The day is highlighted by Bitcoin’s rise today, which for the first time in about 7 weeks revises the $8,000 threshold.

It’s a break that pushes prices just over $8,100, levels that it had abandoned with the flash crash that had lowered the value of BTC by 45% in just over 24 hours.

Bitcoin gains 4% and its rise, as usually happens in these phases, takes the rest of the industry with it. Ethereum rises by 5% and pushes towards the high end of the bullish channel going to close to $210, levels prior to the mid-March drop.

Even Ripple (XRP) seems to have come out of the stagnation phase. Yesterday it gave the first hints of rise, today arrive the confirmations, recovering all the lost ground, after having experienced a more hesitant rise until yesterday. Ripple today has also achieved an increase of 5% and is pushing above $0.215, levels prior to the economic crisis of March.

It is a movement that sweeps away all the doubts of the last few days. Most of the altcoins were experiencing a phase of slowdown which they were facing with the failure to exceed the previous highs. Now the rises in progress, which are developing shortly after the passage of half a day, are causing the sector to boom.

The rises at the moment see more than 80% of cryptocurrencies in positive territory. It is not yet a totally green carpet, but there is no doubt that if this trend continues in the next few hours, even the cryptocurrencies that are now struggling and are marking a negative daily balance can see the upward trend.

Among the big ones today, those who in recent days have been struggling a bit, have anticipated what is happening today. Tezos (XTZ), for example, today loses 0.6%. For Tezos it’s more of a retracement as it has revised its period highs back to the levels of early March in recent days, so it has turned on a bit the trend that broke out today. Today’s decline is due to the gains on the maximum levels touched in recent days.

