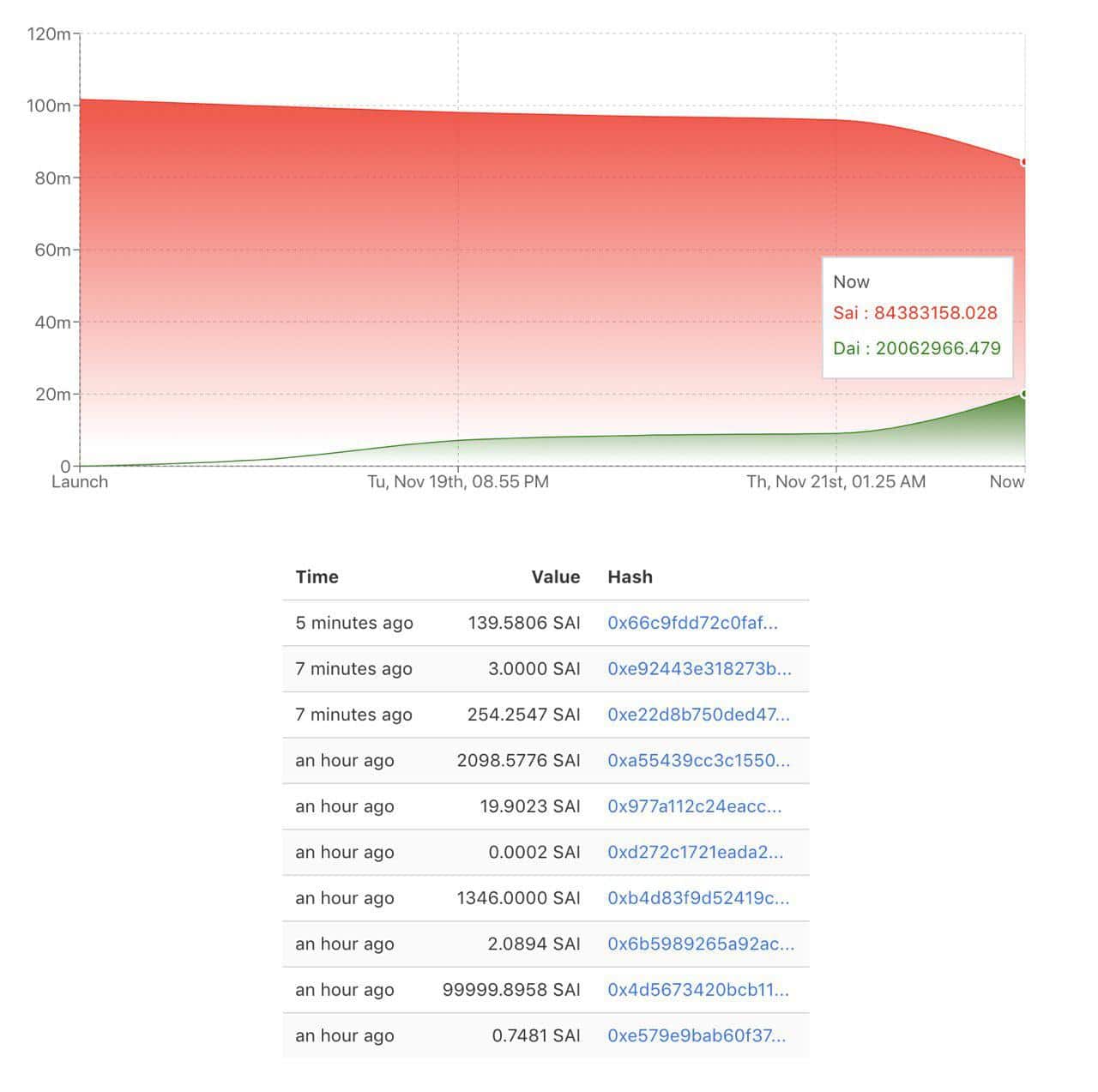

According to the latest news from the DeFi world, the migration from SAI to DAI has exceeded 20 million tokens: on the basis of the Sai2Dai.xyz report, more than 20 million SAI stablecoins have now been converted into the new DAI tokens.

The SAI tokens are nothing more than the old DAI tokens which are only collateralised with Ethereum, while the new DAI tokens are multi-collateralised, albeit always with a value that fluctuates around $1.

The numbers of the DAI stablecoin

The migration of the stablecoin started exactly one week ago, on November 18th, 2019, and is proceeding at a slow pace. After all, the owners of the old DAI tokens, now renamed SAI, have no obligation to migrate to the new version, as the two versions actually coexist.

To date, just under 17% of all SAI in circulation have been converted to the new DAI, with an average rate of around 3 million tokens converted every day.

According to a survey launched three days before the migration, only 35% of the voters had predicted that one week before it started, the SAI converted to DAI would be less than 25%, while 39% believed that they would be between 25% and 50%. 19% thought they would be between 50% and 75%, and as many as 10% thought they would be more than 75%.

The next milestone is to exceed 50% or 52 million tokens. At this rate, it will take more than two weeks before this happens.

However, it must also be said that there has been a strong acceleration in the last four days: in fact, until November 21st, there were still less than 10 million converted tokens, probably because many have waited for the situation to stabilise before proceeding with the migration. As a result, the pace is accelerating and if this were the case, 50% could even be reached earlier than expected.

The value of both the SAI and the DAI tokens is still around USD 1, considering that they are stablecoins. The new DAI tokens can be created by locking up other tokens besides ETH.

The close relationship between DeFi and DEX

DeFi is undoubtedly a sector that is attracting an increasing number of users: with new records of cryptocurrencies being staked or invested. Decentralised finance is, in fact, growing out of all proportion, making decentralised exchanges set new records as well.

In this regard, Leonardo Pedretti, founder of Ethereum Italia, explained to The Cryptonomist:

“Now more than ever Ethereum is the protagonist of the blockchain market. In particular, DeFi (aka Decentralised Finance) has become a fintech layer where startups develop new-generation, increasingly user-friendly, fintech services and products. One example is Instadapp, which offers an interface similar to traditional online banking. This will certainly be one of the trends to follow in the coming years because, unlike the ICO, DeFi concretely helps people to manage their assets in a completely autonomous way and without the use of intermediaries”.

Alice Corsini, COO of Provable Things (ex Oraclize), is also of the same opinion:

“The financial sector is one of the areas that can benefit most from blockchain technology. We saw it with bitcoin and now we see it with the nascent movement of decentralised finance. Being in second place, outperformed in the number of dApps only by gaming applications on the blockchain, DeFi dApps represent a clear breaking point with the traditional financial system, whilst still encompassing its full potential”.