Ethereum trend

Ethereum [-6.78%] hasn’t been able to establish its price above $2,600 yet on this recent rally. On Wednesday, the price sold-off more than BTC and traded most of the day below $2,500 as all markets waited for news from the Federal Reserve on potential interest rate hikes.

Ethereum is the #2 ranked cryptocurrency by market capitalization [$279.5 b] and Ether’s 24 hour volume is $26 million.

The ETH / BTC pair has vastly outperformed over the last 12 months [+154%] but over the last 30 days during this accumulation phase ETH’s [-18.5%] against BTC.

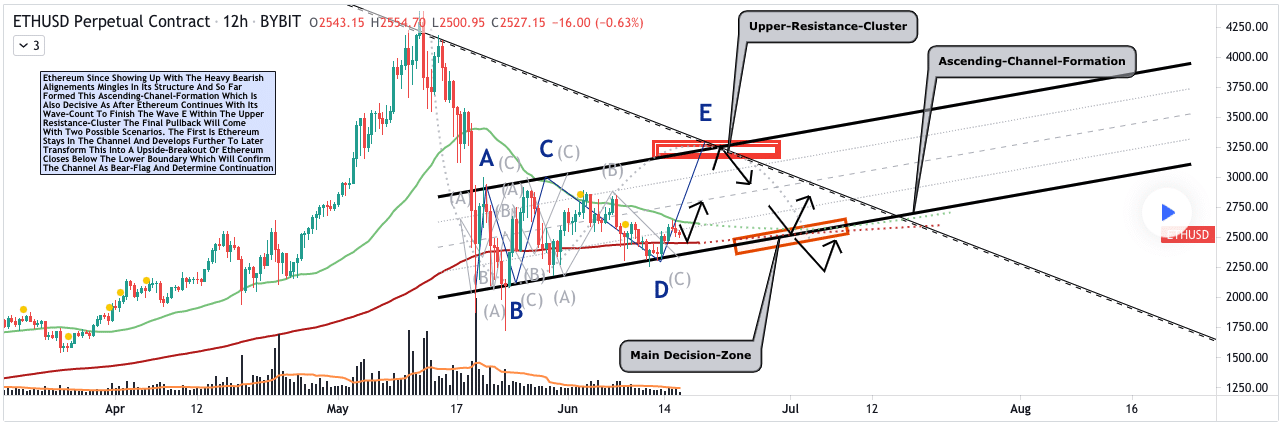

You can see in the above chart from VincePrince that Ether is currently in the ‘Main Decision-Zone’ of his scenario on the ETH / USD 12HR Chart.

Closing below $2,500 Ether on the weekly time frame would be a bearish indicator for the market in the short run.

Ether had a daily candle close below the lower boundary “Main Decision-Zone” on Wednesday of $2,365.

Monero trend

There are more whispers than ever about the importance of privacy coins across the cryptocurrency market. This isn’t a wholly subjective characterization of their popularity rising however, Google Trends and the data relay’s their recent intrigue to market actors.

XMR’s +305% against the U.S. Dollar for the last 12 months and -.43% against BTC over that same duration.

There are a number of edges that bitcoin possesses over Monero but one notable comparative advantage that comes with confidential transactions is fungibility.

Moving forward into this digital epoch the desire for confidential transactions will rise dramatically. For the most basic use cases such as a company’s payroll there are many advantages to XMR and other privacy coins.

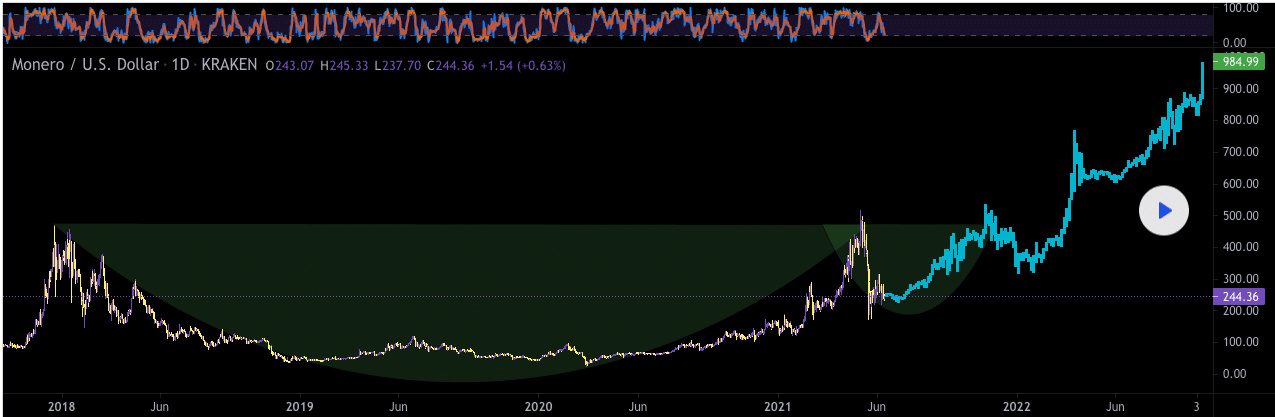

The increased breadth of utility as the number of users adopting cryptos expands mixed with the long term cup and handle above are bullish for XMR.

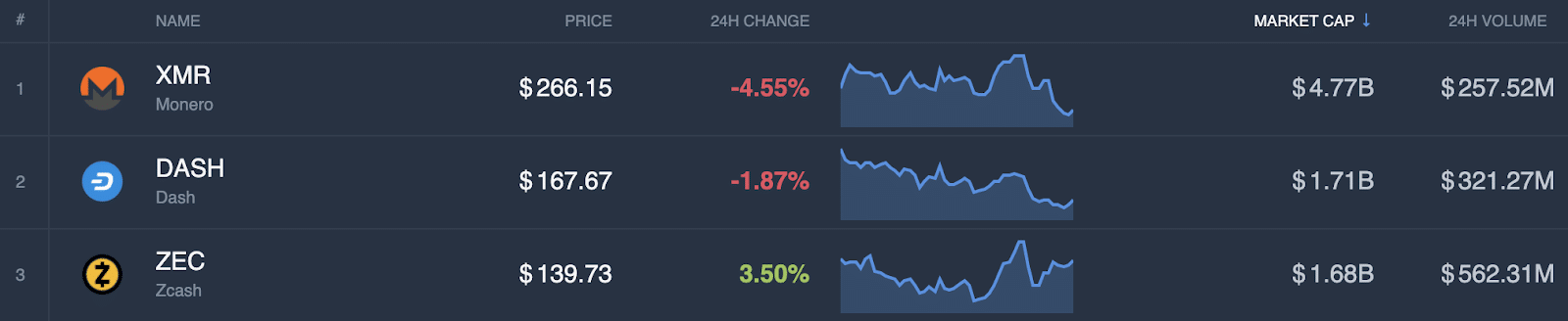

The Top Privacy Coins by Market Capitalization, data from Coincodex

Monero [-3.5%] is the chief privacy coin on the market and looks to be forming a giant cup and handle on the Monero / U.S. Dollar 1D Chart.

The below chart from DonYakka shows just how bullish XMR looks dating back to 2018 when the last bull market began to wind down.

A bearish outlook on XMR is a continuation of the non-evolutionary thesis that eventually the government will crackdown on coins that enable confidential transactions.

XMR had a daily candle close on Wednesday of $262.05.