In this article we will look together at the price analysis and future forecast for the crypto assets Maker (MKR), Stepn (GMT) and Gala (GALA).

What opportunities does the cryptocurrency market have for us today?

Summary

Price analysis for crypto assets Maker (MKR), Stepn (GMT) and Gala (GALA)

First and foremost, it is necessary to mention that we are up against three crypto assets belonging to 3 totally different projects, with distinct use cases from each other.

With regard to the prices of MKR, the governance token of the decentralized autonomous organization MakerDao that manages the issuance of the DAI stablecoin, we can see that the current value is $698.2 per token.

The change in the last 24 hours is at -2.37%, with volumes around $70 million, while the capitalization is $684 million.

MKR’s circulating supply is 977,631 MKR while the maximum supply is 1,005,577 tokens.

This means that 97% of the tokens have already been issued in the market.

The same cannot be said for GMT, a token of the decentralized move-to-earn STEPN application.

Indeed, the GMT token is highly inflationary: only 600 million GMT, equivalent to 10% of the supply has been issued in the market.

This is a common feature within the tokenomics of projects that aim to reward users based on their activity within the community.

GMT’s current price is $0.375 per token, down 0.84% over the past 24 hours with volumes in the $44 million range.

The market capitalization represents $225 million but since 90% of the supply has yet to be unlocked, the fully diluted capitalization comes to over $2 billion. As an example, to date APTOS has a capitalization of that magnitude.

Focus on the GALA crypto

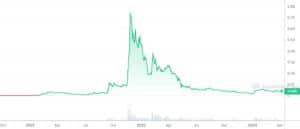

Finally, GALA, a utility token of the web3 games hub “Gala games,” has a current price of $0.0395 per token, with negative change of 2.21% points in the last 24 hours and volumes on the $98 million mark.

The capitalization of the GALA token is $276 million, with a circulating supply of 7,542,496,572 tokens, while the maximum supply is 50,000,000 tokens.

By proportion, just over 15% of the tokens that will be created to support the project have already been unlocked.

The situation is slightly better with GMT, though both represent tokens that may find it difficult to appreciate. Unless the teams of the respective projects find a way to incentivize the use of cryptocurrencies in the network.

There are tokens with high total supplies that nonetheless have managed to maintain a good price given their usefulness in developing the infrastructure of their projects.

The best example is that of ETH, which despite technically infinite max supply, has managed, through the implementation of EIP-1559, to counter inflation arising from the issuance of new coins. Indeed, in recent months ETH has reached a deflationary state, just as is the case with BTC.

Will the MKR metaverse crypto be able to return to all-time highs? What will happen to the Stepn and Gala projects and their respective GMT and GALA tokens?

Let’s take a look at some market predictions to see where the tokens we just analyzed are headed.

Certainly the odds of a return to historical highs are more favorable in MKR than in GMT and GALA.

We explained the reason above and it has to do with the difficulties of appreciation of metaverse and play-to-earn tokens in view of the poor tokenomics.

However, this does not mean that GMT and GALA are doomed, while MKR can boast of an early return to the bull phase.

As we all know, anything can happen in the world of cryptocurrencies: innovations and news run very fast, so future project updates, supply burns, and user incentives could all be game changers.

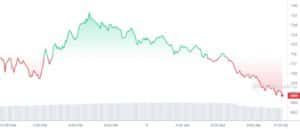

On the technical analysis front, all 3 tokens are well below their respective all-time highs, with drawdowns ranging from -89%, in the case of MKR, to -91% for GMT and -95% for GALA.

This is a common feature during the bear market for tokens that do not have a strong use case.

Altcoins or BTC?

Doing any kind of technical analysis in the face of price collapses like this is futile, at least until there is a bullish market return across the cryptocurrency sector.

Choosing to open positions in altcoins during prolonged bearish phases could be detrimental to one’s portfolio, both for USD and BTC countervalue.

How to know when is the right time to be positioned in altcoins rather than BTC?

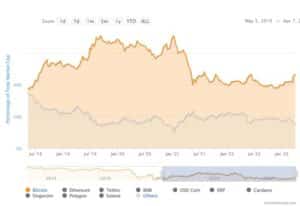

The answer is by no means simple: outperforming the benchmark of the king of cryptocurrencies is the hardest thing that one can attempt, and if proof is needed, it is enough to take a look at market dominance.

Usually so-called “alt seasons,” or market periods in which Alternative Coins perform better than BTC, occur when Bitcoin’s dominance begins a downward phase, following a period when crypto market prices have been on the rise and the same dominance has increased by several percentage points.

The reasoning is that liquidity in the market first is injected into BTC, which causes it to rise in price along with dominance, and then that liquidity is poured into altcoins, before being taken out of the market.

In the last bull market, this situation occurred roughly from January 2021 to July 2021