Last week saw the most intense plunge, with Bitcoin losing 6% on a weekly basis. Ethereum closed with -1.5%.

Statistically, since the first week of October, out of 15 weeks, only three have closed with a red sign.

The decline of -6% is the deepest since the last week of August 2020, although in terms of value with a loss of $2,300 it is the most aggressive decline since March 2020.

However, viewed from a medium to long-term perspective, the current decline should be seen in the context of a strong uptrend that has seen Bitcoin gain over 250% since the beginning of October. This means an appreciation in value of over 2.5 times.

Ethereum is doing even better, with a rise of 300% since the beginning of October, an appreciation in value of over 4 times.

Crypto market today: Chainlink the best among the big

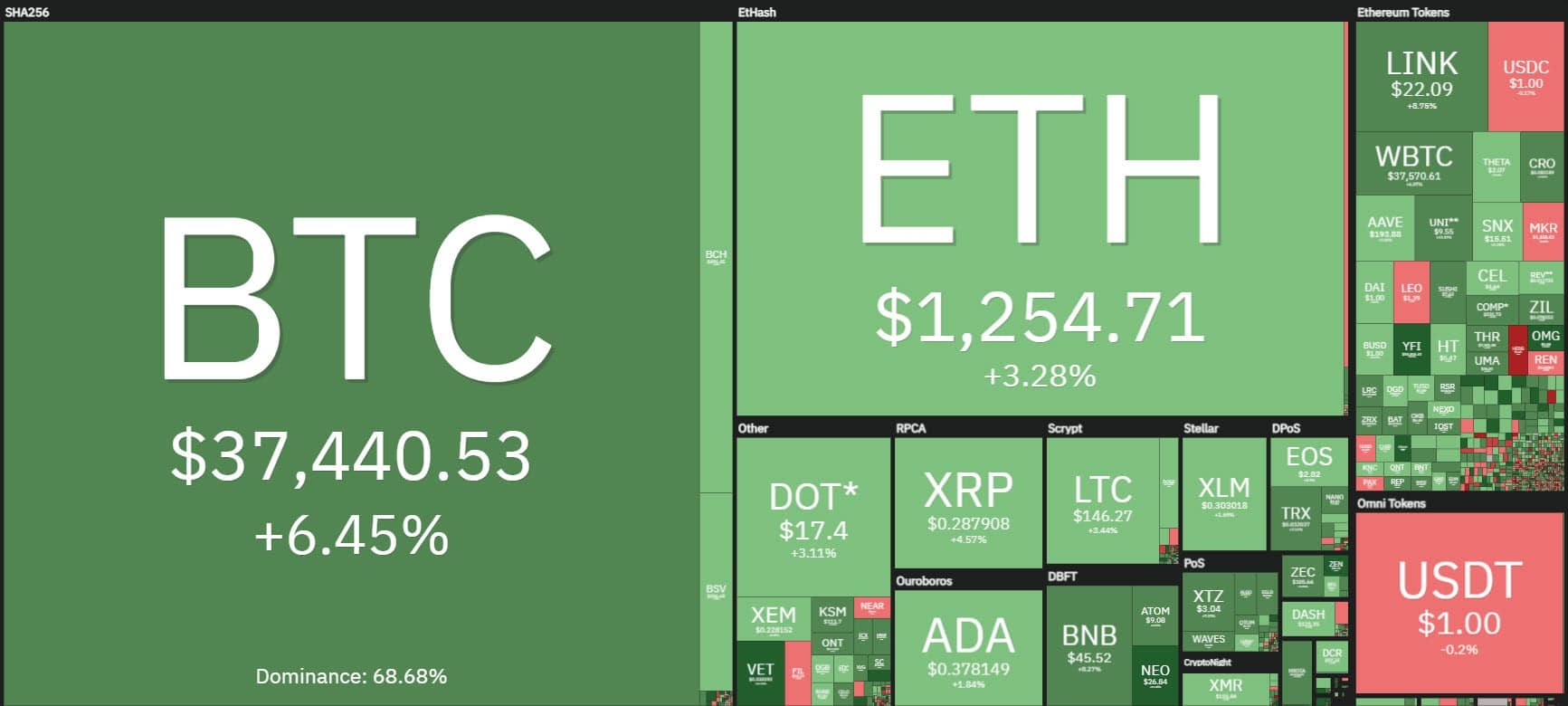

Today’s day began on a positive note, with over 85% of cryptocurrencies above par.