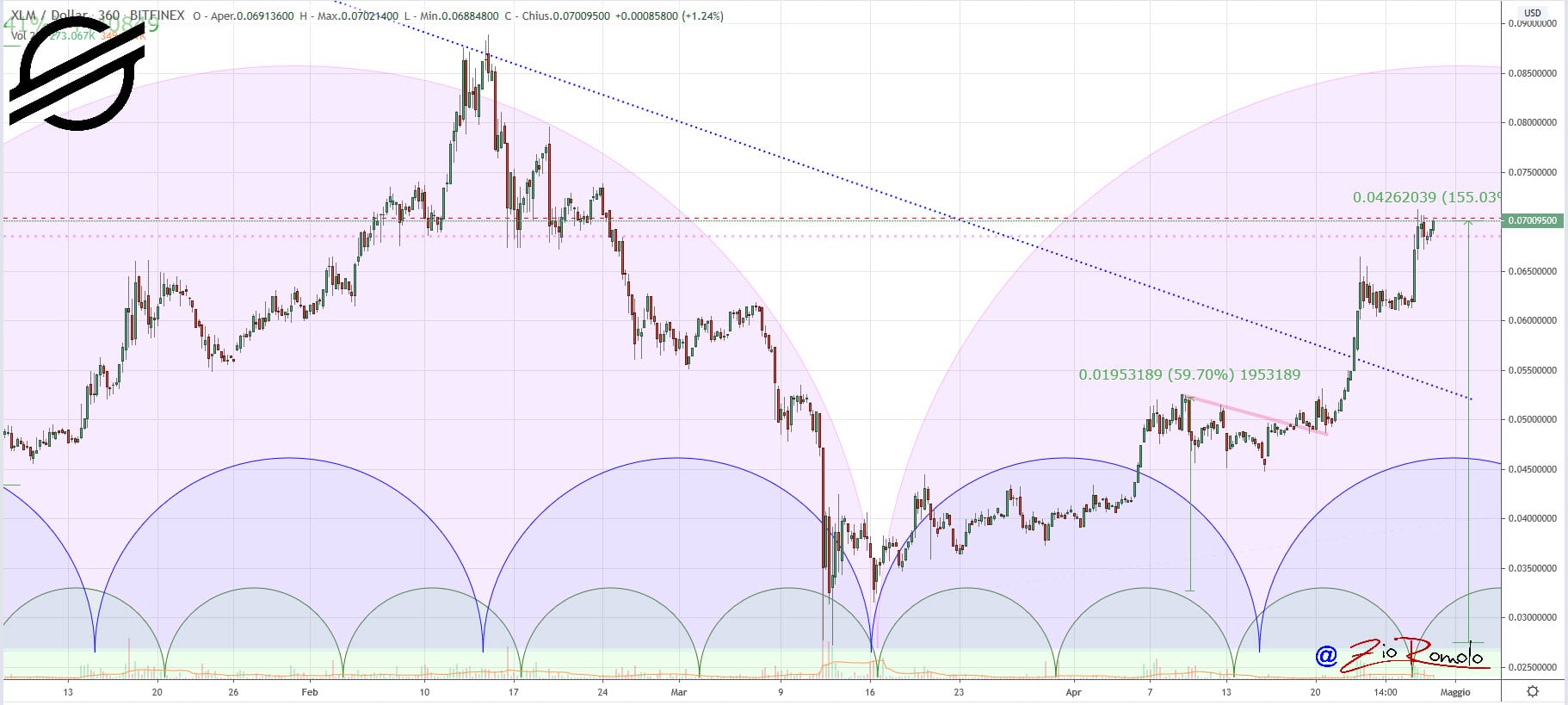

Stellar (XLM) also retraces slightly losing 0.8%. Stellar’s period highs have been in the last 48 hours, returning to the levels of late February, putting the negative month of March behind it. Despite today’s retracement, Stellar sees a 150% gain from the mid-March lows, thus multiplying the value by two and a half times. After the collapse of mid-March, XLM had gone to $0.027, while today it fluctuates around $0.070. This is a very respectable performance in a very delicate phase, not only in the cryptocurrency sector but also at a global financial level.

Some of the best of the day among the big ones include the performance of Ethereum Classic (ETC) which earns 5%. The most explosive rise of the day is that of Stream DATACoin (DATA) which, with a flight of over 70%, enters among the top 100, placing itself in 83rd place in the ranking of the most capitalized with just over 54 million dollars.

However, what stands out today are the concerted movements that are taking place among the main altcoins all in positive. Among the top 30, besides Tezos and Stellar, only (Leo) LEO swings below par.

On the opposite side, among the falls of the day, the deepest movement is that of Hive (HIVE) which goes down by 17%.

The rise at the moment is supported by good volumes, which despite the uncertainty of recent days today rise by 15%, settling over 115 billion dollars.

The market cap is healthy, exceeding 230 billion dollars, returning to the highest levels that were not recorded since last March 10th.

The dominance of Bitcoin, despite today’s strong jump, remains at the levels of the last few hours at 64%, highlighting how the current climb is a concerted climb throughout the industry. Ethereum is one step away from recovery of 10%. While the recovery of Ripple is positive, and in the last 24 hours it gains several decimal points back above 4.2%, levels that had not been recorded for over 2 weeks.

Bitcoin (BTC) at 8000 dollars

The break of the $8,000 puts the turbo and triggers possible stop losses making Bitcoin’s prices jump to almost $8,130 in a few minutes, levels that had not recorded since March 10th. Taking as reference the highs of February and the lows of March, the recovery of more than 62% of the entire bearish movement is evident. It is a technical indication that gives a clear signal of a possible reversal of the trend in the medium term. These are signals that will have to find comfort and confirmation also in the next few weeks, close to the halving.

There is growing interest in Bitcoin, which continues to score new search engine highs just 10 days before the third halving of the miners’ rewards in BTC’s history.

Bitcoin is approaching this historic event with a trend that sees a 100% recovery from the March lows, doubling prices since the collapse of a month and a half ago.

At the moment there are no signs that Bitcoin could fear a reversal of this trend, which would only occur with prices below $7,300, levels currently far apart during the most intense increase since last week.

Ethereum (ETH)

Ethereum is also very good. Attracted by the neckline of the bullish channel started from the lows of mid-March, ETH goes one step closer to $210, a level it has not recorded since last March 8th.

Even for Ethereum, there doesn’t seem to be any signal that could bother this trend that has been going on for a month and a half. A negative signal would only come with a break below $175 in the next few hours.

In these hours, Ethereum is to be observed not only from a technical point of view but also from a fundamental one. Since the days of the crisis in mid-March, the Ethereum network has recorded an increase in smart contracts of about 1 million. It is a figure that comes during a critical period, exploded with the sharp fall in prices that saw ETH lose more than 55% of its value between March 12th and 15th, which if added to the bearish trend started from the highs of mid-February, extends the loss of 70%.

Nevertheless, there has been no lack of confidence of developers and those who rely on the Ethereum network, which from the lows of March 12th sees an increase of 1 million open smart contracts. Considering that from January to March there were “only” just over 450 thousand open contracts, it is clear that the Ethereum network is discounting not only the price but also the development of the network, a moment of new appreciation.