Mt. Gox has been closed for several years, but it continues to be talked about. After the ruling on former CEO Mark Karpeles, it emerged today that an investment fund, Fortress Group, is trying to buy the bitcoins from the exchange’s creditors.

The history of Mt. Gox has been full of problems and misunderstandings, but it was the theft of 850 thousand bitcoins that led to its definitive closure. Since then, a lawsuit has been pending in Japan and the Tokyo District Court has issued an order setting the deadline for reimbursement payments to October 28th, 2019.

For the time being, Mt. Gox’s funds are frozen and will neither be liquidated nor sent to creditors. There are many BTC and BCH in the hands of Kobayashi and which, according to the plan, should be given directly to creditors without conversion into fiat currency.

In early April, the head of Mt. Gox Legal, an organised group of creditors awaiting payment, left his role as a defender after fearing that the matter might continue for several more years.

Mt. Gox and the Fortress proposal

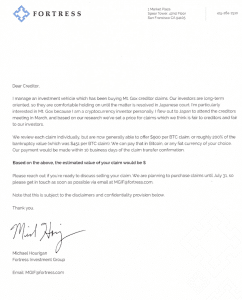

This unclear situation is being addressed by the Fortress Investment Group, an NYC-based group led by Michael Hourigan, which in recent weeks has sent letters to several of the exchange’s creditors with an offer to purchase their claims.

When the exchange went bankrupt, 1 BTC was worth about $450, today the value is about 27 times higher. Creditors, therefore, are hoping to receive all their bitcoins which are now worth much, much more than in 2014 rather than the equivalent in FIAT at the time the exchange closed. However, it is not yet clear how they will be reimbursed, hence the proposal of the equity Fortress Group.

Fortress Group has been active in the cryptocurrency industry since 2013 when it bought about $20 million worth of bitcoin.

This is an extract from the letter received by the creditors:

“Dear Creditor, I manage an investment vehicle which has been buying Mt. Gox creditor claims. We review each claim individually but are now generally able to offer $900 per BTC claim, or roughly 200% of the bankruptcy value (which was $451 per BTC claim). We can pay that in Bitcoin, or any fiat currency of your choice. Our payment would be made within 10 business days of the claim transfer confirmation.”

The letter also contains the value in dollars that the creditor would receive if he accepted this proposal.

If creditors were certain that they would obtain their own BTC, they would not hesitate to reject the proposal as being very disadvantageous compared to the current value of bitcoin. $900 for BTC represents less than 7% of the present value.

Several creditors have already sold their claims in the past for less than the amount proposed by the Fortress group.