The most exciting week of the year, and most likely of Bitcoin’s history, is coming to a close. Over the past few days, from Christmas Eve until yesterday, there have been exciting and glorious days for Bitcoin, which has set new all-time highs that have been the source of euphoria for fans, enthusiasts and others.

The week ends with a clear positive sign that only in the last few hours has seen some profit-taking, causing the price of Bitcoin and that of most cryptocurrencies to fall, with the exception of Ethereum.

Ethereum has been a spectator in recent days, but yesterday it switched into turbo mode and attempted to trigger the start of the altseason, which has been pending since Bitcoin began the glorious ride that saw it break the $28,000 mark for the first time yesterday.

Ethereum leads the sector in this final week of 2020 with Bitcoin hovering below parity today compared to yesterday, while ETH has one of the biggest gains of the day with a 15% jump. Only some DeFi tokens do better, such as REN, Ocean Protocol (OCEAN), Terra (LUNA), THORChain (RUNE) and Chainlink (LINK), with gains of just over 15% and no more than 20%.

The rises led by the queen of altcoins are dragging the sector, where 80% of the top 100 are in positive territory.

These rises of the last few days and hours drag the market cap over $720 billion, the highest levels in 3 years. This is the highest level since January 2018, when the all-time record was set at $830 billion.

The capitalization sees 70% of the market share held by Bitcoin, which for the first time goes beyond 500 billion in capitalization.

Volumes exploded over the festive period, something that had never happened in recent years. To find such euphoric Christmas days we have to go back to 2016 and 2013, when the phases between Christmas and New Year were similar to the current one for Bitcoin, with relevant percentages and gains of 20% in both cases, while this time it went over 30%.

Bitcoin went on to close the week up 12% from last Monday’s levels. In 2013 and 2016, Bitcoin prices were below $1,000, while the cryptocurrency sector was in a decidedly different context from the current one, a decidedly special moment for the sector and for Bitcoin.

Volumes are indeed explosive and yesterday, despite the holiday, more than 10 billion dollars worth of Bitcoin were traded, the second-highest peak ever, marking the second time that the counter value exceeded 10 billion dollars in December. The previous all-time high was recorded on December 17th, exactly 10 days earlier, with over $12.1 billion in counter value traded.

Yesterday Ethereum saw its best day of trading with the highest peak since the beginning of the month at over $4.7 billion, the second-best day since the beginning of the year and the second-best day ever. For Ethereum, the best day remains November 26th, when it exceeded $5 billion in trade for the first time.

This highlights the period and what is happening in these historic days not only for prices.

#BITCOIN CRAVINGS ARE BACK🌈

Yesterday, December 27th, 2020, the #Bitcoin Blockchain saw the second-highest trading volume in dollars, reaching over 68 billion USD 🚀 pic.twitter.com/Xe2W3gsXQU— Federico Izzi (@zioromolo) December 28, 2020

The Bitcoin blockchain had its second-highest trading day yesterday, with over $68 billion.

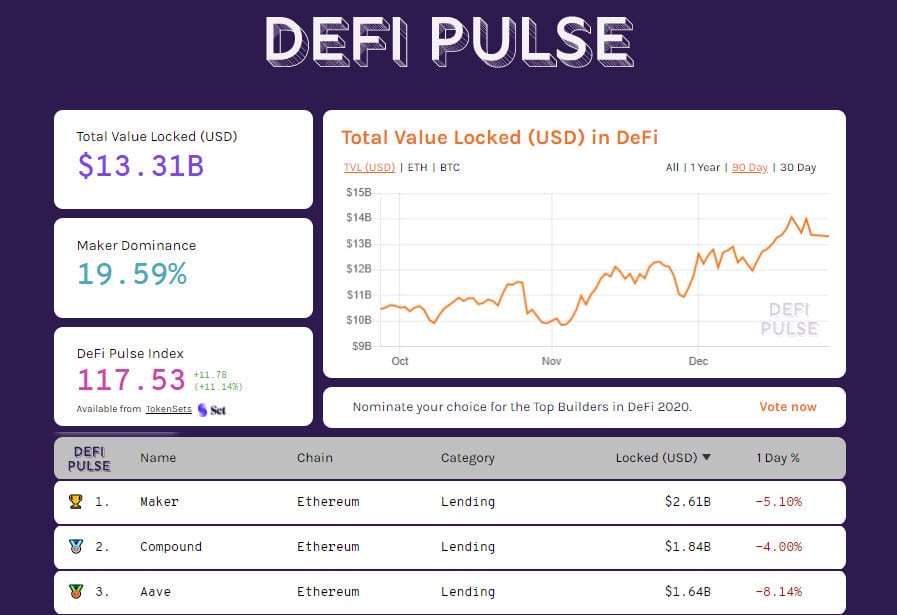

DeFi, record for Aave

Despite the rises these hours, decentralized finance is not benefiting, with TVL remaining above 13 billion but below the December 20th record of over 14 billion.