Chainlink (LINK) is one of the most important cryptocurrencies to have risen in the last 24 hours. It is up 5% on a daily basis and its prices have recently set a new all-time high, hitting $24.

Looking at the top 100, the best performer of the day is The Graph (GRT), up almost 50%, benefiting from the Coinbase listing, followed by Horizen (ZEN) and NEO, both up 20% on a daily basis.

Polkadot overtakes XRP

Polkadot (DOT) achieved staggering numbers over the weekend, exploding in both price and volume. Since Monday, Polkadot has seen one of the best gains on a weekly basis, rising more than 120%, allowing it to climb above $19 over the weekend and setting a period record.

This rise above $19 allows Polkadot to increase its market cap to more than $15.8 billion, moving it into fourth place on the list of the most highly capitalized coins, overtaking XRP, with a difference of $3 billion.

Polkadot has posted one of the best gains since the beginning of the year in just over two weeks, with a performance of 160% YTD, the best among the top 50.

Market cap, volumes and DeFi

Volumes are also staggering: over the weekend it was third in terms of trading volumes behind only Bitcoin and Ethereum.

The day saw volumes return over $320 billion after a quiet weekend. Both Bitcoin and Ethereum on Saturday and Sunday recorded the lowest trading volume since early January.

Today’s rise brings the market cap back above $1 trillion, with Bitcoin’s dominance losing three points from Thursday’s highs, dropping below 67%.

Ethereum remains just under 14%, levels of recent days. XRP despite flunking the 4th position remains above 1.1% dominance.

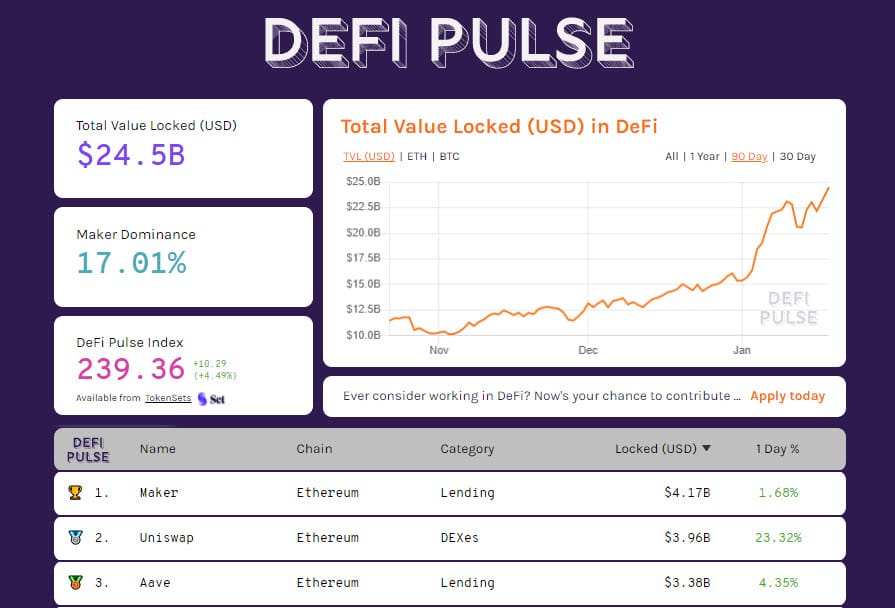

DeFi‘s prices have held up well over the past few hours, with total value locked setting a new all-time high at $24.5 billion. The continued locking of Bitcoin and Ethereum by users is having a positive impact. For both, there is renewed growth and locking on decentralized finance protocols.

Maker retained its leadership position, followed by Uniswap, which jumped up to nearly $4 billion on the protocol, moving into second place among the most used projects. Aave dropped to third, although the value of locked tokens continued to grow, rising to $3.4 billion.

