After two days of apparent calm, Bitcoin roars again. In these early hours of the penultimate day of the year, Bitcoin goes to mark a new all-time high, pushing beyond $28,580, going to close in beauty this 2020 that in December saw the queen of cryptocurrencies excel.

It is a trend that is partly replicated by the rest of the sector. Even Ethereum in these last hours returns to touch the $750, a step away from the new record of the last 2 and a half years. ETH has not moved at these levels since May 2018.

The collapse of Ripple continues

A completely different trend for Ripple, which in contrast to the first two, drops again today, continuing to show clear signs of weakness. Yesterday prices sank below 18 cents of the dollar, the lowest level since last March, when XRP was one step away from 11 cents of the dollar, the lowest peak in recent years.

XRP continues to travel in bad waters, even as more and more exchanges decide to stop allowing trading of the XRP token. Bittrex has been added to yesterday’s list and probably in the coming days, others will be added among those who will delist the token.

From the highs reached at the end of November, the collapse of these days knocks down the quotations of more than 75%. A reversal in strong counter-trend that makes the owners of the token nervous.

Today’s rises, led by Bitcoin, see Polkadot (DOT) excel among the top 10, flying by 12% with a capitalization close to 6.5 billion dollars. With today’s rise, the price reaches $7.6, the highest level in four months. Polkadot is one step away from overtaking Bitcoin Cash (BCH) in sixth position. Celsius (CEL) takes the top step of the podium with a 15% rise. Third best gainer of the day is Terra (LUNA) with a rise of over 5%.

Rising volumes, market cap and DeFi records

The rises in the first part of the day see total volumes over $300 billion, rising slightly in the 24-hour period, but so far already seeing 80% of yesterday’s trading volumes. Bitcoin is already marking over 4 billion in dollar value at mid-day and is likely to surpass the volumes of Monday and Tuesday at $5 billion on the major exchanges.

Trading on Ethereum remains more tepid at $2.3 billion on the major exchanges. These are half the volumes reached in the day between Sunday and Monday, which went over $4 billion on both days.

The market cap rises to $740 billion, the highest level since January 13th, 2018. Credit largely to Bitcoin, which at $520 billion in capitalization, its highest level ever, occupies 70% of the market share. Bitcoin’s rises go on to capitalize the rest of the sector. Ethereum remains above 11%, despite the price being at its highest in three years. Ripple sinks to 1.8%, its lowest level since March 2017.

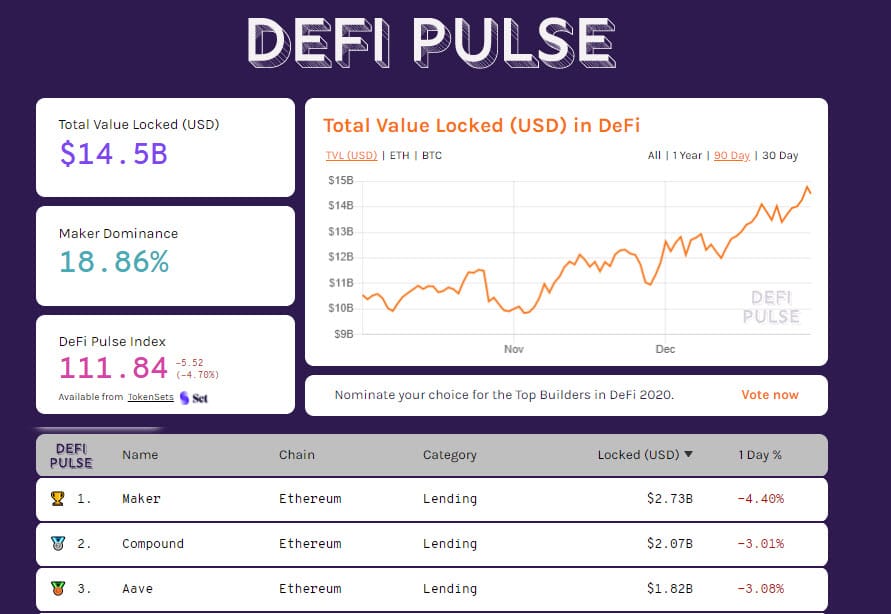

DeFi is close to $15 billion, benefiting from the rises in recent hours. ETH and BTC locked in DeFi projects go back down. Maker remains the industry leader with over $2.8 billion. Compound follows with $2 billion touched yesterday for the first time since the launch of the project, which is one of the “oldest” in DeFi. Aave follows at $1.9 billion.

Bitcoin (BTC), new all-time high

With the rises of the last few hours Bitcoin only confirms the strong bullish trend that now accompanies this trend since mid-December. These are historic days, Bitcoin is preparing to close an impressive year-end, a performance that on an annual basis goes over 245%. Bitcoin puts gold, +23%, and the S&P 500, +15%, to shame.

At the moment, no warning signs are seen for Bitcoin. Further stretching allows for broader price movements. The first sign of possible weakness in the short term would be a return below $24,000. From a medium-term perspective, the distant support is the $20,000 mark.

Ethereum (ETH)

For Ethereum the stretch, even if more contained than in the last few hours, keeps prices at the maximum of the last three years, a step away from $750. Ethereum, despite the difficulties in the short term, with a performance lower than that of Bitcoin, in the long term has more room for margin. For ETH, the only level to be monitored in the medium term is 480 dollars, definitely and distant from the current quotation of more than 35%.

Since the beginning of the year, Ethereum is doing better than Bitcoin with a gain of over 450%. For Ethereum a possible downward movement sees the first support at $660. On the upside, a break of $750 needs volume support: the next target is at $810.

This is my last publication of 2020. Best wishes for a happy 2021 to all of you readers who each day honour me with your company.