Summary

Bitcoin Analysis

Bullish Bitcoin market participants pushed back on Monday and put an end to three consecutive days of selling pressure from bearish traders. When the day’s daily session had concluded, BTC’s price was +$744.5.

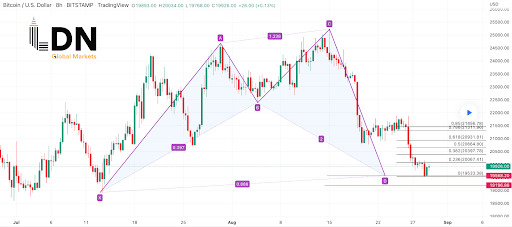

The BTC/USD 8HR chart below from LDNGLOBALMARKETS is the first chart we’re providing analysis for today. BTC’s price is trading between the 0.236 fibonacci level [$20,067.41] and 0.382 [$20,397.78], at the time of writing.

Above the 0.382 fib level bullish traders have targets of 0.5 [$20,664.8], 0.618 [$20,931.81], 0.786 [$21,311.96], and 0.85 [$21,456.78].

Conversely, bearish BTC traders are taking aim at the 0.236 fib level with a secondary target of a full retracement at 0 [$19,533.38]. The third target to the downside for bearish traders is $17,611 which is the 12-month low for BTC’s price.

Bitcoin’s Moving Averages: 5-Day [$21,145.02], 20-Day [$22,720.84], 50-Day [$21,852.37], 100-Day [$27,189.74], 200-Day [$35,792.36], Year to Date [$33,185.17].

BTC’s 24 hour price range is $19,540-$20,427 and its 7 day price range is $19,540-$21,753.13. Bitcoin’s 52 week price range is $17,611-$69,044.

The price of bitcoin on this date last year was $46,989.7.

The average price of BTC for the last 30 days is $22,652.11 and its -12.1% for the same timespan.

Bitcoin’s price [+3.81%] closed its daily candle worth $20,295.6 on Monday.

Ethereum Analysis

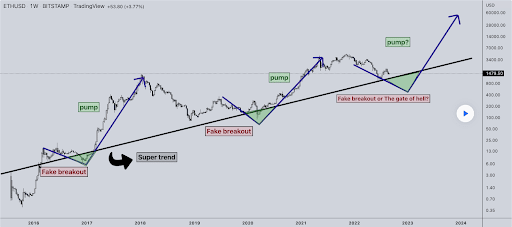

Ether’s price appreciated 130% over during July and the beginning of August but has since lost 30% of its value over the last two weeks. Bullish traders did manage to rally ETH’s price on Monday at an important inflection point [$1,420] on the weekly timescale and ETH’s price concluded its daily session +$126.32.

The ETH/USD 1W chart below by wikipedram96 shows how critical the current level on Ether’s price is at the time of writing. ETH’s price is clinging to an important support that if broken to the downside by bearish traders could spell an eventual trip down to test the $400-$500 level.

There’s really no edge currently to bullish traders as bearish traders have been applying pressure on them since bulls were unable to break the $2k level earlier this month with any real resolve.

Ether’s Moving Averages: 5-Day [$1,623.10], 20-Day [$1,731.66], 50-Day [$1,472.49], 100-Day [$1,846.92], 200-Day [$2,577.16], Year to Date [$2,314.95].

ETH’s 24 hour price range is $1,422.08-$1,553.76 and its 7 day price range is $1,422.08-$1,713.59. Ether’s 52 week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $3,228.54.

The average price of ETH for the last 30 days is $1,708.41 and its -7.19% over the same time frame.

Ether’s price [+8.86%] closed its daily candle on Monday worth $1,552.52 and bulls snapped a three day slide in negative figures.

Algorand Analysis

Algorand’s price was sent more than 5% higher on Monday and finished its daily candle +$0.0156.

The ALGO/USD 1D chart below from Altcenter_Analysis shows the levels that are integral to bullish traders in the short-term. The overhead targets for bullish ALGO traders since they’ve defended the $0.28 level are $0.3409, $0.3803, $0.4199, $0.4709, and $0.5799.

At variance with bulls are bearish Alogrand traders that have been in control of this market over the last week. Bearish ALGO traders want to push ALGO’s price below the $0.27 level and break the bottom of its current range at $0.2556.

ALGO’s Moving Averages: 5-Day [$0.301], 20-Day [$0.333], 50-Day [$0.328], 100-Day [$0.423], 200-Day [$0.793], Year to Date [$0.654].

ALGO’s 24 hour price range is $0.2798-$0.2978 and its 7 day price range is $0.2798-$0.31. Algorand’s 52 week price range is $0.2753-$2.85.

Algorand’s price on this date last year was $1.01.

The average price of ALGO over the last 30 days is $0.33 and its -10.79% over the same duration.

Algorand’s price [+5.52%] closed its daily session on Monday worth $0.298 and back in green digits after finishing Sunday’s daily candle in negative digits.