Justin Sun reported the news on Twitter: the TRON blockchain houses as many as 3000 bitcoin (BTC), which at the current price are over $30 million, making it the second blockchain with the most BTC.

3000 #Bitcoin on #TRON! 838 hodlers and 8128 Txns! Get #Bitcoin on #TRON at @Poloniex! If you are interested in supporting #BTC contact our team asap! pic.twitter.com/7kbnqp6Nl7

— H.E. Justin Sun 孙宇晨 (@justinsuntron) October 10, 2020

Only last month, Sun himself announced that wBTC and wETH would soon arrive on the TRON blockchain thanks to BitGo, bringing the assets on a more scalable blockchain than the original one.

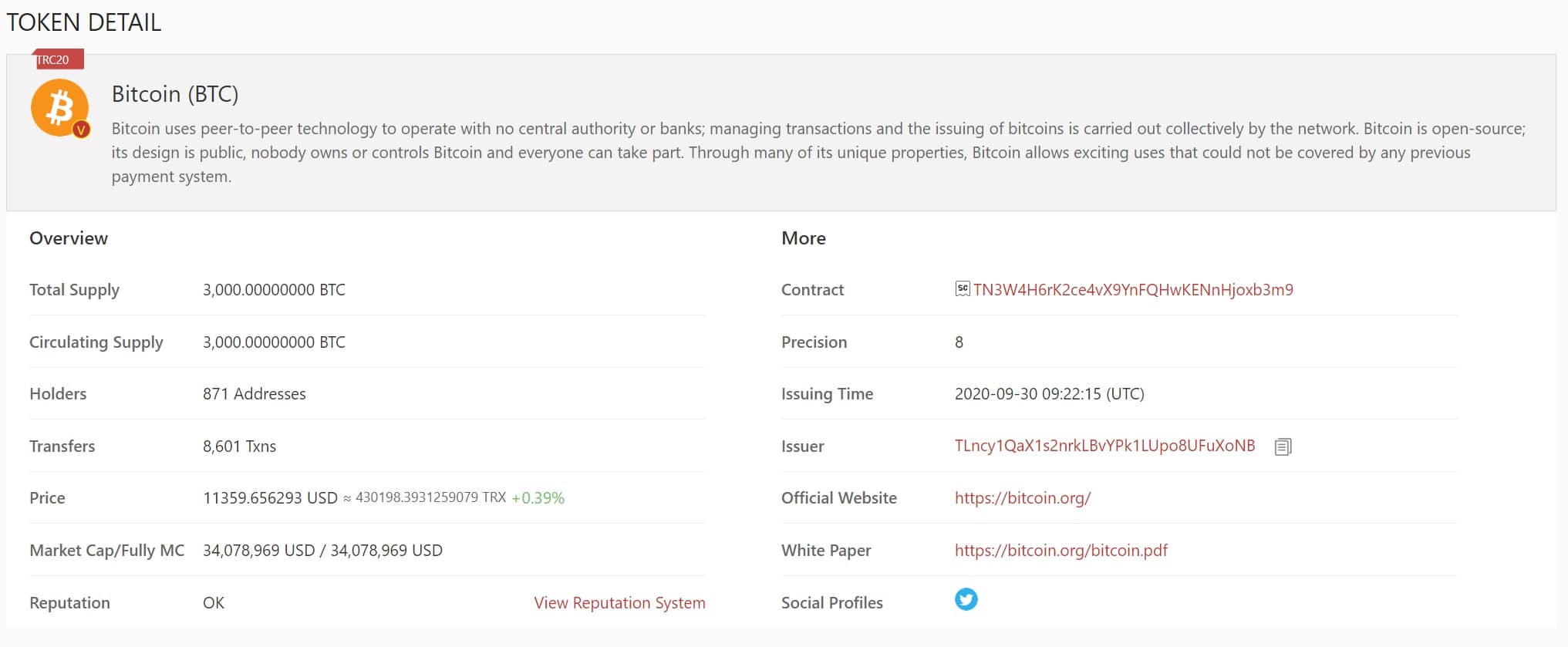

And so, a month later, there is a smart contract where the 3000 BTC are in the hands of 871 different addresses:

Interestingly, these BTC are already available on the decentralized JustSwap exchange and therefore anyone can exchange any token with BTC in a completely decentralized and autonomous way.

It is not yet clear how to transfer tokens from this blockchain to that of bitcoin, and maybe the use of Poloniex will be necessary to act as a bridge between the two blockchains, or maybe in the future a dedicated platform will be created where BTC can be extracted from this blockchain, as in the case of pBTC found on EOS and Ethereum.

Moreover, with this smart contract, the TRON blockchain is in second place among all the blockchains that offer this type of asset: in fact, in first place, there is Ethereum with the wBTC that correspond to over 95 thousand BTC, with a value of over 1 billion dollars.

In second place there is TRON with 3000 BTC and a value of over 30 million dollars, in third place there is Lightning Network with just over 1000 BTC and about 12 million dollars, demonstrating how the other blockchains have taken advantage of the slowness and difficulty of this protocol to attract capital, especially thanks to decentralized finance (DeFi).

Bitcoin on TRON as a form of investment

In fact, it is clear that BTC is now considered as a store of value, rather than a payment system, and while this could be considered a failure compared to Satoshi Nakamoto’s original objectives, it has become an investment opportunity.

For this reason, little by little, BTC has been used as collateral for several stablecoins, such as DAI on Ethereum or EOSDT on EOS, as well as for the creation of liquidity pools.

All this has driven the Uniswap token, i.e. UNI, into the limelight as the wETH/wBTC pair provides 16% APY and it is clear that many are using it to achieve even more rewards.