The leader remains Maker with 2.6 billion, followed by Compound, while Aave in third position goes to 1.6 billion dollars, the highest ever peak for locked collateral.

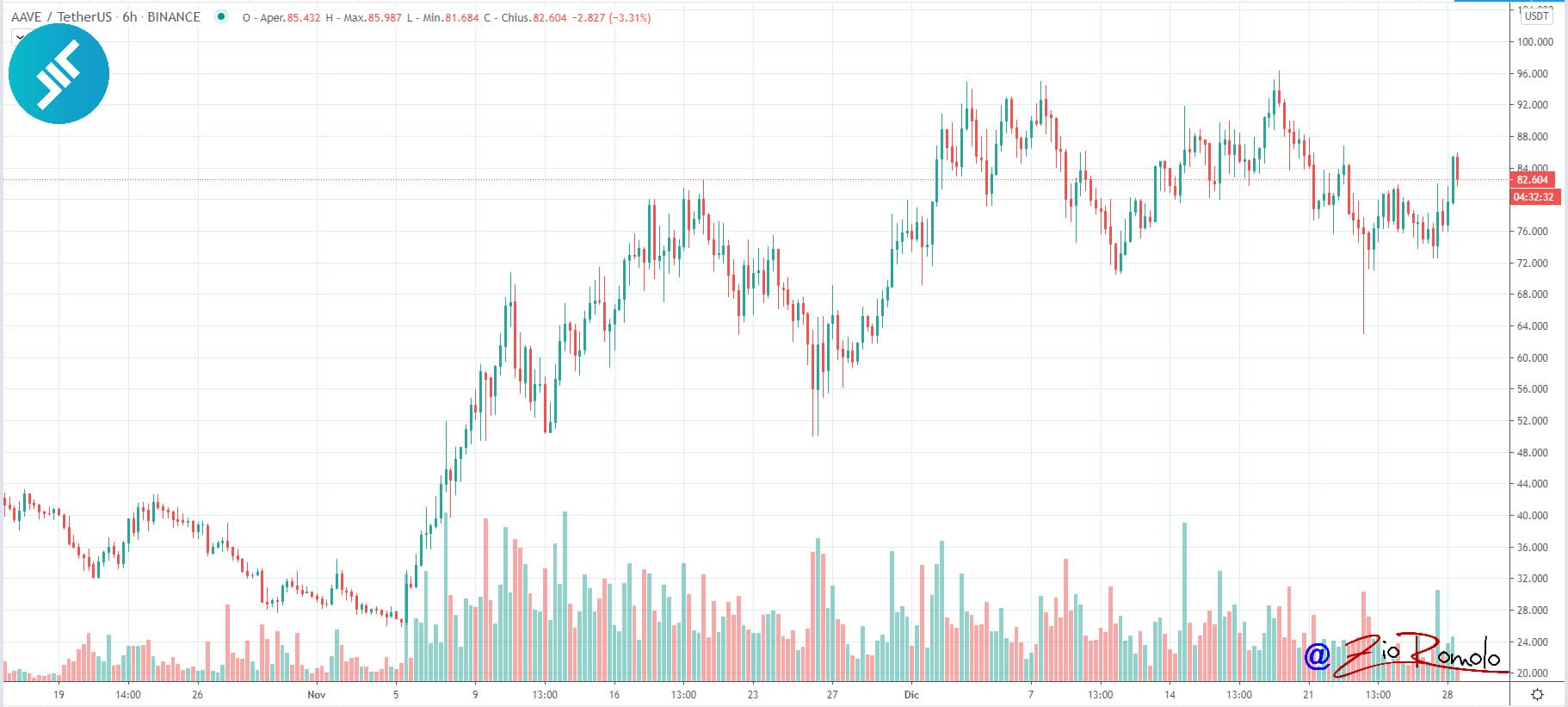

The token, however, is not moving much, staying within the $85 sideways channel. Aave’s fluctuations since late November have ranged from $70 to $85.

