Bitcoin volumes remain low even today. After three consecutive days under one billion dollars in 24 hours, yesterday they exceeded this threshold with $1.1 billion.

Total trading volumes therefore remain at the lowest levels in the last year. To find such low volumes for prolonged time on a weekly basis, it is necessary to go back to autumn 2018.

Bitcoin continues to remain in a range that narrows even more, highlighting how the week just started is registering the narrowest weekly fluctuation since 2015.

Volatility continues to fall, reaching almost 1.10%, the lowest level in the last 4 years: it was since autumn 2016 that there has not been such a small daily volatility on a monthly basis.

Daily volatility on a bimonthly basis has also been the lowest since January 2017.

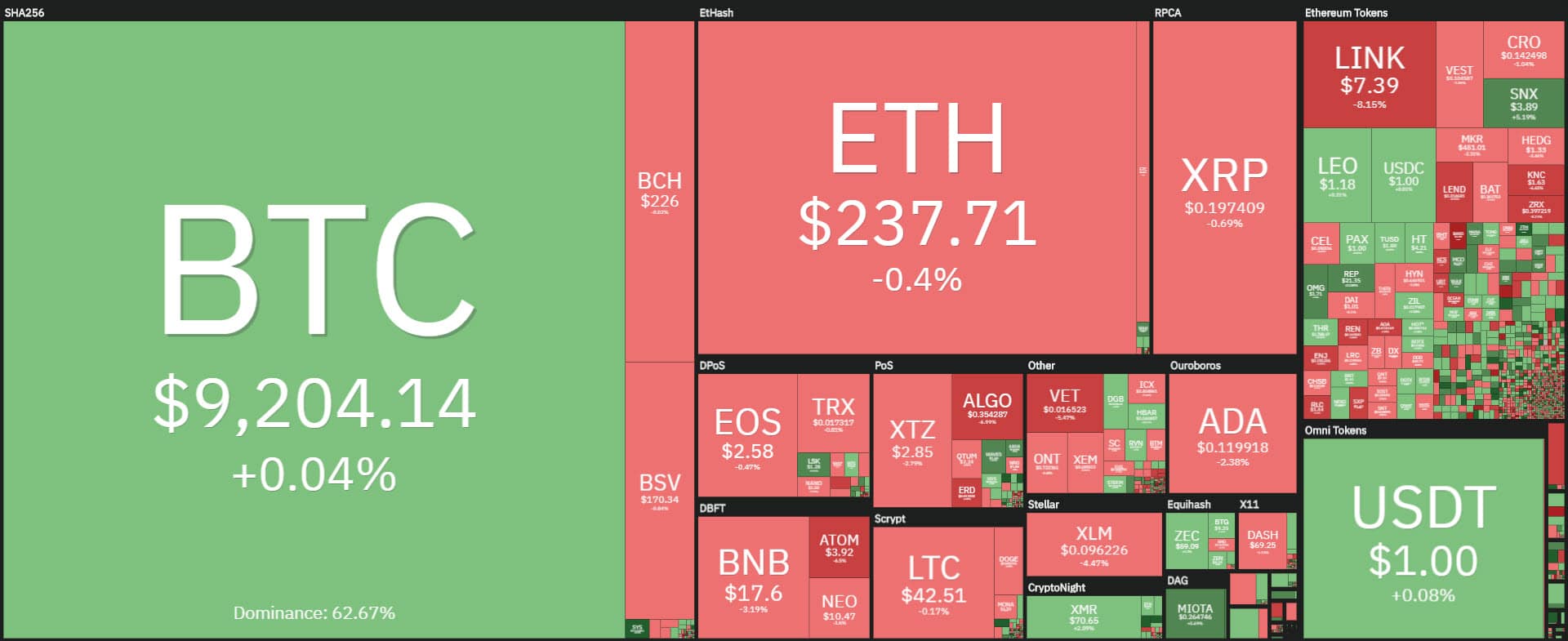

In such an anomalous and frozen environment, it is the altcoins that continue to show signs of exuberance. In the last 24 hours, even though the positive signs remain in balance with the negative ones, there are pronounced upward and downward fluctuations.

This is the case of IOTA that rises 8% trying to return to the top 20. Among the top 30, only IOTA marks a sharp rise. In fact, pronounced declines prevail after the rises of the last few days.

This is the case of Chainlink (LINK) that with very significant trades in recent days, behind only Bitcoin and Ethereum, today sees profit-taking prevail.

Chainlink registers a further extension of the decline started from the highs reached between Wednesday and Thursday of last week when for the first time it touched 9 dollars.

Today Chainlink continues to fall, with a drop of 8%, and the price breaking through the $7.5 wall, falling back to 11th position.

The other vibrant asset of recent weeks, Cardano (ADA), has seen levels return to 14 cents on the dollar, the highest in the last two years. From those levels, it has experienced profit-taking that is causing the price to fall below 12 cents on the dollar. The decline continues even today with a descent of 3%, while maintaining the 7th position in the ranking of the most capitalized.

Speaking of declines, today there is a definite step back for VeChain (VET) and Cosmos (ATOM), both -7%.

The best of the day is SysCoin (SYS), which flies 160% to 80th position. It is a 2014 project, which has remained hardly noticed. It is a platform that allows interoperability between tokens and also designed for the use of microtransactions.