Bitcoin (BTC) rises after last week’s loss

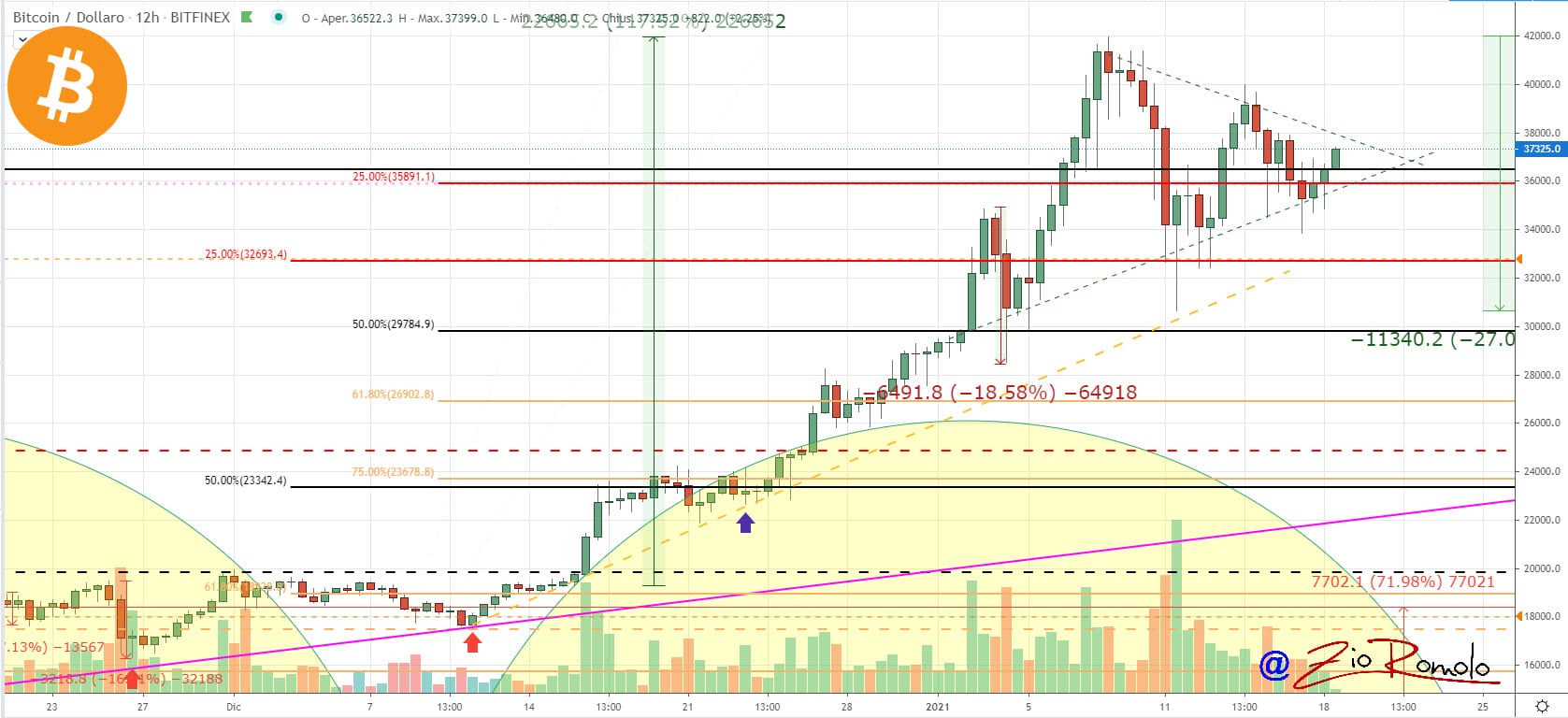

Although with difficulty, Bitcoin remains above $36,000, a level tested several times over the weekend and which coincides with the bullish trendline joining the rising lows since early January. A bullish signal which, unfortunately, has not been confirmed by the highs which have been falling since the top of January 8th.

An interesting triangle is thus technically forming to follow in the coming hours. An upward break above $38,000 or downward break below $36,000, could further increase volatility in the coming hours.

Ethereum (ETH) Price

Ethereum has been caged in the sideways channel between $1,100 and $1,250 for the past 4 days. The signal is positive in the medium to long term as fluctuations remain at the highs of recent years, just below $1,300, but the contraction of volumes in recent days does not help.

In the coming hours or days it is necessary to wait for prices to break out of this channel, above 1,300 or below 1,100 dollars, precisely to understand the intentions for the next movement.