Bitcoin (BTC), historical records for prices

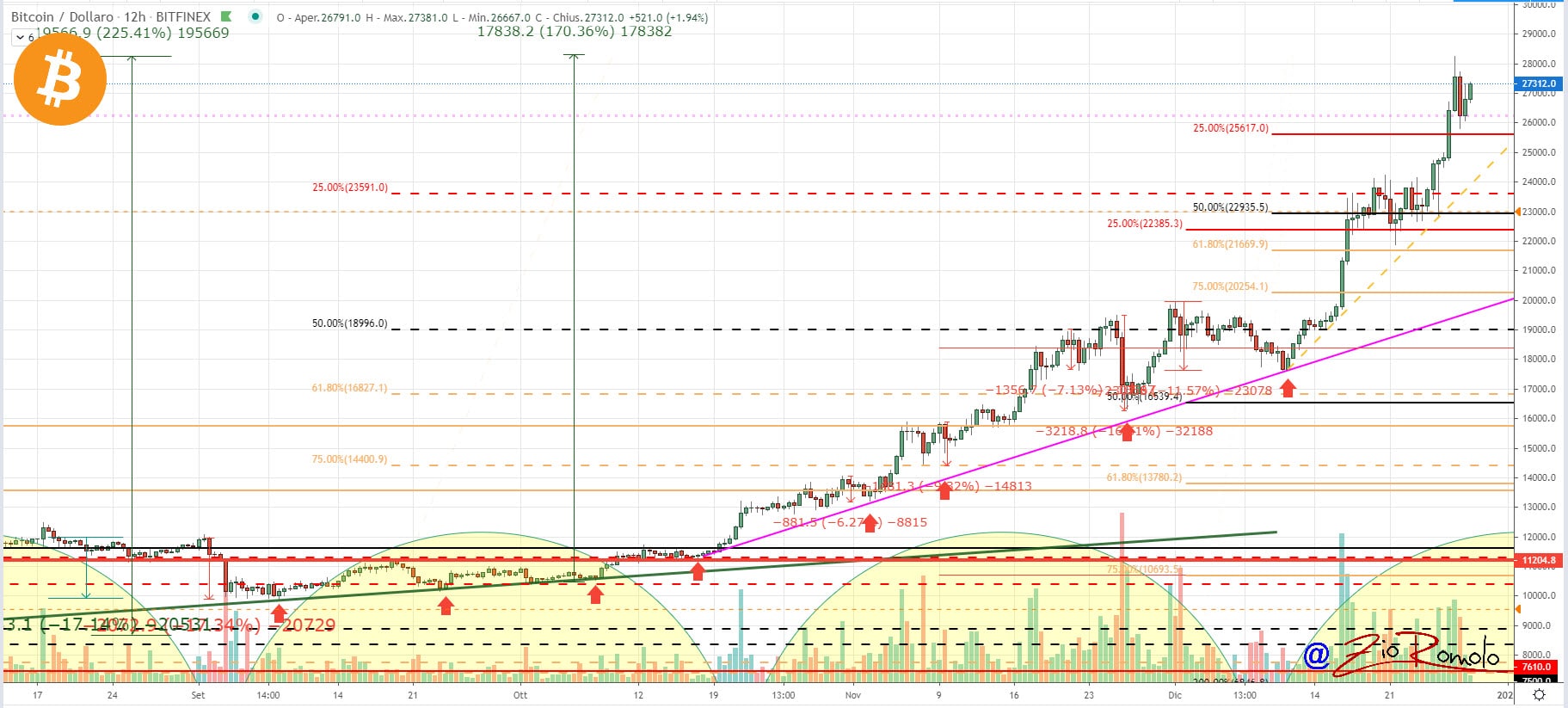

Bitcoin’s rise these days marks the second consecutive week of gains, with BTC yesterday heading for new all-time highs above $28,000 for the first time in its history.

It’s a banner month and if it holds at current levels for the next three days, it would be the second-best month of the year, up nearly 40 percent.

For Bitcoin, yesterday’s profit-taking pushed prices back to test the $26,000 mark, where buying returned and took prices back above $27,000.

After this strong climb Bitcoin has ample room for manoeuvre also in case of any downward movement. A bearish warning would only come in the event of pullbacks to $25,500, but without concern for the monthly trend that began on December 11th, which would only be partially compromised with declines below $23,000 in the coming days.

On the upside, any break above $28,250, yesterday’s record, will have to take place with rising volumes.

Ethereum (ETH)

With the recapture of $738, one step away from $740, at the highest levels since May 2018, Ethereum is starting to lay the groundwork for an early altseason.

For Ethereum, this latest upward gallop increasingly distances the risks of a possible negative compromise of the trend that has accompanied it since the lows of mid-March and that has no longer found any fear of reversal.

With these latest rises, the trend is strengthening in the short term. The alert threshold for a possible monthly reversal is raised, with the first alarms at 630 dollars, 100 dollars from the current values. The real medium-term support is at $480, which has strengthened in recent weeks due to hedging by options traders.