If Friday morning levels were to be confirmed, above $12,900, Bitcoin would see the week close with double-digit gains, +12%, the third best week since the beginning of the year behind the April performance when it closed more than 15% twice.

With earnings of $1,400, of which just under $1,000 recorded on Wednesday alone, it will confirm its best weekly closing in nominal terms since the end of July 2019.

This photographs what has been happening in recent days: for the first time in over 15 months, since June 2019, Bitcoin is once again going above $13,000.

The bullish trend had already given the first signs since last week, with accumulation movements that were subtly recorded and which set the supporting conditions for the strong uptrend that has exploded in recent days, with a movement that started at the beginning of the week.

The increase initially present for two days only on Bitcoin was then reflected in the rest of the sector, including Ethereum, which in these hours breaks through the $400 threshold and returns to important levels for the long term.

Both Bitcoin and Ethereum closed the week with double-digit increases.

The price of Chainlink

Among the top 15 crypto per market cap, this trend is only followed by Chainlink (LINK), which, with a jump of over 12%, is once again reversing the downward trend that characterized its performance from mid-August until 10 days ago.

LINK is making a recovery that once again brings the quotations above 12 dollars, thus trying to reverse the negative trend that has been weighing on it since mid-August.

The day saw a strong rise of Aave, +18%, followed by Waves, which was close to a 10% gain. Third best of the day was Chainlink, with +8%.

On the opposite side, the worst of the day is Crypto.com (CRO), losing 5.5%. After exceeding 5 million users in the last week, it has experienced problems on the platform that seem to have been resolved in the last few hours. But this has led investors to sell, as a result of speculation over fears of platform blockages. In the last week, CRO lost more than 30%.

The second worst is Filecoin (FIL), which is experiencing tensions among the liquidity providers of the decentralized cloud service. Having reached $60 last week, the token is now moving just under $25.

Capitalization and volumes

The market cap consolidates above $390 billion, the highest level since last May, with Bitcoin reaching almost $240 billion, maintaining dominance at 61%. These are important levels that weigh particularly on XRP, which slips to 3%, lower levels than in the last three years. Ethereum is easily defended and is back to a 12% market share.

In the last 24 hours, total volumes have fallen slightly to 130 billion dollars.

In the last few days, volumes have once again seen euphoric movements, with Bitcoin which, with yesterday’s trades concluded with over 2.8 billion in dollars, establishes the fourth consecutive day with trades above 1.5 billion, a condition that had not occurred since the end of September.

Ethereum’s trades are also back on track, with more than $1.5 billion for the second day in a row. This is the first time since mid-September that such massive trading has taken place.

The gains of DeFi

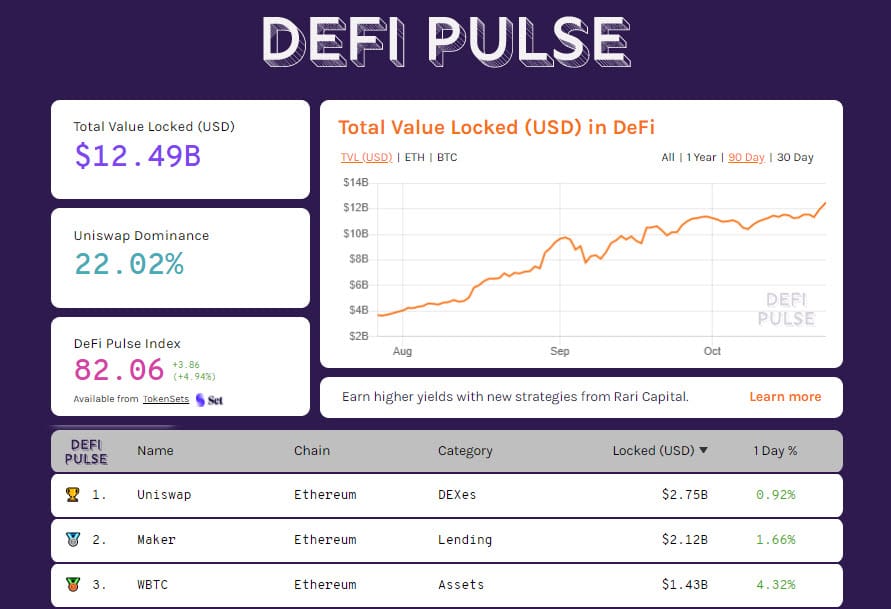

In the last few days, the exposure of tokenized bitcoin has increased, exceeding 171,760 BTC. Ethereum locked on decentralized finance platforms are above 9 million ETH, which in these hours updates the absolute historical records with more than 12.5 billion dollars.

Uniswap remains leader with 2.75 billion, Maker rises to 2.2 billion. Third protocol in the ranking is WBTC which rises to 1.43 billion.

Bitcoin (BTC) strong gains

Bitcoin’s high jump in the last few days marks one of the best times of 2020. Confidence is also returning to the levels of last summer, when for over a month the fear and greed index fluctuated above 70, a level that has recovered in these hours.

The strategies of operators in derivatives strengthen the downward defences, as in these hours they see alerts only with falls of prices distant from the current levels, under 10,650 dollars.

Upwards, the new strategies of coverage are absent and this signal confirms the strength of the last hours.

These are indications that the increase of the open interest is confirmed also from the increase of the future derivatives that with over 5,5 billion dollars reach the highest level of daily closing since September 1st.

Open interest on options updates the absolute historical highs with over $2.6 billion in options remaining open overnight.

Yesterday’s day saw CME’s open interest on futures close over $790 million, the second best overall performance, the highest level since the mid-August closing.

Ethereum (ETH)

Broken the $400 threshold, ETH goes above 415. In order to give a bullish impulse also during the weekend, the price behaviour must be followed carefully.

A danger would come only with signals under 375 dollars, which coincide with the levels that Ethereum was at last week.