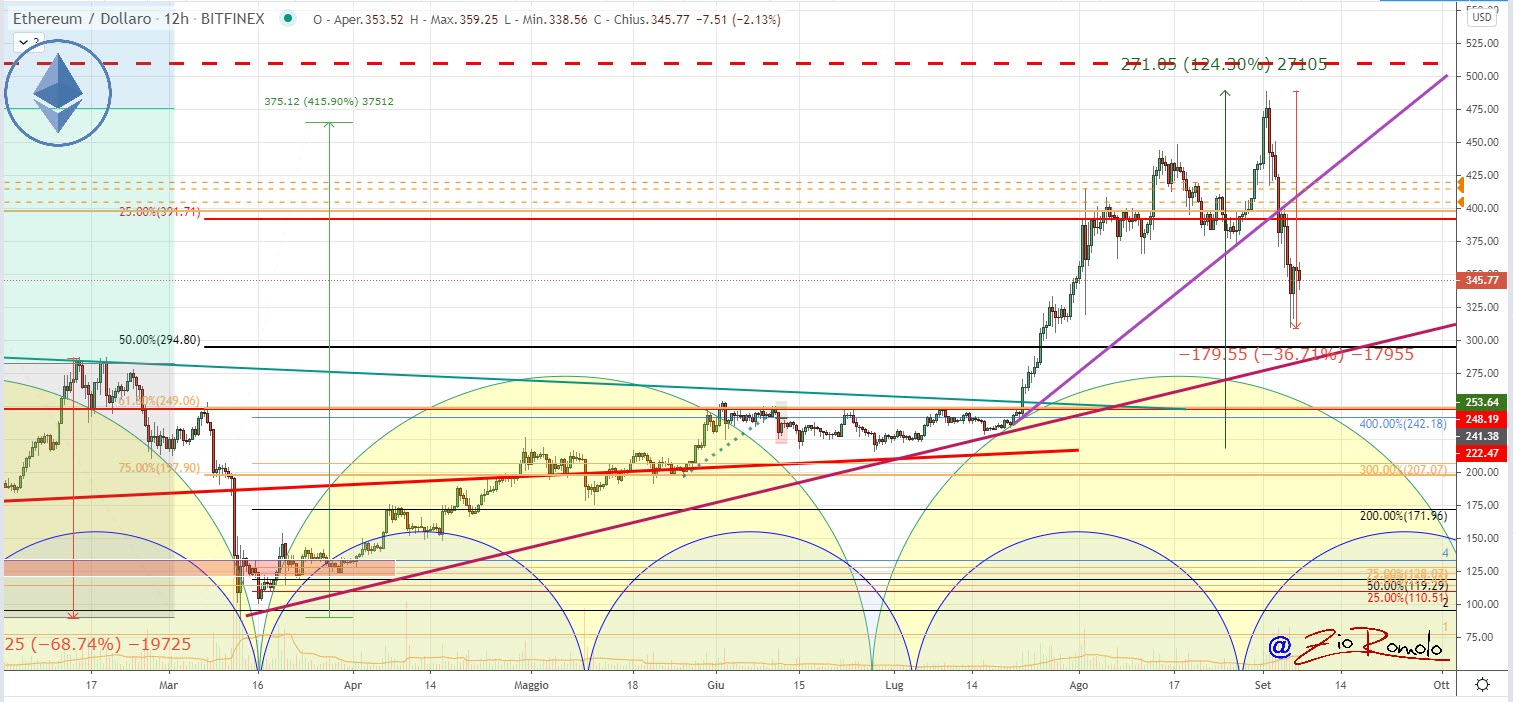

Ethereum (ETH) price

The collapse of these days causes more than 35% of the value of Ethereum to be lost in less than a week. A fall with the worst depth since mid-March.

The $170 loss brings back the prices of the end of July, sweeping the $355 support, repeatedly cited last week as an important support defended by option professionals.

This breakup caused an increase in volatility over the weekend. In a few minutes, prices plummeted stopping the fall just over $310, where the last bastion to protect against the falls is located.

A break in this support would cause further bearish speculation, seriously jeopardising the uptrend that began in mid-March.