SysCoin sees the price rise again in the last few hours with prices above 15 cents, which it has not recorded since July 2018.

DeFi sector

The tokens of the DeFi galaxy, which continues to register high upward and downward oscillations, stand out among the rises. Among the positive signs are Synthetix (SNX), Flexacoin (FXC), which rises 12%, Augur (REP) which rises 5%.

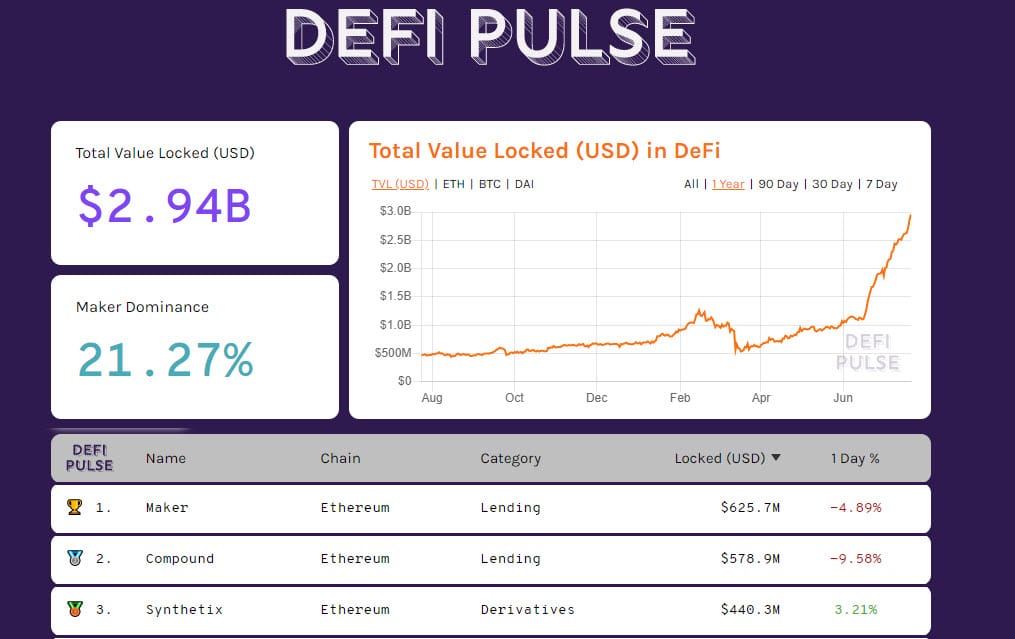

On the opposite side Kava (KAVA), Aave (LEND), Chainlink, Loopring (LRC), Ren (REN), show decreases between 7 and 14%. Despite the prevalence of negative signs, the locked liquidity within DeFi continues to soar, updating the record to 2.90 billion dollars in TVL (Total Value Locked).

Maker (MKR) recovers the throne and maintains the first position with $625 million locked, followed by Compound (COMP) which drops to 579 and Synthetix to 440 million.

The price of the governance token of Compound, launched a month ago, seems to find a balance around $160, following the record set a few hours after the launch of the token that touched $335.

In the DeFi galaxy, it is necessary to mention the high jump of the pNetwork token (PNT, former EDO), which broke the psychological rock of one dollar and rose over $1.03, the highest level since June 2019.

It is a rise that marks an increase of over 2,500% from the March lows in just over 4 months, multiplying its value by 25 times. The market seems to be positively impacted by the announcements and the increasing expectations for the launch of new projects by the pNetwork team.

The DeFi sector at such a particular time is lowering the attention and interest for Bitcoin. Eyes are focused on decentralized finance, which records the highest peak on a weekly basis when it comes to volumes on decentralized exchanges (DEX).

Although there are still 10 days to go before the end of the month, volumes on DEXs are one step away from exceeding the ones recorded in June, with $1.577 billion traded in June, a peak that is now less than $50 million.

This highlights how the DeFi sector and decentralized platforms are increasingly being utilized and growing in interest.

The total market cap continues to remain above $270 billion. The dominance of Bitcoin is just over 62%, lowest levels since July 2019, where it has been fluctuating for 10 days. Ethereum and Ripple remain unchanged at last week’s levels at 9.7% and 3.2% of market share.

Decreasing volumes for Bitcoin (BTC)

The micro fluctuations by Bitcoin between $9,100 and $9,200 do not change the structure of the analysis of the last two weeks. The low volumes direct the attention of the traders to the options that for Bitcoin continue to give signals of downward coverage of $8,950, increasing the hedging positions at this level.

In the last few hours, hedges have also risen to the $9,350 and $9,600 levels. These are the positions to be monitored today.

Options continue to see the open interest rise, reaching the highest level since last June 25th, when the record was set.

Ethereum (ETH)

Situation unchanged also for Ethereum with fluctuations that see prices dancing in a narrow range between 235 and 242 dollars.

In the case of Ethereum, traders are shifting their attention and activity to options, so much so that even in this case the open interest record on options derivatives is updated with over $182 million, the highest level ever for options on Ethereum.

Increased coverage on the $215, level of protection for over a month. Volumes increase between $225 and $230, levels of protection for a possible decrease. The level of protection of the resistance between $245 and $255 consolidates upwards.