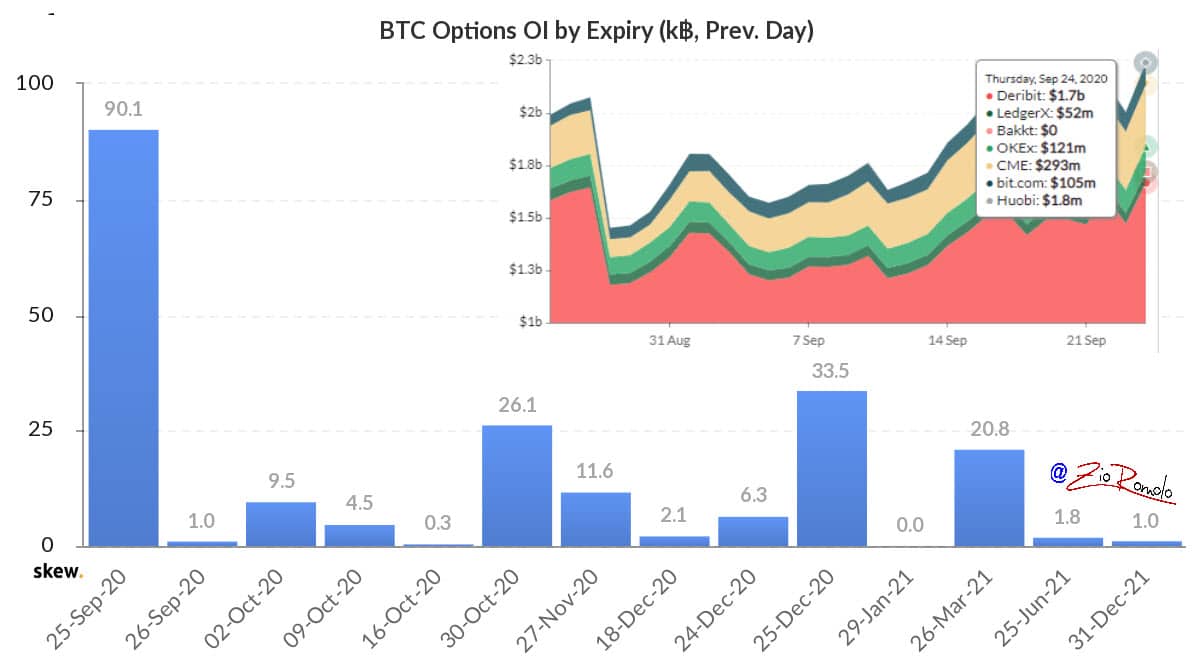

For the second time in a few days, derivative contracts on Bitcoin options reach new historical records. Yesterday, with an open interest of over $2.2 billion of options remaining open, the highest ever peak was reached. Half of the contracts, more than 90 thousand BTC, equivalent to over $1 billion, will expire today.

Bitcoin options expiring, what will happen

Many expect high volatility in the coming hours. Although these are derivative instruments launched recently on the cryptocurrency market, the CME has been offering this possibility since January 2020, and hence without a valid reliable historical series, until now the monthly or quarterly maturities of options contracts have never had particular effects on the volatility of prices during the following hours.

For this reason, it is necessary not to underestimate the deviations of the prices for the whole day without, however, expecting a butterfly effect in the next hours.

The indication of a progressive use of derivative contracts shows that several operators prefer to use financial instruments to hedge risk or to speculate in particular periods of uncertainty or laterality, opening strategies that guarantee an almost certain return in case of both upward and downward directional movements.

Going to analyze in detail the levels (strike) of price more used by the operators, it emerges that the greater part of them that has acquired options in the course of these last weeks did not expect excursions of the prices beyond the 9000 dollars, in case of falls, or over the 11900 dollars, in case of upward movements.

With today’s expiry date these strategies will most likely undergo a realignment of positions and the possibility of using new strikes in the coming days.

It should be noted that open interest on options is an indicator that represents the number of derivative contracts remaining open for Call and Put options. Considering the difficulty of choice and the guarantees necessary to obtain the possibility to operate on these instruments, they are usually instruments used for the most part by professional operators with high financial availability. This is why a careful analysis of the strategies used helps to identify the operational levels chosen to hedge the risks taken on by buying or selling the underlying asset.

On these pages the analysis of options on Bitcoin and Ethereum is applied daily.

Crypto market in recovery

After Wednesday’s falls, yesterday’s day was the best rise in intensity since the beginning of August. Daily closures for Bitcoin with +4.8% and Ethereum +8.8% drag this morning’s recovery throughout the sector.

In the top 100, over 90% are green signs. Among the biggest rises emerges Chainlink (LINK) with a +18%, trying to recover the $10 attempting to reverse the course that in the last month has seen it lose more than 65% of its value from $20 to $7.3.

Despite the recoveries of the last few hours, the week is starting to end with a negative balance for most of the main cryptocurrencies. Only Leo Token (LEO) and Nem (XEM) are preceded by the plus sign with increases above 4% from last Friday’s levels.

Total capitalization recovers over $10 billion in the last 24 hours, returning above $338 billion. Bitcoin confirms its dominance at yesterday’s levels at one step from 59%. Stable market share of both Ethereum at 11.5% and XRP at 3.1%.

Bitcoin (BTC)

The climb of the last few hours reverses the protection of the operators with the strength of the Put more than twice as strong from yesterday’s levels.

In the coming hours, as well as over the next few days, the large area of resistance between $10850 and $11900 becomes the space to be overcome to attract the purchases needed to trigger a solid price rise.

If this is not the case, it remains essential to keep the support at $9900, which in recent hours has been further strengthened with new open contracts to protect this level.

Ethereum (ETH)

Yesterday’s fall has again brought prices back to test the lows at the beginning of the month in the $315 area, where the protections with prevalence of purchases were again triggered.

The rejection of the prices has brought back the quotations in the 345 USD area, which confirms itself more and more as an area of equilibrium of short and medium period.

Also for Ethereum the strategies of the operators in options increase the strength of the Put in support of the recent rebound.

For Ethereum, it remains necessary to recover the levels of area 380 USD first and 405 USD later, in order to invert the bearish trend that since the beginning of September is accompanying the trend of the prices.

On the contrary, a return to the 315 USD area will weaken the resilience of this support and the possibility of opening up space for further extensions to review the next level of support between 305-300 USD, which was forgotten at the end of July.