A day of rest after the bullish hangover that saw bitcoin and Ethereum surge and set new all-time highs.

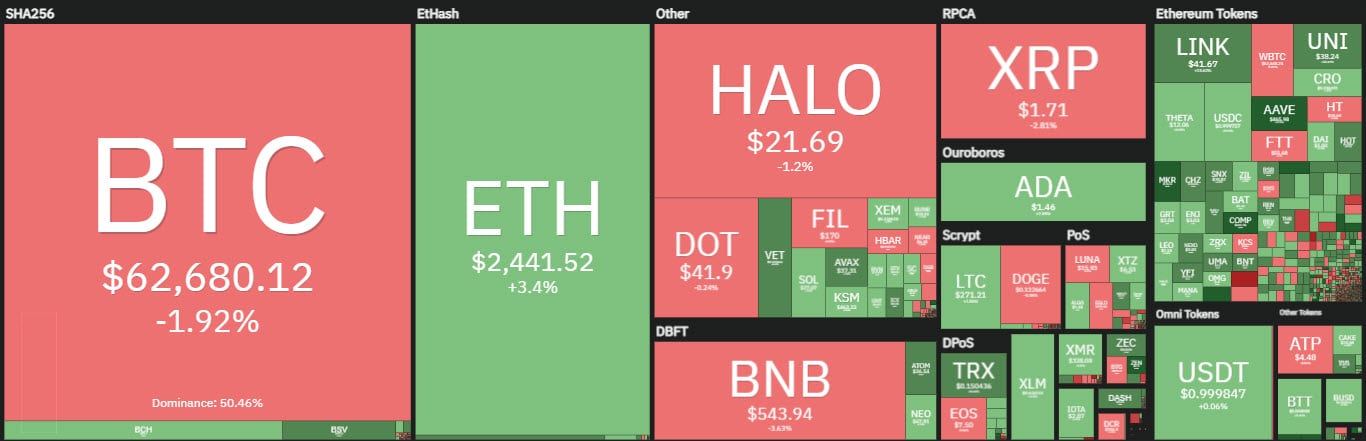

Today the red and green signs are balanced with just over half in positive territory. Scrolling through the list of the top 20 stocks, the red sign prevails. XRP was particularly weak, falling more than 7%, the worst of the big names.

This decline comes after 10 days of strong gains. Despite today’s weakness, XRP’s gain since April 5th has been over 170%.

Among the biggest gains of the day are tokens linked to decentralized finance projects. Among the top performers are Maker (MKR), +20%, Compound (COMP), +15% and Aave (AAVE) and Yearn.Finance (YFI) +12%.

Also among these is the Chiliz (CHZ) token, which recovered to $0.55.

In the last 24 hours, euphoria over new price records pushed total trading volumes above $800 billion, excluding the absolute records of mid-March last year, historically this is the second time that the entire sector has exceeded the threshold of $800 billion traded in a day.

Yesterday saw a strong rebound in trading for Ethereum to over $8.6 billion, its highest peak in over a month.

Bitcoin also had a busy day yesterday with $14.4 billion traded, the second-highest volume day in the past month.

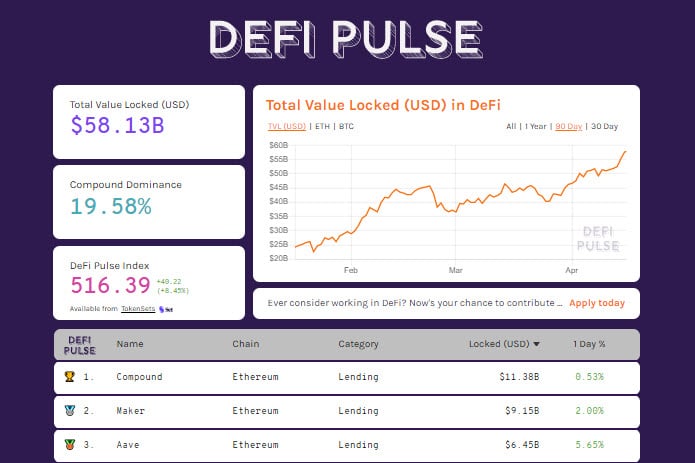

Decentralized finance continues to climb, with the TVL soaring to within a hair’s breadth of $58 billion, a value that has doubled since early February.

A few days after Compound surpassed the $10 billion mark, the second most popular lending and financing project, Maker, is now also approaching the $10 billion mark for the value of its collateral.

Bitcoin (BTC)

Bitcoin has lost just over 3% in recent hours from yesterday’s all-time highs, with prices pushing above $64,800 for the first time.

The exchange rate against the euro also hit an all-time high yesterday for the first time above 54,000.

After the climb of the last 48 hours, bitcoin is reinforcing the bullish trend that began in late January.

In the next few hours, we need to have confirmation of the holding of the previous records of mid-March, precisely $61,300, which has now become medium-term support.

Ethereum (ETH)

Ethereum is one step away from $2,500, continuing the triumphal march that began from the relative lows in late March. The new record on the spot market for Ethereum also boosted derivatives trading which yesterday recorded new all-time highs for trading volumes, both on futures and options traded.

This indicates a return of interest not only for the spot market but also for professional investors. The rises of the last few days have pushed prices away from the medium-term supports, thus bringing Ethereum into a space of relative safety. From these levels, the first sign of danger will only be with a return below 1,900 dollars.