From yesterday’s highs, Bitcoin has lost more than 15%, a decline occurred in less than 24 hours, while Ethereum instead sees in these last three hours prices plummet from the top of $1,160 by about 25%.

It is a very volatile phase that comes after a bullish phase that has characterized the whole holiday period and that has seen double-digit gains for several consecutive days.

In fact, following the bullish hangover of this past weekend, strong profit-taking is beginning to take place, which in the last few minutes is causing the rise to falter.

Records of today and the past

On January 3rd, 2017, in the hours following its 8th anniversary of the genesis block, Bitcoin celebrated the attempt to match its previous historical record with prices that on the following days, January 4th-5th, 2017, marked the break of $1,000 and the attempt to match the previous historical record set at the end of 2013, between November 30th and December 4th, of $1,175.

From there we know what happened next: 12 months later, on December 17th, 2017 the price of Bitcoin marked the previous all-time record of $20,000. It was a gain that since the beginning of the year saw the price of Bitcoin multiply 20 times its value.

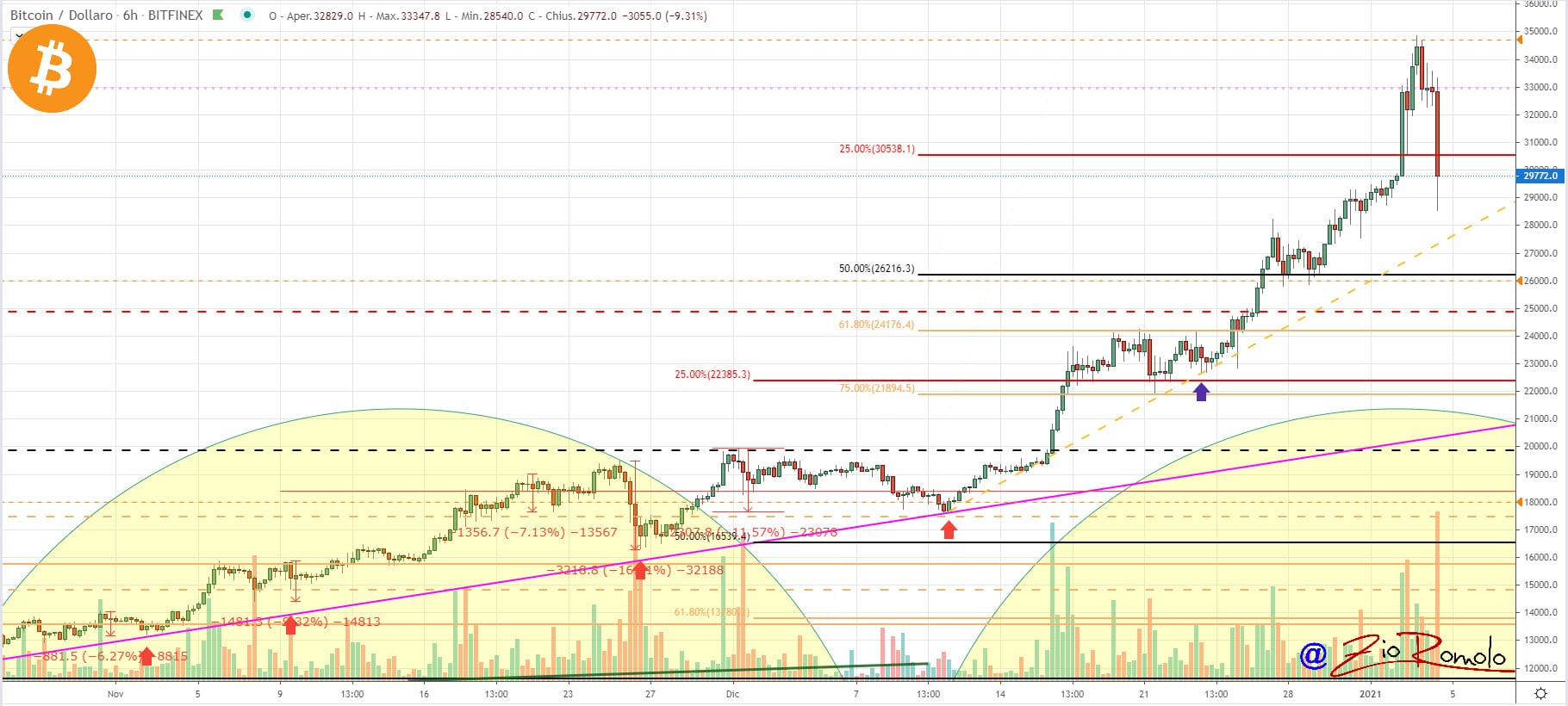

The year 2021 starts off with an even better trend, bringing back memories of 2017. What happened yesterday gives hope. Yesterday, when the 12th anniversary of the first block mined on the Bitcoin chain was celebrated with a record that saw prices one step away from $35,000, to be precise $34,873 (taking as reference the prices recorded on Bitfinex).

These were celebrations that then during the rest of the day saw profit-taking begin. Instead, the celebrations continued on Ethereum and the entire altcoin sector.

The uptick was led by Ethereum, which in the last few hours saw the price fly over $1,150 at first light today, the highest level in 3 years.

It was exactly since late January 2018 that Ethereum had not seen prices above $1,100. For ETH, it’s a strong and fast movement that sees one of the best performances in recent years with a gain that on a daily basis went over 30%.

The achievement of the technical, as well as psychological, threshold of $1,000, sees ETH recover about 80% of the bearish movement that characterized it from January 2018 to the lows of March 2020.

