Yesterday’s rise has been cancelled out by the return of weakness which now prevails for Bitcoin, Ethereum and over half of the major coins.

Among the big names, Ripple (XRP) is showing a weak bullish sign as it attempts to recover from 47 cents on the dollar. Uniswap (UNI) is shining, rising more than 8%, benefiting from the excellent momentum of DEXs, which continue to record growing trading volumes.

Total market capitalization remains above 1,500 billion with Bitcoin confirming its 60% share of the entire sector. It is followed by Ethereum at just under 12% and Cardano which consolidates its third position in the list of the most highly capitalised.

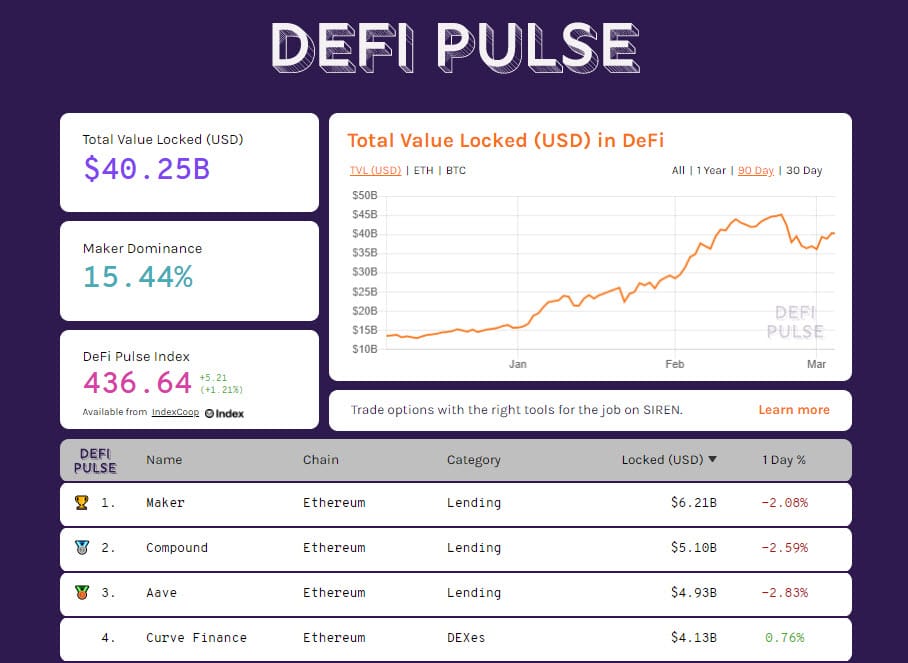

The total value locked in DeFi is back above $40 billion with the number of ETH rising again to above 8,600 ETH locked in decentralized finance projects, the highest peak since mid-November.

Bitcoin (BTC), weakness prevails

Bitcoin fails in its attempt to conquer the $52,000 mark, slipping back below the psychological threshold of $50,000. Weakness continues to prevail in the medium-term trend, which aligns with the closure of the two-month cycle as already indicated in recent days hypothesized at the turn of March.

It is useful to continue to follow with detachment the trend of prices that could undergo shocks with rises above $53,000, the highs reached in the last 10 days, or down the lows of the last weekend, namely the $43,000 area.

Ethereum (ETH)

Ethereum follows a similar trend where weakness still prevails despite yesterday’s attempts to rally above $1,650.

The resistance that has been repeatedly indicated as an important operational level in recent days confirms its importance and remains a level to be monitored for the rest of the week.