Looking at the trend of the last 24 hours, new records have even been set for the market capitalization that prior to the fall of these hours saw the market cap rise to over 900 billion dollars, the highest absolute value that goes beyond the records of January 8th, 2018, when it exceeded 830 billion dollars.

It’s a capitalization that has largely been supported by Bitcoin, which has surpassed $550 billion for the first time in history, holding over 72% dominance. Despite the excellent performance of the last 24 hours that lay the groundwork for a new altseason, with the main altcoins posting double-digit rises, their total capitalization exceeds $260 billion, which are not the highest peaks but date back to May 2018. Whereas in the previous golden phase of January 2018 they managed to exceed $540 billion (excluding Bitcoin capitalization).

Eyes on Litecoin

Among the major rises that are characterizing these last few days, the spotlight is set on Litecoin (LTC).

Litecoin, with a recovery by prices to $170, the highest level since May 2018, in some stages of the day yesterday saw its total capitalization rise to $10 billion, taking the third position among the largest capitalized behind Bitcoin and Ethereum and undermining Ripple that after the movements of these hours contends for the third position.

Excellent rises in these days also for Polkadot (DOT) that sees its price registering a rise that in yesterday’s day saw it surpass an 80% gain on a weekly basis, among the best of the week.

What is happening in these hours sees Ethereum as the best of the top 100 in the ranking despite its gain on a daily basis has shrunk from +30% at the beginning of the day to +17% from yesterday morning’s levels. It is followed by Cardano (ADA) which gains 15%, and third-best of the day is Aave which gains 11%.

Among the best of the top 100, SushiSwap (SUSHI) stands out, rising 15%. SushiSwap registers a record level of trades on its decentralized exchange where volumes go beyond $1.6 billion, record levels for the “vampire” DEX born from the Uniswap project. It is precisely Uniswap that remains the leader among DEXs, trading over $1.1 billion.

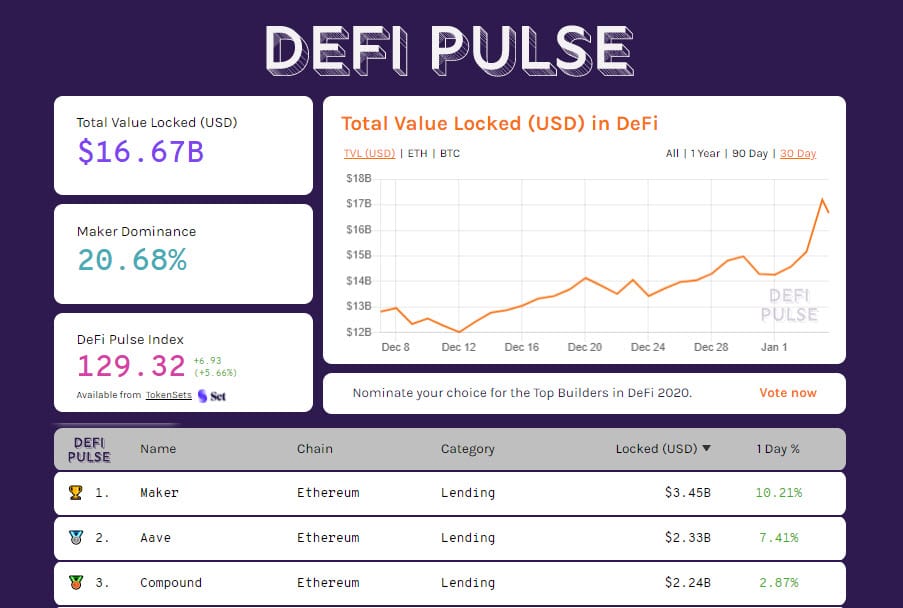

DeFi: TVL exceeds $17 billion

The DEX in these last 7 days record levels pushing over $9 billion in total volumes. It is precisely decentralized finance that has characterized the first days of the new year with records that in the last few hours have seen the total value locked exceed 17 billion dollars for collateral locked calculated in USD.

The leader in the sector is Maker, which sets its absolute record with over $3.5 billion dollars of collateral, followed by Aave with $2.3 billion and Compound with a difference of a few hundred million. For the latter, it is a record due to the value of the token used as collateral that has gained strength in the last 48 hours.

The tokenized BTC set a record for counter value of projects minting Bitcoin on the Ethereum network, rising above 4.5 billion. This is not due to new BTC but to the value of BTC surpassing $34,000 This goes to benefit on the total value tokenized on DeFi projects.

Bitcoin (BTC): derivatives contribute to the decline

The rises seen in this initial phase are making people dizzy and alarmed, prompting short-term investors to take juicy profits, which bring Bitcoin back above $30,000 in these hours. It is a volatile phase where it is necessary in the coming hours to understand the holding of the psychological threshold of $30,000.

From a short-term perspective, the bullish dynamic support is just above the levels seen in these hours, the $28,000. In case of failure to hold this support there would be room for further lunges to test the next $24,000. These are levels that until a few hours ago seemed abandoned, but it is necessary to maintain caution because Bitcoin, like the entire cryptocurrency sector, is always subject to high volatility especially after directional phases (in this case only bullish) that have been characterizing the trend of Bitcoin for over three weeks and that at the moment have not recorded any retracement.

This retracement in this phase of the day seems to give the first signals that, nonetheless, will have to be better analyzed tomorrow.

The declines of these last hours have been caused not only by profit-taking but by a cascade of liquidation of derivative contracts of upward positions.

In fact, in the last 24 hours, bitcoin records a liquidation of upside long contracts of more than $1.5 billion. On Saturday and Sunday, bitcoin derivatives on platforms that allow trading during the days when financial markets are closed recorded two consecutive days with trades of $80 billion on a daily basis, the highest peaks since the record of December 17th, which was a weekday though, Thursday.

This has most likely characterized, with the opening of the CME, a forced closure of positions to the downside that have therefore caused an office closure of contract positions and this has generated an earthquake, a turmoil that cascaded to liquidate other positions that in the last 2 hours have been positions to the upside without liquidity coverage.

Ethereum (ETH): drop below $1,000

Ethereum sets a record that from the lows of the beginning of the year sees with the high of the period recorded today a rise of more than 60%. Even ETH in this first part of today’s day sees profit-taking activities that bring prices back below $900.

These are declines that do not affect the strong uptrend that is supporting the rise of Ethereum from the lows of December 23rd. For ETH there is ample room for movement that would not compromise the current uptrend if not under the psychological aspect with prices below $750.

With the price above this range, the current bullish trend present for 10 days would not be compromised. From a medium-term point of view, the danger of a possible reversal is definitely far away and would only arrive with prices below 550 dollars, levels almost 50% distant from the prices of these minutes.

Ethereum, after the drop to 850 dollars is seeing its prices return above 950 dollars in the middle of the day.